Agent banking: the shiny spot in lending landscape

Agent banking, which uses banking solutions to the unbanked persons, is certainly going from strength to strength, with both deposit collection and mortgage loan disbursement on the rise.

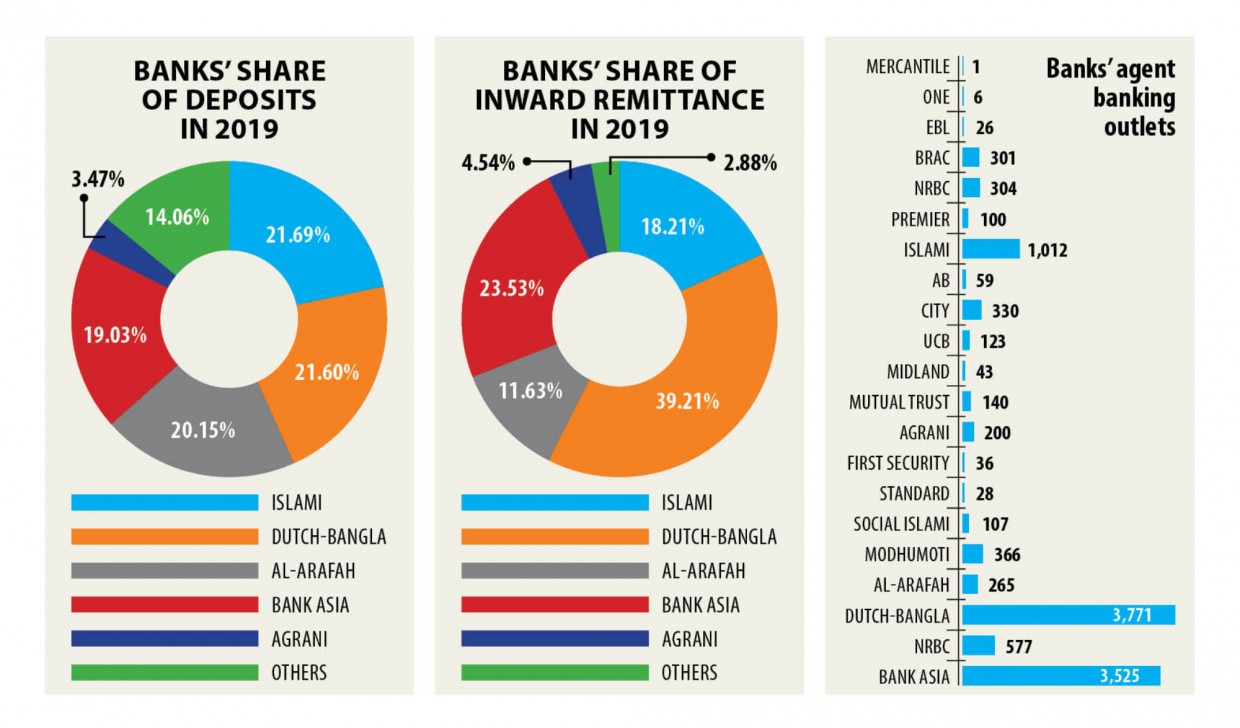

Loan providers earlier kept their main focus on collecting deposits from clientele through the new banking wing nonetheless they have given the same importance to bank loan disbursement and inward remittance.

As of September this past year, mortgage disbursement through the agent banking channel was Tk 446 crore, which is more than double that from a good year earlier. As well, deposit collection gone up 142 % to Tk 7,517 crore, according to info from the central bank.

"The tremendous growth of agent banking proves that the underprivileged people are thinking about banking services," explained Md Arfan Ali, managing director of Lender Asia.

There remains huge scope for widening agent banking simply because lenders are but to increase their traditional banking service to the many unbanked people.

"We will focus even more on agent banking in the times ahead as operational cost of the banking windows is much, much lower compared to the traditional one," Ali said, adding that Lender Asia will disburse loans at 9 % from April through agent banking as per the government instruction.

At present, the lending company is disbursing loans which range from Tk 20,000 to Tk 200,000 to borrowers at mortgage loan of 14-15 % through the channel.

The lower operational costs for agent banking can help Bank Asia sidestep the difficulties stemming from implementation of single-digit interest on lending.

As of December this past year, loan disbursement by Bank Asia stood at Tk 259 crore, which is 58 per cent of the total outstanding loans provided by all loan providers through agent banking.

Agent banking will get more popularity for mortgage loan disbursement in the coming days as rural persons tend to be forced to have loans from non-governmental organisations and the informal sector at a higher interest rate, Ali said.

"So, we've laid focus on disbursing loans by our brokers so that underprivileged people can take their expected loans at a price less than the rate made available from the informal sector," Ali added.

The central bank issued the agent banking guideline in 2013 however the licensees didn't start full-fledged businesses until 2016.

Agent banking presents limited banking and economic products and services to the underserved population by engaging representatives less than a valid agency arrangement.

It is the owner of an store who conducts banking transactions on behalf of a bank.

Agents provide products and services such as dollars deposits, withdrawals, remittance disbursement, small value mortgage loan disbursement and restoration of loans, and cash payments under the government's social safety net programmes.

"The banking service offers caught the attention of rural people very fast due to its hassle-free solutions," said Md Anwarul Islam, general manager of the Financial Inclusion Division of the central lender.

The Financial Inclusion Division is focused on monitoring agent banking.

"Buyers initially faced some sort of confusion on whether the outlets actually ran banking services. But such ambiguity possesses been removed, which experienced helped agent banking to flourish."

Banks will introduce the electronic Be aware of Your Client (e-KYC) for agent banking soon, that may let clients open accounts within 5-6 minutes, he said.

"This gives further increase to agent banking," Islam added.

Outlets of agent banking distributed Tk 15,534 crore in remittance this past year, up an astounding 180 % year-on-year.

Receivers of remittance usually head to their lender branches to accumulate remittance, but they may easily receive the cash from agent banking outlets that tend to be located next to their house, said a Bangladesh Lender official.

Besides, for lenders agent banking is a good way to obtain low-cost deposits: the price tag on collecting deposits through the winder is 1-1.5 % lower.

"And people in rural areas mostly prefer financial savings accounts," he said.

As of December last year, 21 banking institutions combined have 52.68 lakh accounts, up 114 % from a year previously.