Govt’s insatiable appetite for bank funds

Poor income collection has forced the government to exceed its total annual borrowing limit from banking sources seven and half of a months in to the fiscal year, creating a probable credit crunch for the private sector.

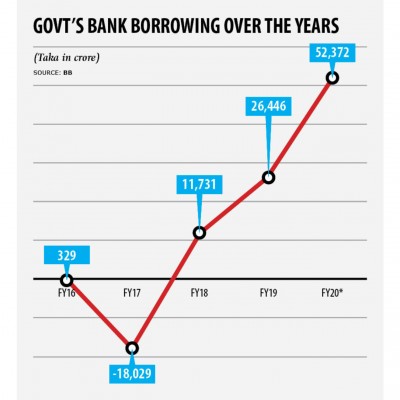

The government has set a borrowing limit of Tk 47,364 crore for fiscal 2019-20, but by February 16 it has taken Tk 52,372 crore, that is a fresh record for an individual year.

Last fiscal year, the federal government borrowed Tk 26,446 crore from the banking sector.

The government wouldn't normally have had a need to borrow so much from banks had it used the foreign loans proficiently for implementation of the gross annual development projects, said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue.

"Capital market might have been another source for the federal government from the perspective of its fund management, however the market has been going right through a haphazard situation for months."

However the government has mainly been forced to borrow the large amount from banks due to its earnings shortfall, he said.

Provisional data showed the National Board of Revenue (NBR) could log in Tk 124,500 crore in the first seven months of the fiscal year, missing the mark for the time by a whopping Tk 39,500 crore.

"The federal government should increase its earnings collection by hook or by crook in order to tackle the large amount of borrowing from the banking sources. If not, it will face a substantiate interest burden in the years ahead."

The large level of government borrowing will have an adverse effect on the private sector in the coming days as businesses will be unable to obtain requisite funds from banks.

At present, banks aren't feeling the pinch as the demand for credit from the private sector is subdued, Rahman added.

Private sector credit growth stood at 9.83 % in December this past year, which is the lowest since 2008 at least. Available Bangladesh Bank data goes dating back to 2008.

But banks will face extreme liquidity crunch when businesses begins expanding their investment in a full-fledged manner, Rahman said.

"We are not facing any difficulty to control our funds right now," said Md Arfan Ali, managing director of Bank Asia, adding that the problem may not sustain in the long run given the upcoming probable credit demand.

Credit demand is likely to grab from April, when banks will implement the single-digit lending rate on their all loan products except credit card, he added.

Besides, the government borrowing is likely to creep up in the ultimate quarter of the fiscal year, when the implementation of ADP is commonly ramped up, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

"Banks would start facing problems then," he added.

As of February 16, the federal government owes banks Tk 160,467 crore, up 48.44 % from June 30, 2019.

"A good number of banks are feeling comfortable about offering loans to the federal government as this is a totally risk-free lending," said AB Mirza Azizul Islam, a former finance adviser to a caretaker government.

Many banks are showing reluctance in offering loans to the private sector as deposit growth hasn't increased as expected.

"The federal government should avoid massive government borrowing from banking sources for the higher interest of private sector. If the private sector is squeezed, employment generation will not widen. In such a situation, the country's GDP growth will face a hurdle," Islam added.