Nine banks incur net losses found in Q1

Nine banks faced net losses found in the first one fourth of this year as the majority of them have been in the red for a long time due to wide-ranging financial scams.

The banking institutions are Bangladesh Krishi, BASIC, Rajshahi Krishi Unnayan, Padma, Bangladesh Commerce, Meghna, Bangladesh Development, ICB Islamic and NRB, info from Bangladesh Lender showed.

Of lenders, Bangladesh Krishi Bank faced the best amount of net loss amounting to Tk 774 crore in the 1st 90 days of this year.

The specialised development lender also incurred a net lack of Tk 533 crore last year.

This has given a sign that the net loss in the bank may increase to a huge extent this year when compared to previous year.

An official of the lending company said that it had been facing a large volume of default loans since 2012, when it gave away funds to the non-farm sector on a breach of banking norms.

"The bank's loan restoration development from the farm sector is very good, but a big amount of fund possesses been stuck in the non-farm sector, which managed to get a loss-making loan company," he added.

BASIC Bank suffered the next highest volume of net loss found in the banking sector.

Between January and March, the lender's net loss stood at Tk 130 crore.

Md Anisur Rahman, managing director of BASIC Lender, said that 60 % of the total loans given out had converted into non-performing loans.

Just as much as 90 % of the defaulted loans, that have been disbursed around 2009 and 2013, are uncollectible, Rahman said.

At least Tk 4,500 crore was swindled out of your bank, where a amount of senior officials and table members including the then BASIC Bank Chairman Sheikh Abdul Hye Bacchu were allegedly involved.

The lender also mobilised long-term deposits during the period at a higher interest rate, which includes now turn into a burden for the lender.

He went on to express hope that the bank would grab of its dire straits within the next one or two years as it has taken different actions to make the lender profitable once again.

Padma Bank faced a good net loss of Tk 89.84 crore in the first quarter.

Md Ehsan Khasru, managing director of Padma Lender, said the web loss of the lender would lessen later on since it had taken an idea to turn the lender profitable by 2023.

Padma Bank, that was renamed from The Farmers Lender to wipe out its legacy of corruption, incurred a net loss of Tk 151 crore this past year.

Meghna Bank also faced a net lack of Tk 23 crore.

Sohail RK Hussain, managing director of the bank, said that it had reserve adequate provision, which had created the problem.

"The web loss won't continue for longer and we'll surely enjoy income at the ultimate quarter of this year," he said.

The banking sector, even so, registered a collective net profit of Tk 1,356 crore in the first quarter as nearly all banks performed better despite the pandemic during the period.

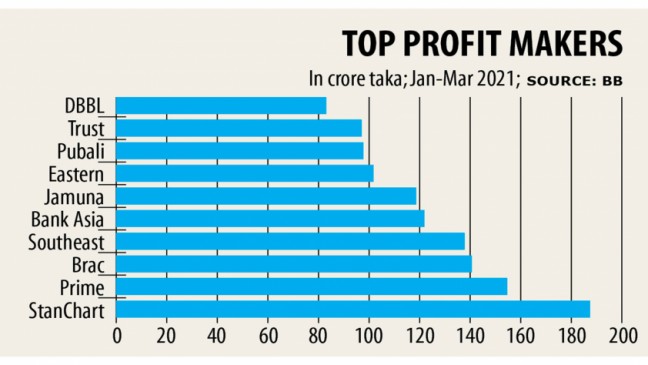

Standard Chartered Bank has showed the very best performance found in the first quarter by method of logging a net profit of Tk 188 crore.

Six other banking institutions - Eastern, Jamuna, Lender Asia, Southeast, Brac and Prime - also registered more than Tk 100 crore net profits through the period.