Bangladesh Bank braced for tighter grasp on private banks

The rot starts at the very top, it is often said. In fact it is this pandemic that the central bank is looking to tackle in the brand new Banking Companies Act.

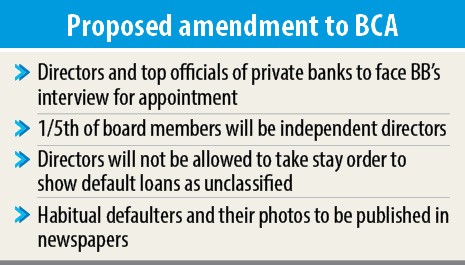

For instance, it has proposed interviewing both directors and managing directors of individual banks before they are appointed, as per the draft of the amendment to the BCA that is uploaded on the finance ministry's website on Monday for the judgment of the general public.

All stakeholders features been requested to provide their view within 21 working days.

The Bangladesh Bank's intervention in to the appointment of key personnel in private banks does not simply end there: the interview board may also nominate additional and deputy managing directors, all top executive posts of lenders.

All perfectly, but had the draft proposed express banks, where irregularities are dime a dozen, feel the same rigour in appointing top executives, it could seem to be the amendments has its heart and soul in the proper place.

The draft also bars anybody involved in any fraudulent activities or financial crimes or with detrimental observations of financial regulators from holding top posts in banks.

Directors who display default loans as unclassified by taking stay-orders from the Large Court will also lose their position on the respective bank boards.

However, those that reschedule their default loans as per the banking norms might be spared.

The quantity of directors of a bank is a maximum of 20, which one-fifth should be appointed as independent directors.

The qualifications of independent directors have been mentioned in the draft become well.

Anybody who previously served as director, officer, advisor, consultant or auditor of the lending company cannot be its independent director.

A person may also not be permitted to carry independent directorship of she or he comes with an ongoing relationship with different banks as director, officer, advisor, consultant or auditor.

An alternative solution director will be permitted to serve the board of a lender for no more than half a year and he/she may play the purpose for once a year.

In various cases, the alternative directors of most banks have always been serving the boards as the initial directors haven't visited the country.

The initial directors will be forced to take part in the board appointment if the draft act move muster in the parliament.

Any borrower who does not repay his/her loans despite his/her capability to do so will be termed a habitual defaulter, as per the draft act made by the finance ministry for banks.

Banks and finance institutions must publish the set of habitual defaulters with their pics on the respective lenders' website and newspapers.

Mortgaged lands should be taken over by banks within a month of the borrower being declared a habitual defaulter.

Habitual defaulters won't get any trade licence and they'll not be permitted to register their house and vehicles.

They'll also be barred by the Registrar of Joint Stock Companies and Businesses from opening new companies.

The draft act has also included a fresh provision to restructure, liquidate and merge troubled and weak banks.