Default loans fall slightly for relaxed rules

Defaulted loans on the banking sector went down slightly in the 3rd quarter this year because of the moratorium on mortgage payments supplied by the central bank.

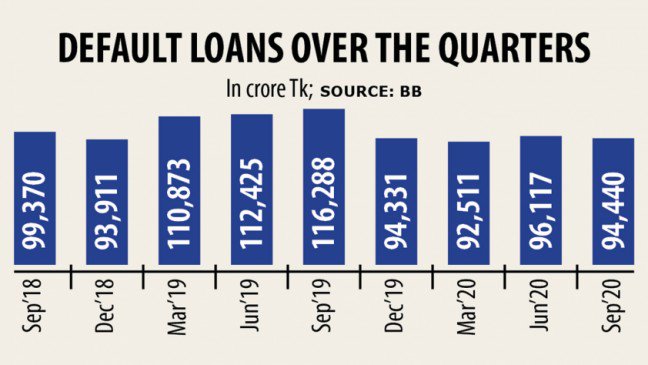

Non-performing loans (NPLs) stood at Tk 94,440 crore by September, down 1.74 % from 90 days earlier and 18.73 per cent year-on-year, data from the Bangladesh Bank showed.

But experts and bankers termed the reduction in the NPLs "meaningless" since it occurred as a result of central bank's instruction to loan providers not to classify any loans until December this season.

The moratorium on bank loan payments was introduced in the middle of March following the coronavirus pandemic arrived on the shores of the united states and started hammering monetary activities.

The support was initially expected to last before end of June. Later it had been extended up to December as the health crisis showed no indicators of abating.

The ratio of defaulted loans stood at 8.88 % of the total outstanding loans of Tk 10,63,626 crore in the banking sector by September.

The ratio was 9.16 % in June this season and 11.99 per cent in September this past year.

The ratio of the NPLs declined as banks are disbursing loans utilizing the stimulus packages initiated both by the federal government and the central bank.

"Banks can now recover loans somewhat despite the financial hardship, helping bring down their defaulted loans slightly," said MA Halim Chowdhury, managing director of Pubali Lender.

The actual picture of defaulted loans will be apparent in the center of another year when the moratorium facility will not be available, he said.

The NPLs declined massively in the final quarter of last year on the trunk of another regulatory forbearance of the central lender.

For instance, defaulted loans stood at Tk 116,288 crore by September last year, but the figure nosedived to Tk 94,331 crore by the end of the year.

The central bank had allowed banks to reschedule their defaulted loans by accepting a deposit of only 2 % of the fantastic amount rather than the existing 20-50 per cent.

Banks rescheduled defaulted loans greater than Tk 50,000 crore beneath the relaxed facility.

The ongoing moratorium facility has already established a big effect on the reduction of the NPLs this year.

"The reduction in the NPLs hasn't brought any meaningful modification to the banking sector as the toxic loans will rise at a faster pace after the moratorium is lifted," said Ahsan H Mansur, executive director of the Insurance policy Exploration Institute of Bangladesh.

Banks experience not stopped posting off their undesirable loans, bringing a positive impact on the outstanding shape of the NPLs for the time being, he said.

There is absolutely no scope to be complacent as using the challenge awaits lenders in the times to come, he said.

Banks should adopt a good cautious stance while offering new loans given the ongoing business slowdown, such that they are able to protect themselves from the pressure of delinquent loans, he said.

BB data showed a lot more than 50 % of the defaulted loans were with the nine state-run banks.

Defaulted loans on the state-run banks, however, decreased 0.22 % to Tk 47,355.07 crore by September from three months ago, the central bank data showed.

Forty-one private banks kept defaulted loans of Tk 45,037 crore, straight down 3.33 % from 25 % earlier.

The NPLs in nine foreign banks decreased to Tk 2,049 crore in contrast to Tk 2,059 crore 25 % ago.

"The downward development of defaulted loans is an effective sign during instances of crisis. We must try to continue the momentum," explained Syed Mahbubur Rahman, controlling director of Mutual Trust Bank.

A great number of clients possess rescheduled and restructured their defaulted loans in recent periods, which helped curb delinquent loans, he said.

"But, we don't really know what may happen post-moratorium," explained Rahman, also a ex - chairman of the Association of Bankers, Bangladesh, a forum of managing directors of banking institutions.

"Banks have to begin full-fledged preparation to tackle the problem to arrest the practical jump in the toxic loans," he said.

The NPLs may lower further this quarter as the moratorium is still available, he said.

Salehuddin Ahmed, a former governor of the central lender, said the central bank should strengthen monitoring in order that banking institutions carried out due diligence while lending.

"This can help avert any probable crisis found in the post-moratorium period."