BB asks banks to keep extra Tk 10,000cr in provisioning

Banks will need to set aside an additional amount of around Tk 10,000 crore found in provisioning to absorb shocks due to the ongoing economic hardship due to the coronavirus pandemic.

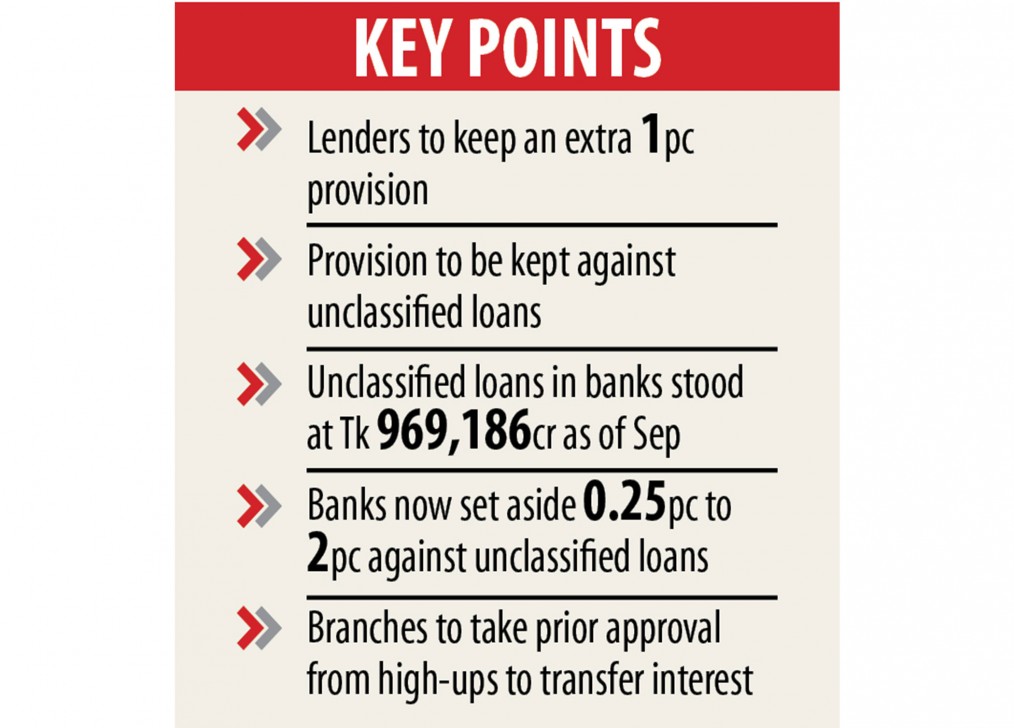

Lenders must keep an extra 1 per cent provision than what they today maintain for his or her unclassified loans, according to a central bank notice.

Analysts welcome the maneuver saying the initiative is a good time-befitting one.

The calculation of the new provisioning rule will have to be implemented predicated on the outstanding loans by December 31 this year.

Banks now set aside 0.25 % to 2 % against unclassified loans. It really is 20 % to 100 per cent against defaulted loans.

A provision can be an amount earmarked for the probable, but uncertain, monetary obligations of an enterprise. The purpose is to produce a year's balance even more accurate, as there can be costs, that could be accounted for in either the current or previous year.

In Bangladesh, the necessity of provisions has declined because the primary quarter of 2020 after the central bank allowed banks to enjoy a moratorium.

Before issuing the notice, the central bank has completed a study to find the upcoming shock in the banking sector as debtors continue to like a moratorium facility until December.

On March 19, significantly less than two weeks after the government primary reported the country's maiden coronavirus case, the central bank asked lenders never to consider businesspeople to be defaulters if indeed they neglect to repay instalments until June 30.

The moratorium facility was in the future extended until December and has curbed the rising trend in default loans and provisioning requirements.

According to the banking rules, lenders usually are allowed to transfer the interest of the loans, which is yet to come to be realised, with their income books.

Such interest is going to be treated as an accrued interest on banking norms.

Banks are permitted to exhibit the accrued interest seeing that income, but such amounts must be treated due to an interest in suspense if loans become defaulted, said a good central bank official.

From this backdrop, net profit in the banking sector is likely to get heavily inflated this year.

But the most current central bank move has reined in inflated net profit in banks.

Banks would need to keep an additional Tk 9,500 crore for the 1 % extra provisioning based on the outstanding non-performing loans by September this season, according to a central bank calculation.

But the figure increase in the ultimate quarter of this year.

By September, unclassified loans found in the banking sector stood in Tk 969,186 crore, 91.12 % of the full total outstanding loans, info from the central bank showed.

Non-carrying out loans (NPLs) stood at Tk 94,440 crore on September, down 1.74 per cent from that 90 days earlier and 18.73 per cent year-on-year, BB info showed.

The country's banking sector has historically faced provisioning shortfall as a result of failure of 10 to 11 banks.

The ongoing moratorium facility has helped banks lower the provision shortfall to Tk 2,644 crore in September as opposed to Tk 8,119 crore twelve months ago.

Banks will have to keep carefully the amount found in the sort of "special general provision-Covid-19".

Lenders will never be allowed to transfer the provision to income or any other segments without permission from the central bank.

"This is a wise decision taken by the central bank beyond doubt," said Ahsan H Mansur, executive director of the Policy Exploration Institute of Bangladesh.

Classification offers been stopped because the inception of the year due to the regulatory forbearance, he said.

So, the initiative can help banks to soak up the shock, said Mansur, as well chairman of Brac Bank.

He, however, explained some weak banks would deal with difficulties to keep the required provisioning placed by the central bank.

Mutual Trust Bank Managing Director Syed Mahbubur Rahman echoed him. "This is a good thing but it will create pressure on some banks," he said.

The central bank has also given a couple of instructions to transfer interest and profit of the loans, which have not been realised due to the moratorium facility, with their income segment.

Banks must have prior approval from the board of directors to transfer the accrued interest of loans, whose size is a lot more than Tk 10 crore, with their income segment.

If the loan size ranges from Tk 5 crore to below Tk 10 crore, the branch managers will need to take no-objection clearance from the managing directors of banks.