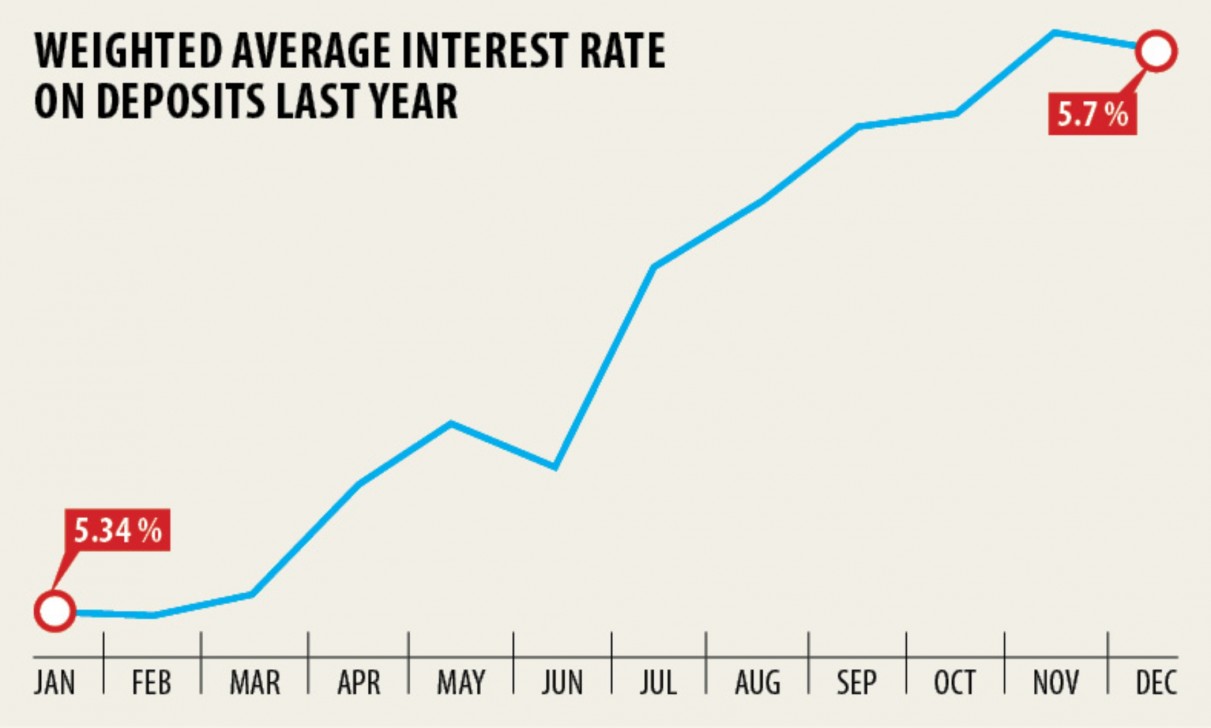

Bank deposits now largely fetching 6pc interest

Nearly all banks have previously implemented the 6 % interest rate on their fixed deposit schemes (FDR) as part of their preparation to supply loans at 9 % interest in a number of months' time.

The development employs private banks' sponsors and managing directors in a gathering with Finance Minister AHM Mustafa Kamal on December 30 this past year had decided to set single-digit rates of interest from April.

Subsequently on January 28, the Association of Bankers, Bangladesh (ABB), a forum of managing directors of banks, took your choice to provide only 6 % for FDRs from February 1.

The Daily Star has collected the FDR data of 29 banks and found seven -- Mercantile, Southeast, Trust, AB, IFIC, Premier and National -- are yet to lower their interest rate to 6 per cent.

The seven banks, however, have previously taken measures to lessen the interest rate on the FDRs though.

Setting the interest at 6 % for deposits overnight is a hard task because they have offered savers 8-9 percent rate when selling the schemes, said officials of banks.

"This is actually the respective bank's decision if they will lower the interest on deposit. But, we will need to do it if you want to make single-digit lending rate sustainable," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

The 6 % interest rate can help banks to lower the price tag on fund, which will play a role in implementing single-digit lending rate smoothly, he said.

National Bank (NBL) Additional Managing Director ASM Bulbul said that his bank had already taken initiative to lower the FDRs to 6 % before April.

The bank has already fixed the interest rate of 6 % for 3-month FDR, he said.

NBL savers are receiving 9.50 % interest from their 6-month and 1-year FDR products respectively.

"We will certainly reduce the rates within March," Bulbul said.

Mercantile Bank in addition has fixed 6 % interest for 3-month FDR, nonetheless it continues to be offering 6.50 per cent for 6-month and 7 % for 1-year.

The lender will implement the 6 % interest before April, said its Additional Managing Director Mati Ul Hasan.

"We've already lowered the interest on deposit. And the rate will be reset soon," he said.

To facilitate banks to charge 9 % for loans from April, the finance ministry on January 20 instructed the autonomous, semi-autonomous and government companies to keep half of their surplus funds at 6 % interest with private lenders.

The remaining half of their deposits will head to state banks, which may offer only 6 % interest.

The private banks would get government funds in line with their paid-up capital.

But Brac Bank Chairman Ahsan H Mansur said banks would have to face a dire consequence because of the 9-6 % bounds.

A great deal of money will go directly to the informal sector from banks as a result of government's decision as savers will not finally get any return from keeping deposits at banks, he said.

"If we calculate the prevailing inflation level and charge imposed by banks, savers will be losers for parking their money at banks," said Mansur, also a former official of the International Monetary Fund.

He feared that savers of lenders would invest their profit cooperative societies to be able to manage high returns.

But such investment will be highly risky as a good number of cooperative societies had earlier stopped their procedure after embezzling funds of common people.