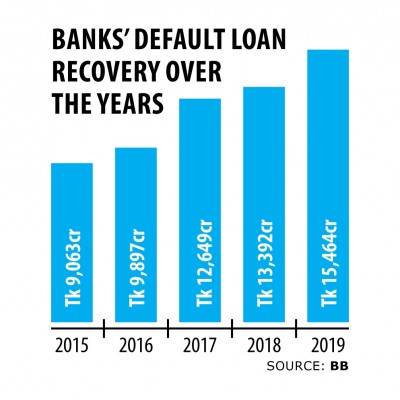

Silver lining for the banking sector as being loan recovery soars found in 2019

Pushed into a restricted corner banks put up a spirited fight against the mounting default loans last year, as their mortgage recovery went up 15.46 %.

Banks retrieved Tk 15,465 crore from defaulters in 2019, according to info from the Bangladesh Lender.

The positive news comes at the same time when a lot of the banks are mired in problems, including too little corporate governance and an upward trend of defaulted loans.

"Banks are suffocating under the burden of the defaulted loans plus they have no approach other than to provide all-out efforts to recover the delinquent loans," said Md Arfan Ali, managing director of Lender Asia.

There is no scope for banks but to look at a solid loan recovery programme to perform their operations.

"Our recovery team is monitoring defaulters round the clock to realise the undesirable loans. The monitoring offers paid off as we've recovered a handsome amount," Ali added.

But another managing director of a bank said the restoration of defaulted loans would have been far better had the central lender certainly not offered the relaxed rescheduling service.

The facility allows defaulters to reschedule classified loans by making a down payment of only 2 % of their outstanding amount rather than the existing 10-50 per cent.

The defaulters also got a year's grace period.

But only Tk 536 crore were recovered as deposit, a tiny amount given the full total rescheduling amount of Tk 19,119 crore.

Many habitual defaulters have unclassified their loans by simply giving a small amount of cash, creating a barrier for banks to recovering their defaulted loans smoothly, the MD said.

Despite the calm rescheduling facility and a strong recovery work, default loans stood at Tk 94,313 crore by the end of 2019, up 0.42 per cent year-on-year.

Dhaka Bank has got travelling restriction on a good number of habitual defaulters from the courts, which helped in containing the default loans, said its MD Emranul Huq.

The bank also filed cases against the defaulters under the Negotiable Instruments Act, 1881 within its effort to expedite the recovery of defaulted loans, he said.

Large borrowers usually have prompt measures to repay loans when they face embargoes ongoing abroad, he said.

"Many habitual debtors of my lender had faced the consequence this past year, which forced them to repay the amount of money hurriedly. We will continue your time and effort this calendar year as this is an excellent tool to bring down the default loans," Huq said.

Pubali Lender gives awards to the officials based on their effectiveness of recovering defaulted loans, said it is MD MA Halim Chowdhury.

Loan recovery could have been increased manifold had loan providers settled the pending circumstances with the money loan courts in a quick manner.

He fears that banking institutions would face a hardcore situation in recovering the defaulted loans this season as a sizable number of borrowers had managed the one-year grace period.

Besides, many companies are going through trouble because of the outbreak of coronavirus across the globe, he said.

"Banks may be strike hard by the problem and this could have an adverse effect on their recovery programme," Chowdhury added.

Default loans recovered by state-run banks rose 1.40 % year-on-year to Tk 4,110.56 crore in 2019. It rose 22.66 % to Tk 11,267 crore for individual banks.

Recovery at foreign banks, however, dropped 42 per cent to Tk 87.52 crore.