Breather for small borrowers

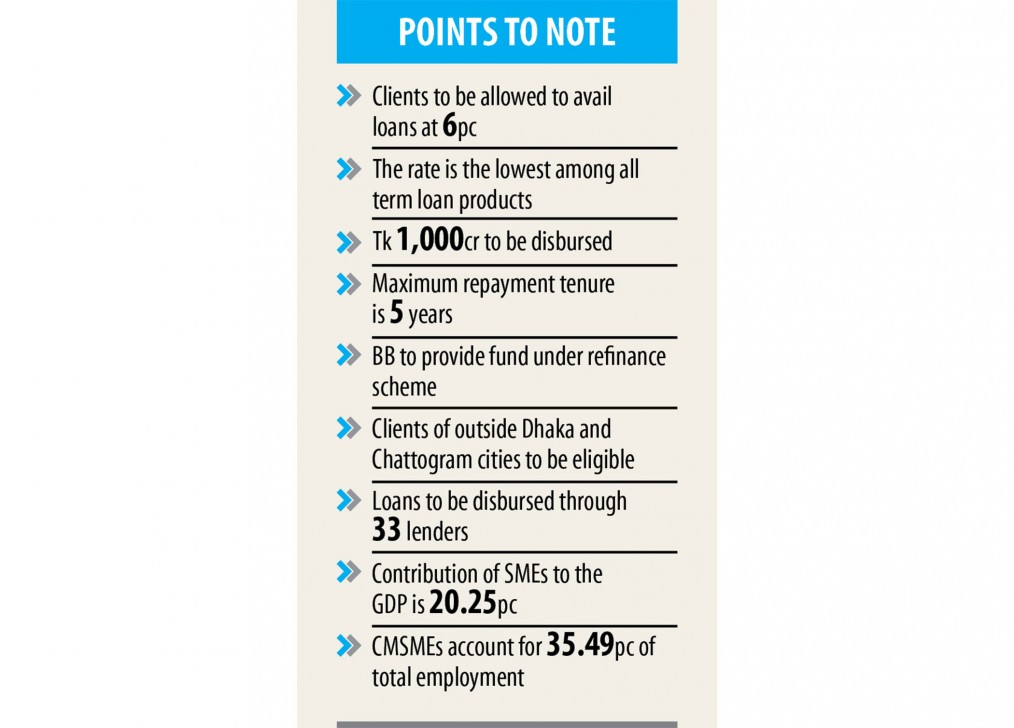

Bangladesh Bank yesterday slice the interest rate of a good refinance scheme for the CMSME sector, which is one of the worst-affected sectors through the coronavirus pandemic, allowing debtors to get term loans in 6 % instead of 9 per cent.

The new rate may be the lowest among all financing rates charged by banks for term loans.

Cottage, micro, little and method enterprises (CMSMEs) is now able to get a lot more than Tk 1,000 crore at the lower interest, a Bangladesh Lender official said.

The central bank took the initiative to fortify the sector's business capabilities amid the economic hardship due to the ongoing coronavirus pandemic, according to a central bank notice.

CMSME consumers that reside beyond the Dhaka and Chattogram metropolis corporations will be eligible to enjoy the lending facility from the project.

In addition, the production sector and women entrepreneurs will get priorities to get funds from the scheme.

Clients are permitted to take performing capital or perhaps term loans from the refinance scheme. The utmost repayment tenure of a working capital loan is twelve months while it is several yr for term loans.

The central bank rolled out the refinance scheme styled, 'Second Small and Medium-Sized Enterprise Development Project', in 2017 with financial support from the federal government and the Asian Development Bank.

The ADB provided $200 million, and the federal government chipped in with $40 million to create the project aimed at building the rural economy radiant.

The project has generated a room for bank loan disbursements to the tune of Tk 2,000 crore.

As much as 21 banks and 12 non-banking financial institutions have signed a participation arrangement with the Bangladesh Bank to disburse the fund to clients.

Lenders can manage funds from the central lender at two per cent interest rate. They are able to disburse the fund at a optimum rate of 6 per cent.

This means they'll enjoy four per cent interest by providing funds to clients.

Around this October, the central lender disbursed Tk 1,000 crore to 3,300 clients beneath the refinance scheme.

Bangladesh Bank gives priority to women business owners and the making sector when coming up with disbursements from the fund, said AKM Fazlur Rahman, project director of the refinance scheme.

"This gives a boost to the entire economy aswell," added Rahman, likewise the executive director of the central bank.

Lenders are often obliged to disburse SME loans in an interest rate of 9 per cent while instructed by the central lender.

The most recent rate cut for the refinance scheme will provide breathing space to the rural businesses within their fight against the economical slowdown, another central bank official said.

Beneath the refinance scheme, clients are permitted to avail a maximum of Tk 3 crore with a optimum repayment tenure of 5 years.

The BB also introduced a Tk 20,000 crore stimulus package for the CMSME sector in April to help small borrowers tackle the Covid-19 fallout.

As per the rules of the stimulus bundle, CMSMEs may take working capital at 9 per cent interest. Of the interest, 4 % will come to be borne by the borrowers and 5 % by the government.

By November, lenders disbursed 35 per cent of the stimulus bundle.

Clients are permitted to get 50 % of their outstanding loans for previous investments found in the manufacturing or provider sectors. It is 30 per cent for trading activities.

There is absolutely no ceiling for loans availed from the refinance scheme.

"The central bank's initiative gives a big raise to the country's CMSME sector," said Syed Abdul Momen, head of SME at Brac Bank.

"The rural overall economy will gain a good momentum for this reason rate cut aswell," he added.