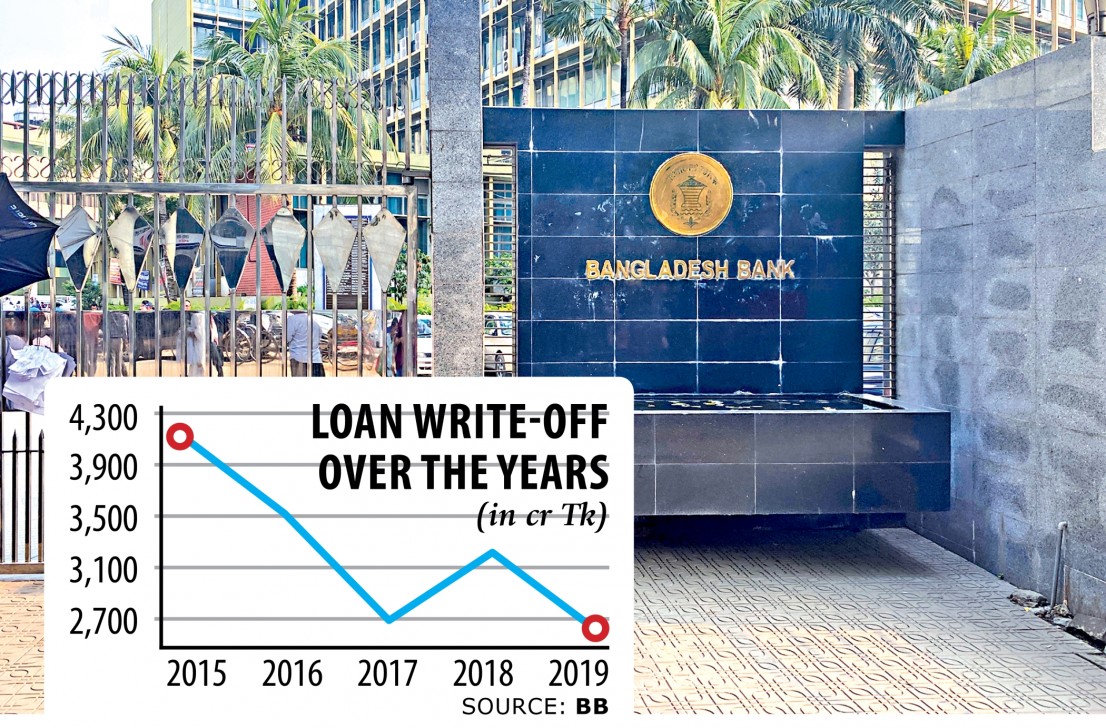

Loan write-offs sink to a good five-year low

Loans written-off by banking institutions plunged to a good five-year lower in 2019 as loan providers recommended relaxed rescheduling facility provided by the central lender to completely clean up their balance bed sheets.

In banking, banks write away bad debt that's declared non-collectable, removing it from their balance sheets.

This past year, loans amounting to Tk 2,597 crore were written-off, down 19.03 % from a year earlier, according to data from the central bank.

Banks have to keep 100 % provisioning against the written-off loans, making it difficult for many loan providers amid lower incomes. This led loan providers to use the relaxed rescheduling center to lower their defaulted loans, bankers state.

In 2019, defaulted loans totalling Tk 50,186 crore were regularised, the best on record for an individual year.

Of the sum, Tk 18,584 crore was regularised beneath the central bank's relaxed policy announced in-may last year.

The facility allows defaulters to reschedule classified loans by simply making a deposit of only 2 % of their outstanding amount rather than the existing 10-50 per cent.

Banks recovered Tk 479 crore in deposit from the loans rescheduled beneath the policy.

Lenders weren't keen to write off defaulted loans this past year as they need to keep a big amount found in provisioning from revenue, said M Kamal Hossain, managing director of Southeast Lender.

"Many banks are even failing to provide dividends to shareholders. How could they then clean up the total amount linens using the write-off tool?"

The rescheduling facility has helped banking institutions push apart the defaulted loans, Hossain said.

Despite a large amount of loans being rescheduled, defaulted loans went up 0.42 % year-on-year to Tk 94,313 crore this past year.

Written-off loans would have increased drastically if banks hadn't got the calm rescheduling facility, reported Zahid Hussain, a previous lead economist of the World Bank's Dhaka office.

Banks' efforts to completely clean up the total amount sheet using the center will not bring worthwhile for them.

"Oftentimes, rescheduled loans become default loans. Hence, the financial wellness of banks might not be long-lasting," he said.

Some Tk 13,284 crore of the soured loans which were regularised last year have grown to be defaults once more, BB data showed.

Sponsor-directors have received dividends by avoiding written-off loans, said Ahsan H Mansur, executive director of the Policy Analysis Institute of Bangladesh.

Assets in the banking sector could have widened had lenders maintained provisioning against their soured loans, he added.

Khondker Ibrahim Khaled, a good former deputy governor of the central lender, echoed Mansur.

Banks want to paint a much better picture because of their financial health either utilizing the write-off tool or perhaps the loan rescheduling service. "But the financial overall health of banks won't improve the truth is."

"Default loans will go up once again, which may strike the banking sector in a dreadful approach in the times ahead. And we have to face issues in tackling the situation," Khaled added.

A complete of Tk 56,016 crore has been written off since the facility was introduced in January 2003.

Of the amount, 79 per cent has remained outstanding to date, meaning banks' efforts to recuperate the loans didn't bear much fruit.

As of December this past year, state-owned banking institutions have written off Tk 23,258 crore and private banks Tk 30,889 crore.

Two state-run specialised banking institutions -- Bangladesh Krishi Lender and Rajshahi Krishi Unnayan Lender -- wrote off Tk 604 crore and foreign banking institutions Tk 1,265 crore.