Stocks ride on blue-chip, multinationals

The stock market rose yesterday riding on the blue-chip stocks and multinational companies.

The DSEX, the benchmark index of the Dhaka STOCK MARKET (DSE), rose 31 points, or 0.62 per cent, to 5,126.43.

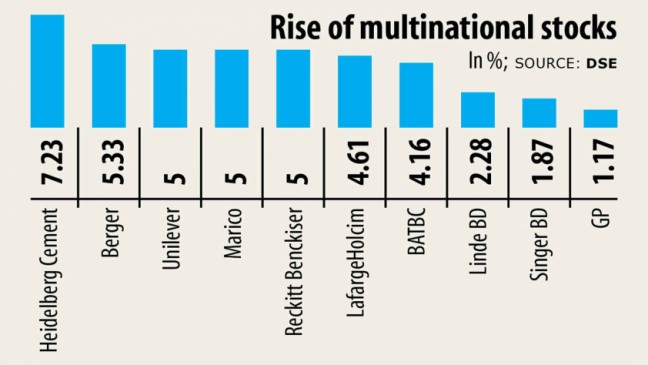

Stocks of almost all of the multinational companies rose a lot more than 4 per cent thanks to higher demand from institutional investors before dividend declarations.

Of the 12 multinationals listed with the DSE, seven witnessed a rise of over 4 % and three by one to two 2 per cent. The rest of the two observed no change.

Several banks and non-bank finance institutions are increasing their investments in the stock market as their lending business isn't in their usual shape, said Khairul Bashar Abu Taher Mohammed, CEO of MTB Capital.

Many lenders have not been able to recover loans this season because of the pandemic-induced economic pressure. So, most of them do not need to lend, he explained, adding that credit growth of the banks fell over the last few months.

The majority of their investment is in the multinational and blue-chip stocks, indicating that these were wary of their investment these times.

On the other hand, December marks the finish of the year for some multinationals, and they'll declare a dividend soon, stated Taher, also a former secretary-general of the Bangladesh Merchant Bankers Association.

Among the multinationals, HeidelbergCement rose 7.23 %, Berger Paints was up 5.33 per cent, and Unilever advanced 5 %.

GlaxoSmithKline Bangladesh was first recently renamed Unilever Consumer Care following purchase of 82 % of its shares by Unilever Group.

Institutional investors are expecting handsome dividends this season despite the scourge of the pandemic, said a top official of LankaBangla Securities.

Many multinationals maintain financial reports predicated on the calendar year, therefore the time for them to declare dividends is closing found in, he said.

This prompted many institutional investors to pour money to avail the stocks of the companies that contain always paid good dividends, he added.

Multinationals in Bangladesh are still lucrative considering their earnings and potentials, so investors are actually investing in their stocks, said Syed Adnan Huda, vice-president of UCB Capital Management.

The investment in these stocks comes typically from institutional investors, not general investors, he added.

A high official of IDLC Securities said there is nothing to be cautious about the sudden rise of the multinational stocks because these were held by institutional and foreign investors.

"Normally, they will not be gambled with," he said.

Sunday was a good weekend abroad so foreign investors did not make the purchases, he added.

Turnover, another important indicator of the currency markets, amounted to Tk 1,003 crore yesterday, up from Tk 936 crore a session ago.

Maksons Spinning Mills topped the gainers' list rising 10 % accompanied by Dominage Steel Construction Systems, MI Cement Factory, Alif Industries, and IFIC Bank.

IFIC Bank's stocks were traded the most, amounting to Tk 67.27 crore, accompanied by Beximco Pharmaceuticals, Beximco, Rupali INSURANCE PROVIDER, and Fortune Shoes.

Of the 354 companies to witness trade, stocks of 141 advanced, 153 declined, and 62 remained unchanged.

Keya Cosmetics shed the most, 10.29 %, accompanied by Esquire Knit Composite, Bangladesh National INSURANCE PROVIDER, Nitol Insurance Company, and Vanguard AML Rupali Bank Balanced Fund.