Opening a bank account now easier than ever

The central bank yesterday simplified the account opening sort of banks as part of the government's efforts to get persons to come under the formal financial umbrella.

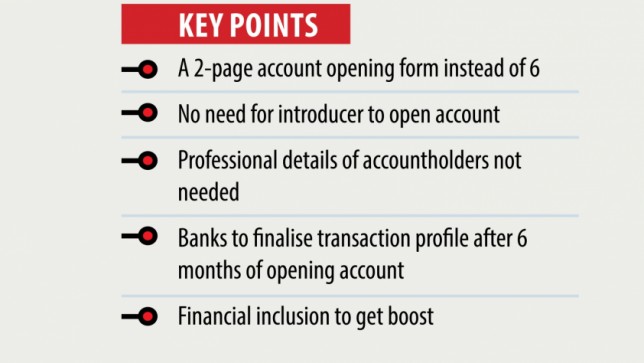

Now, customers will have to fill only a two-page form rather than the previous six-page one to open a merchant account, according to a Bangladesh Bank notice to lenders.

People who have a valid national identity card (NID) won't need any introducer to open a merchant account. However, an introducer will be a must for many who don't have an NID.

Customers will also not need to say their other banks' account related information in the brand new form, which was drafted by a government-formed committee comprising of officials of the finance ministry, the central bank and banks.

The new form will also not ask the professional identity of the accountholders as the NID database has such information.

The election commission has allowed banks to gain access to to its NID database to permit them to cross-check customer details while opening account or settling any financial transaction.

And you don't have to add any emergency contact of the accountholders in the proper execution now. Banks can communicate with the nominees in the event of any emergency, said a BB official.

The banking watchdog in addition has changed the transaction profile area of the form.

Banks earlier fixed the transaction profile according to the declaration distributed by the customers. Now, they'll observe the customers' transaction profile for half a year and form a decision.

The BB has uploaded three samples of account opening form on its website, that will cover person, institution and government, semi-government and autonomous entities.

It has additionally provided samples of fixed deposit scheme, savings and special schemes.

The banking regulator introduced a uniform account opening form for all banks in 2017. But this time it has revised the proper execution to streamline the procedure.

This will leave a positive effect on the banking sector all together as customers will now have the ability to easily fill their account opening forms, said Md Arfan Ali, managing director of Bank Asia.

According to the draft of the National Financial Inclusion Strategy, the government has taken an idea to ensure all matured people begin using bank accounts within 2024.

The latest initiative can help materialise your choice, he said.

The BB simplified the Know Your Customer form a couple of weeks ago, which is another good step to strengthen the financial inclusion agenda taken up by both central bank and the federal government.