Bank Asia to create receiving remittance less complicated than ever

Bank Asia has think of a novel approach to generate remittance within its work to get migrant employees to send money home through the state channels.

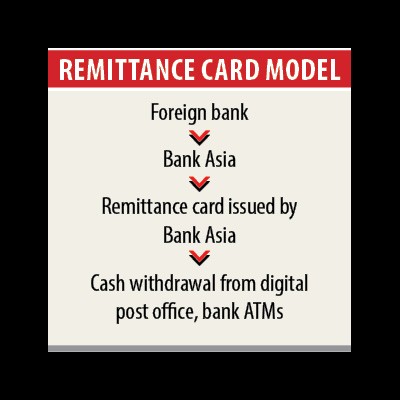

The private loan provider is defined to introduce the remittance card that can be utilised at the 8,500 digital branches of the Bangladesh POSTOFFICE across the country along with the cash machines of any bank to withdraw funds.

Bank Asia receives about $1 billion found in remittance every year. The lender is expecting the physique will double this season once the remittance card can be rolled out in the future this month.

"This is a novel set up that will ultimately encourage remitters to send their funds through the formal channel on the subject of a real-period basis," said Md Arfan Ali, managing director of Bank Asia.

Receivers of remittance won't face any hassle seeing that the expatriate Bangladeshis can directly deposit their hard-earned funds to the remittance cards of their near and dear kinds.

The initiative may also help those moving into remote areas as much loan providers are yet to create branches there however the post office's digital branches can be found.

Every digital branch of the post office has installed a point of sales (PoS) terminal where in fact the receivers will swipe their remittance card to obtain desired fund.

Besides, the agent banking booths of Lender Asia will also be able to supply the cash through the use of their PoS terminals.

Bank Asia has up to now allowed a complete of 3,422 brokers in the country to perform small-scale banking.

The latest approach means customers can avoid likely to bank branches to withdraw cash, Ali said.

Both the digital branches of the Post Office and Bank Asia's agents provides remittance card to clients with respect to the lender.

Customers will not need to spend any amount to avail the card, which is issued within three times of application.

To find the card, customers should complete the Electronic Understand Your Customer (e-KYC) form. And presented the central bank's recent move to roll out e-KYC the process will take just 5 minutes.

Customers will be allowed to fill the e-KYC by simply submitting their national identification card.

Bank Asia will also make discounts available for cardholders if indeed they purchase items from stores with that your lender features agreements, Ali said.

Remittance has recently turn into a major device for the government to control its macroeconomy seeing as exports continue to slide in recent months.

It has developed into lifeline of the market given the frustrating performance of all other economic indicators.

In February, expatriate Bangladeshis delivered real estate $1.45 billion to take the tally to $12.49 billion so far this fiscal year.

The eight-month receipts were up 20.05 % year-on-year, according to data from the Bangladesh Bank.

The approach would also help further the central bank's financial inclusion agenda as it would attract rural persons to open accounts with the lending company, according to Ali.

Besides, remitters may also be discouraged to send cash through 'hundi' channel, that is a cross-boundary illegitimate money transferring program that sidesteps banking institutions, Ali said.

Bank Asia's net revenue in 2018 stood in Tk 226.62 crore, up 10.68 per cent year-on-year.

Shares of Bank Asia, which made its debut on the Dhaka STOCK MARKET in 2004, closed at Tk 16.50 yesterday, up 1.85 per cent from the previous day.