NRBC: First bank in 12 years to go for IPO

NRB Commercial Bank is going public to improve Tk 120 crore from the stock market, a move that could help to make it the first lender in Bangladesh in 12 years to be listed on the bourse.

The original public offering was approved at a meeting of the Bangladesh Securities and Exchange Commission (BSEC) yesterday.

With the consent, the country's bourses are set to obtain a bank's stock for the very first time in 12 years, the BSEC said in a news release. The bank will concern 12 crore common shares at face value.

The bank commenced its journey on April 2, 2013, as a scheduled bank.

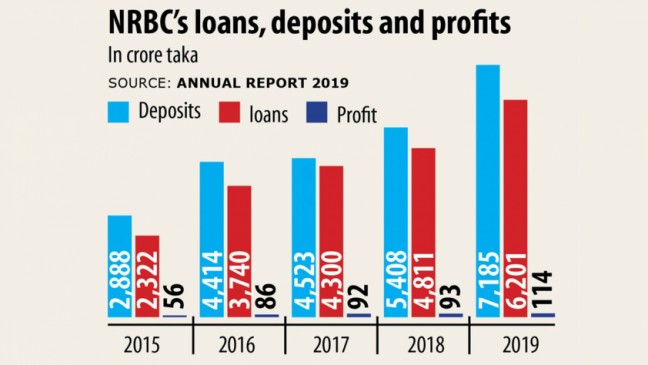

NRB Commercial Lender registered deposits of Tk 7,185 crore in 2019. Its total loans and advancements amounted to Tk 6,201 crore.

The IPO proceeds will be used to buy government securities and enhance the lender's investment in the stock market, the news release added.

The bank's weighted average earnings per share going back five years was Tk 1.55. Per-talk about net asset benefit stood at Tk 13.86 by June 30, 2020.

NRB Commercial Bank's go back on the asset was 1.46 %.

For the betterment of the currency markets, the bank's IPO membership will be completed next February, the BSEC explained.

The commission set a later date for the subscription following requirements from investors, who said these were facing liquidity shortage due to an increase in the IPOs in recent times.

AFC Capital and Asian Tiger Capital Companions Investment is the IPO's issue manager.

During the commission achieving, the BSEC also made a decision to impose a fine in the chairman and three officials of Stylecraft, a great export-oriented garments manufacturer, to get breaching the securities tips.

"They broke the guidelines related to insider-trading and you will be fined a good similar total what they earned from unlawful trading," the BSEC said.

The stock market regulator also gave its consent to Lub-rref to publish its prospectus to improve Tk 150 crore by issuing 4.52 crore shares through the book-building process.

When a company wants an increased price than face value while issuing latest shares, the price is set through bidding, to create the book-building method.

The BSEC asked eligible investors to submit bidding analysis and process of bids over Tk 50 for each and every share of the business.

It would check out the process if the eligible shareholders follow the due process, the BSEC added.