Agent banking winning hearts of remitters

Along with deposit mobilisation and loan disbursement, banks' agent banking outlets are becoming increasingly the key point in distributing remittance in the remotest the main country.

Remitters now choose the platform largely since the beneficiaries can withdraw funds without visiting any bank branches, which are often located a long way away from their homes.

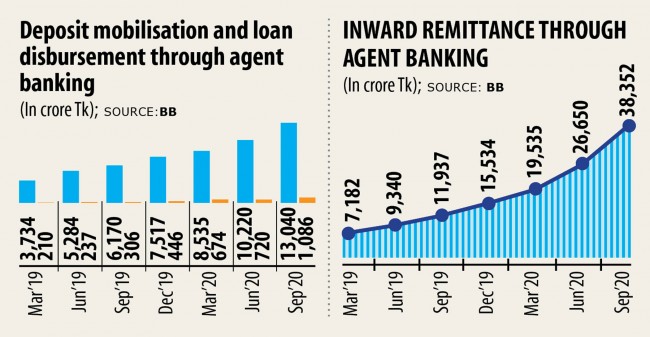

Between July and September, agent outlets disbursed Tk 38,335 crore in remittance, up 43.84 % from three months earlier and 221 % year-on-year, data from the central bank showed.

There are two known reasons for the surge in remittance flowing through the agent banking, said Md Anwarul Islam, general manager of the financial inclusion department of the central bank.

First, the agent booths are often located next to the houses of the recipients. Second, the 2 2 % cash incentive supplied by the federal government has attracted people, he said.

In the past, a good number of expatriate Bangladeshis recommended hundi, an unlawful cross-boundary financial transaction system, to send their hard-earned money to permit their near and dear types to get it smoothly sidestepping the complex fund withdrawal process in the bank operating system.

But the recipients can now withdraw the fund easily from the agent outlets, which are expanding in the united states, pushing the hundi channel aside.

As of September, the total number of agent outlets stood at 14,016 in contrast to 9,391 twelve months earlier.

The federal government has been providing the 2 2 % cash incentive against remittance from July last year to inspire the Bangladeshi diasporas to send fund through the formal channel.

In some instances, banks are providing one per cent additional cash incentive along with the two per cent if the remitters send the amount of money through the agent banking outlets.

Islam hoped that there surely is without doubt that more remittance would be channeled through the agent banking in the times ahead. Migrant personnel remitted $2.11 billion last month, way greater than $1.64 billion flown to the united states in the same month a year ago.

Brac Bank has decided to embrace the branchless banking model riding on the agent banking method, said its Chairman Ahsan H Mansur.

"We have an idea to create agent outlets in every village to bring the unbanked persons beneath the financial umbrella," he said.

The bank has disbursed 50 % of the total outstanding loans of Tk 1,086 crore given through the agent banking by all lenders.

Nineteen banks now operate agent banking. The central bank issued the agent banking guidelines in 2013 within its effort to bring the unbanked population beneath the banking network to widen the financial inclusion.

Deposit mobilisation and loan disbursement have received a momentum on the trunk of the window.

Deposit collection soared 111 % year-on-year to Tk 13,040 crore by the end of September. Loan disbursement grew 255 % to Tk 1,086 crore.

Bank Asia has taken several initiatives to increase loan disbursement through agent banking, said its Managing Director Md Arfan Ali.

"In order to noticeably raise lending through agent banking, we will set up sub-branch atlanta divorce attorneys upazila where full-fledged branches are not available," he said.

The sub-branches will approve the micro-loans replacing the top office as the bank looks to decentralise the existing system, Ali said.

The bank, which includes up to now disbursed 27 per cent of the full total outstanding loans given via the agent banking outlets of most lenders, will disburse Tk 800 crore in 2021.

"The agent banking model ought to be used to provide the fund to the underprivileged section beneath the government's social back-up programmes," said Abul Kashem Md Shirin, managing director of Dutch-Bangla Bank (DBBL).

Sonali Bank is now focused on disbursing the fund, however the beneficiaries of the social safety net programmes do not have accounts.

If the fund can be disbursed through the agent banking window, more transparency will be ensured, Shirin said.

The prospect of the agent banking is bright because of the initiatives taken by the central bank and banks, Anwarul Islam said.

Customers now permitted to open an account with a realtor within 5-7 minutes by filling the electronic KYC (know your visitors) form.

"It has attracted people," Islam said.

As of September, the total number of accounts under the programme stood at 82.21 lakh, up 107 per cent year-on-year.