Soaring post office deposits to come crashing down

Savings accounts in post offices saw soaring deposits in recent years thanks to high interest rates offered by the federal government to tempt persons in the suburbs and rural areas to use formal channels for parking their funds.

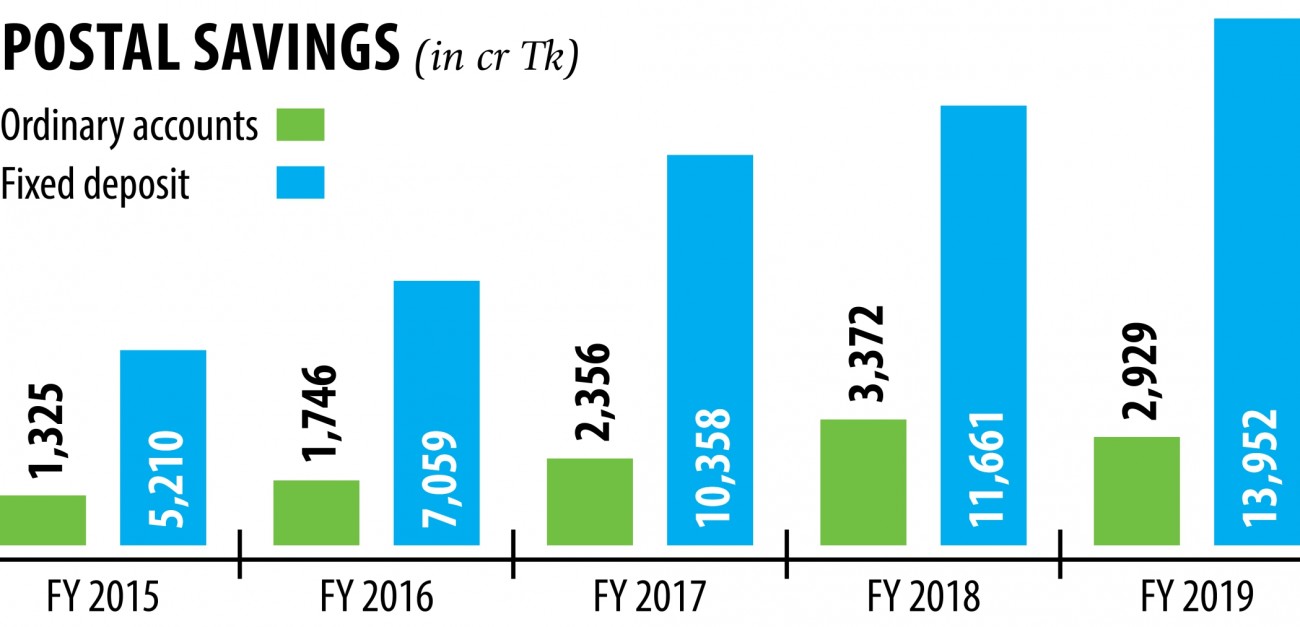

Deposits in ordinary accounts in post offices a lot more than doubled to Tk 2,930 crore in fiscal 2018-19 from Tk 1,325 crore four years earlier, according to data from the Department of National Savings (DNS).

A similar trend has been observed in cases of fixed deposit accounts in post offices.

Savers deposited Tk 13,950 crore in fiscal 2018-19 in fixed deposit accounts in post offices, that was a lot more than two and half times the deposits received in fiscal 2014-15.

"High interest rate appears to be one of the reasons for the rising deposits," said Khandker Shahnur Sabbir, deputy postmaster general of Bangladesh POSTOFFICE.

As a result of government's crackdown over the last several years, there has been almost no presence of multi-level marketing (MLM) firms that used to provide exorbitantly high interest levels to attract deposits.

The absence of these informal channels could possibly be another cause of people's interest in depositing money in post offices.

"And a wide array of small savers in the rural and suburban areas deposited their money in post offices," said Sabbir, also a senior postmaster of Dhaka GPO.

Until February 12, the finance ministry offered as high as 11.28 per cent interest on a three-year fixed deposit account with post offices, which is greater than the interest rates given by banks.

In case of ordinary accounts in post offices, the interest was 7.5 %, which is also greater than the rates proposed by banks for savings accounts.

However, the government's latest move to cut interest levels on savings in post offices has created frustration among savers and will probably bring down savings and encourage the return of against the law MLMs.

For example, interest on three-year term fixed deposits was reduced to 6 % from 11.28 % as the government aims to lower interest levels in bank deposit and lending.

The interest on ordinary and fixed deposit accounts in post offices was almost near the interest rates made available from national savings certificates until the other day.

But the interest rates on deposit accounts in post offices were halved suddenly as the interest rates on savings certificates remained unchanged.

The interest levels on ordinary accounts and fixed deposit accounts in post offices have already been low in line with the banks in a bid to produce a balance, said a finance ministry official.

This is the first-time the interest levels of deposit accounts in post offices and savings certificates of the DNS saw a gap in interest rates.

Khondker Ibrahim Khaled, a former deputy governor of Bangladesh Bank, said the most recent move would discourage savings.

"The interest on banks' savings has been cut by force. Now, the interest on deposits in post offices has also been reduced. This action affecting the marketplace mechanism won't bring worthwhile to the economy," he said.

The government's total outstanding liability stood at Tk 289,267 crore as of June 2019. Of the total amount, ordinary accounts and fixed deposit accounts in post offices were 13.97 %, according to DNS data.