Sukuk era begins

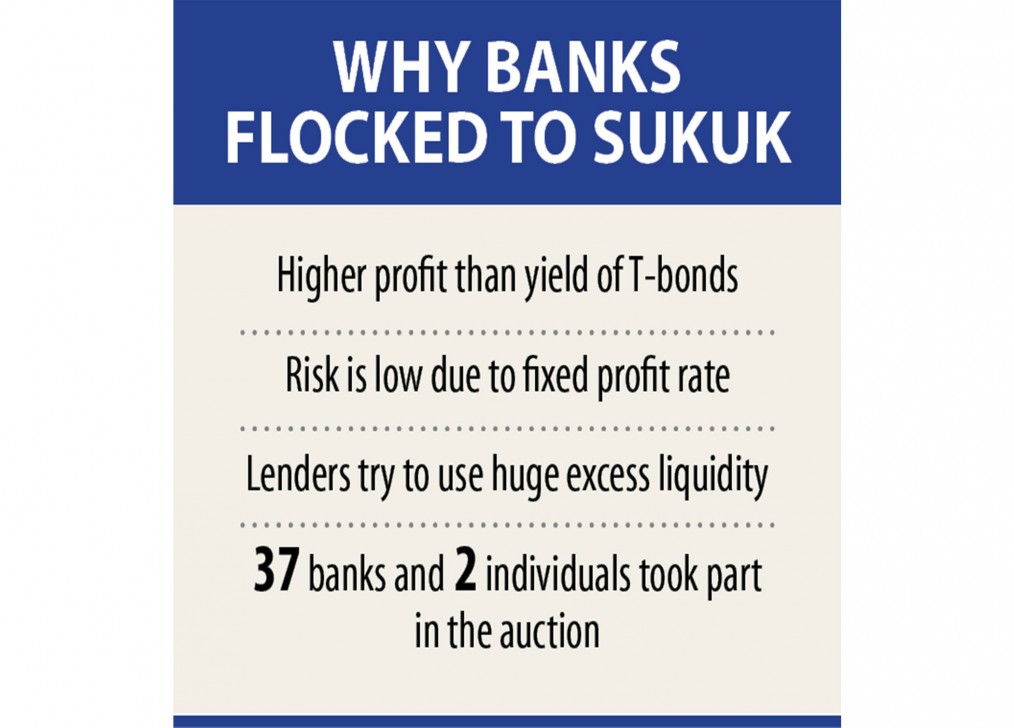

Banks yesterday flocked to sukuk to invest their idle cash and manage an improved yield than in conventional treasury bills and bonds due to Bangladesh held its first-ever auction for the Islamic bond.

Banks and individuals put 39 bids worth Tk 15,153 crore against the targeted volume of Tk 4,000 crore.

The auction committee of the central bank allocated the fund proportionately among the bidders. Due to this fact, every bidder received sukuks equal to 26.4 % of their investment.

A sukuk is an Islamic fiscal certificate, very similar to a treasury relationship and structured to create returns in compliance with Islamic finance principles.

The government will raise Tk 8,000 crore through the issuance of the sukuk to implement a safe water supply project.

The central bank will raise the rest Tk 4,000 crore in May.

The Shariah-based bond is likely to help the government maintain its deficit financing at a time when it is struggling to acquire revenues as a result of economic hardship due to the coronavirus pandemic.

Although Shariah guidelines don't permit to utilize the Islamic bond to control budget deficit directly, the fund can help the federal government implement infrastructure projects.

Investors will receive a profit of 4.69 % on the investment in the Islamic bond.

The central bank has fixed the rate predicated on the Bangladesh Government Islamic Investment Bond (BGIIB). The last declared profit-posting ratio of the six-month BGIIB is 3.69 per cent, and the central bank has added one percentage indicate determine the rate for the sukuk.

Profits will come to be paid on a good half-yearly basis.

The yield on both T-bills and bonds has reduced as the government is issuing securities to control the budget deficit.

So, banks choose the sukuk, which offers a higher fixed profit rate, mainly because a safe haven for their expense, a central banker said.

Thirty-seven banking institutions, including eight Islamic loan providers, and two specific investors took part in the auction.

State-run Sonali Lender was the most notable bidder as it placed a bid of Tk 2,000 crore.

In addition, banks are now sitting on excess liquidity due to lower credit demand as a result of business slowdown. The surplus liquidity in the banking sector stood at Tk 169,650 crore in September.

Relating to a central lender study, 28 per cent of the country's shareholders are reluctant to invest in the interest-bearing T-bills, bonds and other government securities.

Against the backdrop, both conventional and Shariah-based banks heavily invested their fund in the tool, another central banker said.

The profit rate of the sukuk is greater than the five-year Treasury bond, which now provides an interest of 4.64 per cent.

The sukuk will mature in five years, and the federal government looks to implement the safe water supply project by June 30, 2025.