Serial bank scamsters’ days could possibly be numbered

Scamsters' errant ways might soon be checked given a database the central bank is preparing.

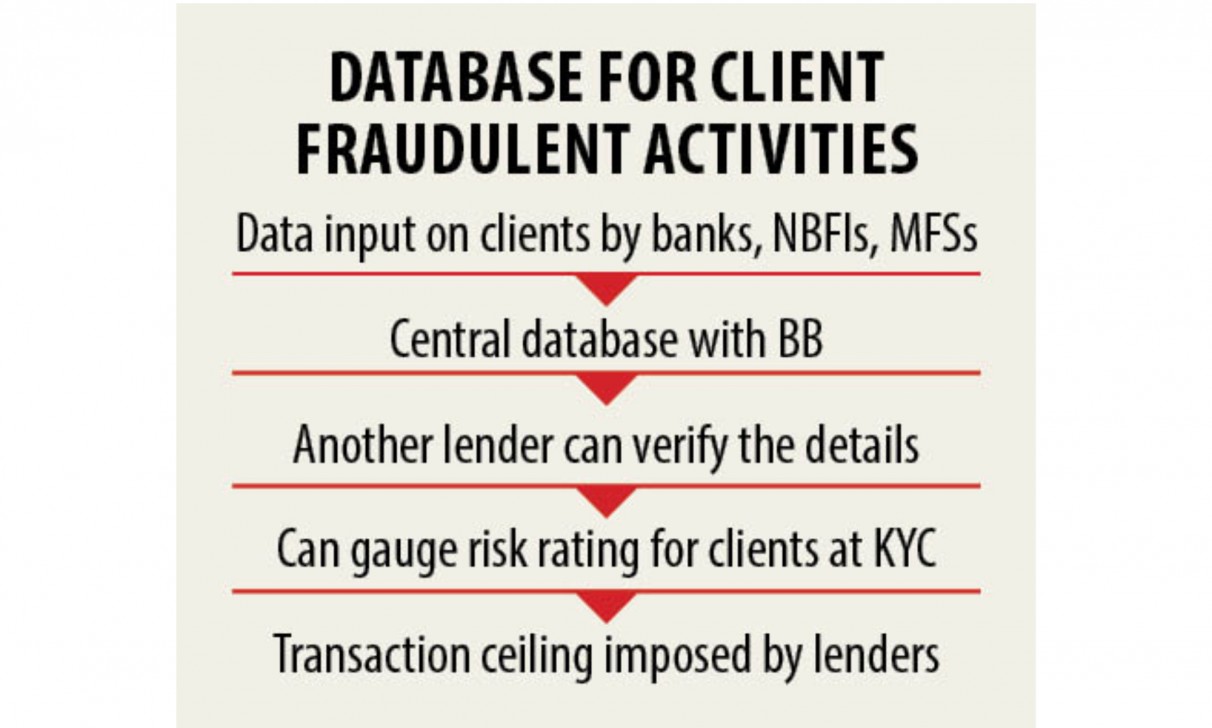

Banks, non-bank financial institutions and mobile financial providers will input information on a central database. If any fraudulent activity is found against a client, lenders will attach it to the database.

Each lender will verify the info of each client once he/she opens a merchant account with the entity.

"The database will be operated like the credit information bureau (CIB) storage of the central bank," said a Bangladesh Bank official with strong understanding of the matter.

The central bank has already started work for the database, which will be live within this season, he said.

Lenders will use the information of the database if they will fill up the KYC (know-your-customer) type of clients.

Clients will a get yourself a rating predicated on their previous banking record at the database.

A poor transaction ceiling will be fixed for a client if he/she was involved in fraudulent activities previously. Sometimes, banks will not open any account in favour of a client if serious forgery are available.

The CIB has been storing the nature of loans taken by clients permanently. Lenders will verify the credit score status before giving any fresh loans to a borrower.

The forgers is now able to get banking services from other lenders even after committing fraud with a bank, according to a central bank paper.

Lenders cannot get any information of such forgery in the absence of a central database.

"Such forgers are dangerous for the complete banking sector. They frequently forge the cheque book and embezzle deposit of clients," the BB paper said.

The database will store clients' details such as for example their parents' name, date of birth, national identity number, tax identification number and present and everlasting address.

"Lenders will also input the description of forgery cases at length at the database. If any client earlier got punishment for forgery, lenders must mention it aswell."

Along with clients, the banking record of the prevailing clients may also be assessed to repair their risk rating.

This can help secure financial transactions more in the banking sector, the official said.

The name of the software, which is used for storage of the info, is Corporate Memory Management System.

The central bank's Information Systems Development and Support Department are working on it.

Operational module procedure and regulations will prepare yourself when the software will be equipped for operation.

The central bank will take opinion from stakeholders about how to operate it within an efficient manner before launching it formally.

The National Integrity Strategy Implementation related committee of the central bank will be running the software.