NRBs can now park their funds in FDR, DPS

Non-resident Bangladeshis (NRBs) is now able to keep their funds in the kind of Fixed Deposit Receipts (FDR) and Deposit Plus Schemes (DPS) with local lenders following a central bank directive yesterday.

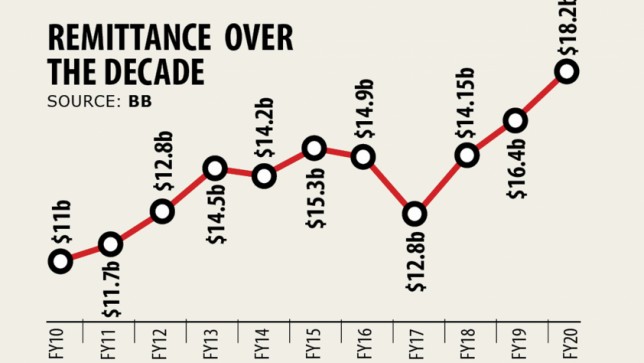

The move comes as the main government's efforts to channel in $3-$5 billion in additional remittance from expatriate Bangladeshis this fiscal year from fiscal 2019-20's record-setting $18.2 billion.

This fiscal year already started on a strong footing: $2.6 billion flew in July, that is a record for an individual month. Finance Minister AHM Mustafa Kamal credited the two 2 per cent cash incentive on remittance that he introduced last fiscal year for the surge in inflows that are beating all odds.

The other day, the finance ministry said all steps will be taken to generate higher remittance through the legal channel. This latest notice from the central bank, it seems, is the main drive.

Banks will need to introduce dedicated NRB deposit products for the Bangladeshi diaspora in order that they can keep their hard-earned profit banks on a long-term basis at attractive interest rates.

The deposit accounts should be opened in the type of a savings accounts for at least one year, according to a notice from the Bangladesh Bank.

The accounts may also be opened without any initial fund for individuals who are set to go abroad for employment purposes.

Earlier, the NRBs were permitted to open savings or current accounts with banks but did not get favourable interest levels against their fund.

With this backdrop, they were compelled to create deposits through relatives, resulting in complexities for the NRBs in many cases when attempting to securely avail the funds, said a central bank official requesting anonymity.

Now, however, the Bangladeshi expatriates can deposit their money as FDRs if they transfer the fund by method of declaring it as Foreign Money and Jewellery (FMJ) or completing the forex declaration form.

Any amount of forex may be earned by an incoming passenger with the declaration to the relevant customs authority in FMJ form.

However, no declaration is necessary for levels of up to $5,000 or equivalent in other currencies.

The central bank has asked banks to supply competitive interest or profit against the deposit products.

Banks were previously permitted to extend loans to non-resident account-holders if they had met their personal requirements on funds placed in a deposit account.

Once mature, banks could pay the proceeds of the deposits, including interest or profit, to the beneficiaries or nominees of the account.

If account-holders that reside abroad see fit, the arises from their matured accounts could be credited into interest or profit bearing FDR accounts that bear their names.

If the NRB decides to move to Bangladesh permanently, the proceeds can be made available to them through the one-time settlement or pension style monthly or quarterly settlement.

NRBs can also continue to keep up with the deposits from local sources following their go back to Bangladesh.

The BB notice included a choice to repatriate payments abroad from the balances held in the deposits on maturity or before maturity for meeting subsistent needs with permission from the central bank.

The initiative will help NRBs to make a safety net in Bangladesh, the BB official said.

They'll not face financial difficulties carrying out a permanent return to Bangladesh as the deposited fund can help them meet their expenses.

That is a time-befitting initiative certainly, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank. This may also inspire NRBs to send their money home using formal channels, he added.