Dhaka Bank to provide customer support through WhatsApp

WhatsApp has become a non-negotiable the main modern life. Which explains why banks in lots of countries have embraced it to deliver their customer support very effectively.

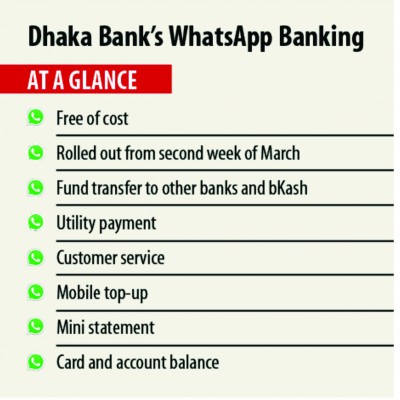

And out of this month, customers of Dhaka Bank can get real-time banking service through the messaging platform, in an initial for Bangladesh.

The lender is set to roll out the novel digital banking model for its registered 2.5 lakh clients from the next week of March as part of its push towards digitisation in order to attract tech-savvy customers.

From today Dhaka Bank will roll out WhatsApp banking on a pilot basis among its employees, said its Managing Director Emranul Huq.

"This can help us to determine problems before launching it formally for clients," he said, adding that Dhaka Bank got approval from the WhatsApp authority last month to introduce the service.

Customers can transfer funds from Dhaka Bank to other banks and bKash, the country's major mobile financial service provider, make utility payments and mobile top-ups.

The WhatsApp banking platform will offer mini statements to customers and credit card-related transaction record.

Customers may take the service both through messages and voice calls on the WhatsApp platform.

For example, any customer could make calls to the customer service centre of Dhaka Bank through WhatsApp if he/she faces any issue while in the home and abroad through WhatsApp.

This can help reduce the price tag on customers as WhatsApp is a free of charge internet-based communication application.

Besides, Dhaka Bank won't impose any change on clients for enjoying banking services through WhatsApp, Huq said.

The lending company is hoping more than 50,000 of its customers will embrace the service within the next 2-3 months.

"WhatsApp banking model may also attract new clients because they can get to conduct hassle-free banking and settle transactions while sitting at their home or office."

The country's youths are highly tech-savvy and the brand new banking model may catch their attention too.

Over the next few day, Dhaka Bank will send a text message to its registered customers with link of the WhatsApp banking services.

After clicking on the hyperlink, customers will have to send a 'Hi' or 'Hello' message to initiate the WhatsApp banking service.

They'll then be asked to reconfirm if they would like to take banking service on the platform. They'll then be asked to input their account number and create a four-digit passcode for the platform.

After completing the procedure, the lender will send a one-time password to clients for completion of the registration process.

"WhatsApp banking is safe because all messages are secured with end-to-end encryption," Huq said.

In case of theft of customers' smartphone, the thief will never be in a position to conduct banking service through the platform by pretending to be the client.

For the reason that, without the passcode the WhatsApp banking wouldn't normally be activated and the thief wouldn't normally know this passcode.

The client, however, should immediately deactivate their WhatsApp account by informing the client service centre.

"We've been rolling out several digital banking service in the last few years to maintain with the technology-based contemporary times. And the latest one will add value to your banking services further," Huq said.

The lender in addition has centered on expanding its SME and retail banking service in an instant manner and WhatsApp banking is only going to assist in implementing the roadmap.

Dhaka Bank's retail and SME financing stand at 12.5 percent of its total outstanding loans of Tk 19,563 crore as of December last year.

"We've set a target to enhance the financing to the segment at 35 % of our outstanding loans within 2024," Huq added.