Banks have to reserve more funds to absorb shocks

Banks must keep aside even more funds in provision than they often maintain to create them well-equipped so that they are able to absorb shocks from any upsurge in bad debts due to the business enterprise slowdown in the coming year.

The central bank is currently working on the problem and would have a decision soon, Bangladesh Bank officials said.

A brand new instruction will get to banks within a time or two, they said.

"The central bank is now analysing banks' net profit and provisioning closely. And it'll have a decision to the result in the quickest possible period," explained BB Executive Director Abu Farah Md Naser.

He said banks will be instructed to avoid showing an excess profit this season by maintaining additional provision. "This will help minimise shocks in the coming year."

Although the central bank's circular in September extended the deadline for loan classification further to December, it gave a hint to take measures for the fortification of the provision base as well.

Banks now reserve 0.25 % to 2 % against unclassified loans. It is 20 per cent to 100 per cent against defaulted loans.

A provision can be an amount earmarked for the probable, but uncertain, monetary obligations of an business. The purpose is to make a year's balance more accurate, as there could be costs, which could become accounted for in either the current or previous year.

In Bangladesh, the necessity of provisions has declined since the primary quarter of 2020 following the central bank allowed banks to take pleasure from a moratorium.

On March 19, less than two weeks following the government primary reported the country's maiden coronavirus circumstance, the central bank asked lenders never to consider businesspeople to be defaulters if indeed they neglect to repay instalments until June 30.

The moratorium facility was after extended until December and has curbed the upward trend of default loans and the provision requirement.

Non-doing loans (NPLs) stood at Tk 94,440 crore on September, down 1.74 % from that 90 days earlier and 18.73 per cent year-on-year, BB info showed.

The country's banking sector has, historically, faced provisioning shortfall as a result of failure of 10 to 11 banks.

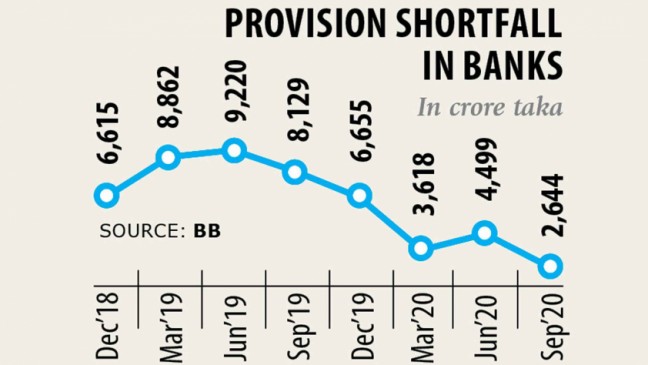

The ongoing moratorium facility has helped banks bring down the provision shortfall to Tk 2,644 crore in September as opposed to Tk 8,119 crore twelve months ago.

By September, 21 banks have failed to hold additional provisioning while 12 banks faced a good shortfall in assembly the regulatory necessity, according to central lender data.

Banks in other countries have set aside additional provisioning to protect their financial wellness from the potential hazards emerging from the ongoing economical hardship.

But, the banking sector found in Bangladesh is definitely reluctant to take action. Rather, banks want to increase net earnings to give a good sum of dividend to their directors.

As a consequence, the net earnings in the banking sector soared 33.60 % year-on-year to Tk 2,424 crore in the first half of 2020 despite a collapse in business and a feeble recovery of loans.

Lenders are actually transferring the pursuits of the loans that are yet to come to be realised to their income literature inflating profits artificially. This interest is cared for as an accrued curiosity in banking norms.

Banks are allowed to express the accrued interest due to income, but such amounts need to be treated seeing that an interest in suspense if loans become defaulted.

Banks ought to be asked to hold even more provisions against unclassified loans while loan classification has stopped as a result of the moratorium, said Salehuddin Ahmed, a past governor of the central lender.

The central bank also plans to improve the provisional requirement of unclassified loans, another central banker said.

Bankers experience welcomed the central bank move, saying this would help banking institutions strengthen their financial well being.

Emranul Huq, managing director of Dhaka Lender, said using the situation in the banking sector will be apparent next year.

"So, we have to take preparation at this time. Keeping unwanted provision will mitigate risks to an excellent extent," he said.

MA Halim Chowdhury, managing director of Pubali Lender, echoed Huq.