Interest caps poised to shrink National Board of Revenue's collections

The state coffer's receipts from the banking sector, which makes up about about one-third of the National Board of Revenue's Large Taxpayers Unit's collections, tend fall in the wake of interest caps on loans and deposits, said taxmen and bankers.

"This is likely to reduce banking institutions' operating income," said Trust Bank Managing Director Faruq Mainuddin Ahmed, adding that the decline in banks' profit will invariably lead to a decrease in tax collection.

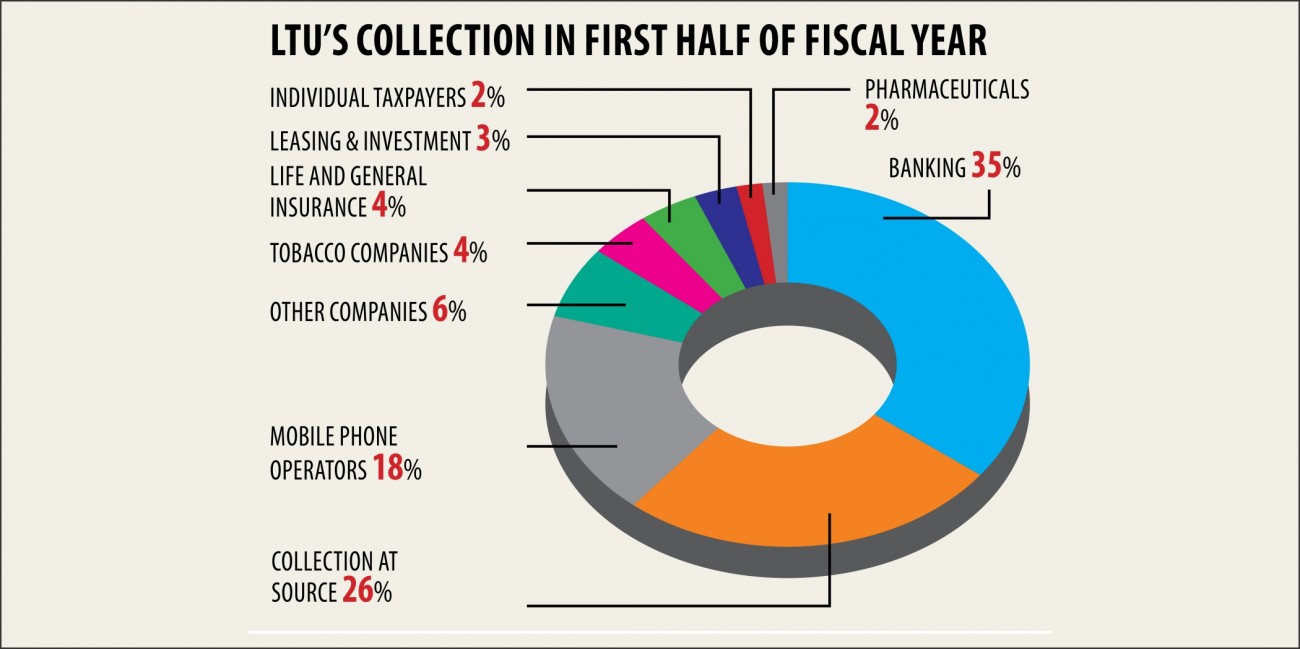

Banks accounted for 35 % of tax assortment of Large Taxpayers Product, the key tax collector for tax under the NBR, in the first one half of the current fiscal year.

Among the reasons banks' revenue will shrink is as a result of inclusion of consumer loans to the 9 % interest bracket, he said.

Consumer loans do not require any protection and the healing process is cumbersome and requires even more manpower for supervision.

"If the rates of interest on consumer mortgage loan are reduced to 9 per cent, no bank should be able to manage. That is why bank's money will drop therefore will their gains," he stated, while welcoming the lessening of interest rates for industrial credit for giving a boost to industrialisation.

All the banking institutions own downsized their budgets to handle the new interest levels, Ahmed added.

Taxmen said the effect of interest rate lowering and subsequent drop found in profitability of banks will tend to be visible within the next fiscal 12 months as banks can pay tax based on their incomes found in the 2019 twelve months.

The LTU is in charge of collecting tax from 439 big companies, including banks and insurances, along with 720 individuals.

Its total collection was practically one-fourth the total tax of Tk 73,000 crore collected by the NBR in fiscal 2018-19.

The LTU logged in Tk 17,420 crore last fiscal year and the quantity of collection from the banking sector was 38 per cent of its total receipts.

Between July this past year and February this season, the LTU accumulated Tk 10,200 crore and the contribution of banking sector continuing to remain more than one-third of its total tax receipts, regarding to taxmen.

On the surface it seems banks' income will decline for interest cuts, explained a senior official of LTU wanting to remain unnamed.

If the demand for loans increases due to the lower interest levels and the quantity of defaulted loans improves, now there would be no influence on tax collection, he added.

Tax collection from the banking sector will definitively reduce when there is no improvement in default loan circumstance, said Towfiqul Islam Khan, senior research fellow in the Centre for Insurance policy Dialogue.

"If banks usually do not improve their proficiency, the new rates of interest may perhaps affect profitability of the banking sector and the collection of corporate tax from the sector," he said.

"It demands to be seen the way the move impacts the entire economy of the country," he explained, adding that if the market is benefitted by the interest cuts, revenue collection is likely to rise.

The reduction of deposit rate though will hit the tax receipts on interest earnings from savings and set deposits.

Deposit growth in banking institutions saw a good steep decline found in January, in a advancement that can be seen as the direct affect of the capping of interest on savings to 6 per cent.

"Tax will decline proportionately good drop in deposit fee," said a senior official of Taxes Zone-1 that manages assortment of the withholding taxes from interest incomes in depositors.

The NBR collected Tk 6,577 crore tax on interest income of saving and fixed deposits previous fiscal year, up 9 % year-on-year, according to info from the field office.

The tax authority collects 10 % tax on interest earnings of depositors with Taxpayers Identification Figures (TINs) and 15 % from those who do not have TINs.

Banks deduct the taxes on behalf of the NBR even while crediting the interest profits to savers.