Banks to pay out another Tk 1,350cr on stocks

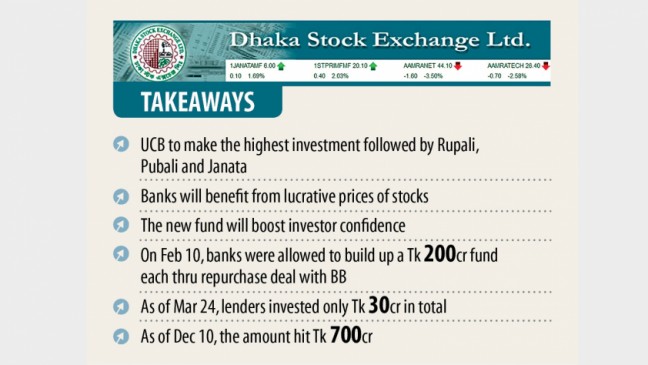

Banks are going to invest yet another Tk 1,350 crore in the stock market by utilising Bangladesh Bank's incentive, a production that will more likely to increase both liquidity flow and investor self-assurance.

The highest investment commitment came from United Commercial Lender followed by Rupali, Pubali and Janata.

By December 10, loan providers had invested Tk 700 crore available in the market however the additional investment will probably to flow in to the market in the approaching months, according to central bank data.

The move comes at the same time when community banks are facing excess liquidity credited too little demand for loans as a result of a possible second wave of the pandemic.

The Covid-19 outbreak can be affecting investment decisions, as a result of which prices of many stocks are staying relatively low.

"We have made a decision to invest in the stock market as many scripts remain lucrative and it may be successful if the investment may continue for years," said a top official of a scheduled bank, preferring anonymity.

"Profitability in the banking sector is in peril as a result of ongoing pandemic. Consequently, we are searching for every possible approach to utilise our funds," he added.

Based on the official, local business owners are struggling amid the Covid-19 outbreak, which may turn many good debtors into defaulters.

According to Bangladesh Bank data, loan providers have decided to invest in the stock market mainly after the outbreak started in early March, weeks after the central lender had offered a motivation in the type of a good Tk 200 crore fund.

On February 10, the banking regulator rolled out a deal that allows banks to create a Tk 200 crore fund by firmly taking it from Bangladesh Lender through a repurchase agreement against treasury bills and bonds owned by them.

But as of March 24, loan providers had invested sole Tk 30 crore in the currency markets under the initiative.

The banks must pay 5 per cent interest for the fund and the credit tenure will be until February 2025.

Prof Abu Ahmed, a currency markets analyst and former economics professor at the University of Dhaka, said how much funds produced available is not little from the perspective of liquidity available in the market.

"It'll boost investor self-assurance," he added.

However, the banking institutions should invest for the long-work and in fundamental stocks because most of them are still lucrative.

"Investment related officials ought to be efficient within their tasks so that banking institutions don't swallow any damage from the market, then your lenders will get encouraged to invest further," Ahmed said.

"This is very good news for the market, that may benefit from their expenditure," said Rasel Mahmud, a good stock investor.

If the banks do not get sudden exits after earning income, then your general investors would definitely get confidence to get more, he added.

A senior Bangladesh Lender official, preferring anonymity, said that although they have allowed banking institutions to invest to a larger level, they should remain wary of the fund.

"We don't want to visit a repeat of 2010," the official said.

In 2010 2010, banks had enormous investments in the stock market, causing a boon in the bourses' index.

But on the other hand, when the bubble burst, several banks and non-banking finance institutions incurred considerable losses.

So, banking institutions should invest for the long-run so that investors gain self-confidence and help the lenders earn back their cash, he added.

The country's loan providers are even being cautious right now so they invest in blue-chip stocks in order to avoid any erosion of their fund, said Khairul Bashar Abu Taher Mohammed, CEO of MTB Capital.

"Banks have begun investment their funds in to the marketplace, including treasury bonds, due to their financing scopes are limited amid the Covid-19 fallout," he said.

Their investments are fuelling investor confidence, trade and index movement of the marketplace, the merchant banker added.