Cash takes back seat as Covid drives cards use

The make use of both credit and debit cards went up heavily in March as persons purchased more products through digital means amid the recent resurgence of Covid-19.

Total card loans kept by lenders stood at Tk 1,783 crore in March, up 18 per cent from a month ago and 57 % year-on-year, data from Bangladesh Lender shows.

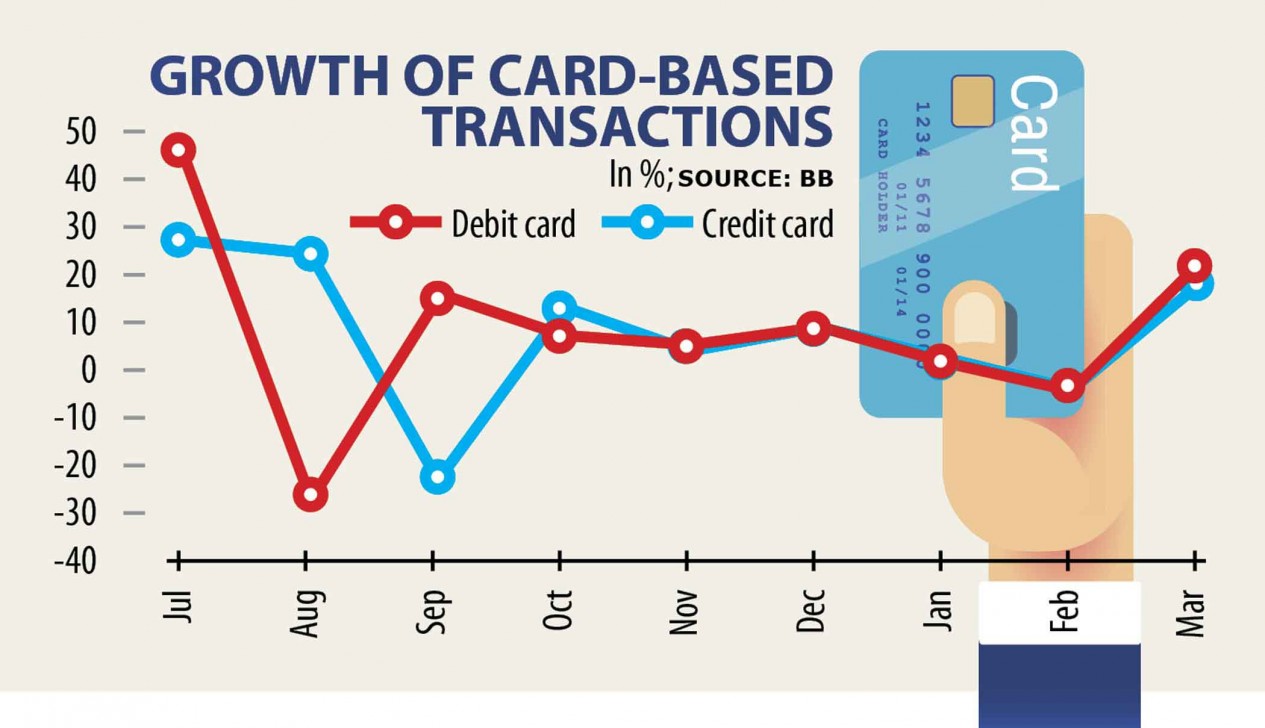

The growth in March was also the highest within the last seven weeks since September this past year as the prior highest growth was 24 % in August.

Customers' dependency on debit cards increased substantially found in March as the amount stood at Tk 22,000 crore, up 22 per cent from that a month previously and 45.33 % year-on-year.

The growth of debit card transactions can be the highest within the last eight weeks as the amount of cardholders surged 44.66 % in July.

The Daily Star spoke with top officials of card divisions at four banks and one handling director, most whom said that the next wave of the pandemic is basically in charge of the sudden upsurge in card transactions.

Ahsan Ullah Chowdhury, head of cards and digital banking at Eastern Lender Ltd (EBL), said that people had prepared beforehand to tackle the next wave of the pandemic since March, putting a confident effect on the card transactions.

Although the government imposed restriction on public motion in April, it had earlier requested people to stay in the home in March to support the second wave, he said.

"This had had a good positive impact on e-commerce as persons started to embrace digital systems since April this past year when the primary wave pass on," Chowdhury said.

EBL, one of the largest credit credit card providers in the country, as well observed the upward transaction trend found in April, he said.

HM Mostafizur Rahman, brain of retail banking at Dhaka Bank, mentioned three reasons for the increase in cards transactions at his lender.

People came back with their normal lifestyle found in February, which also continued found in the first 1 / 2 of March, he said.

Consequently, transactions through cards maintained an upward style during the period and various persons purchased lifestyle products beforehand to celebrate March 26, which may be the country's independence day.

They also purchased products in March beforehand to celebrate Pahela Baishakh, the first working day of the Bangla year, he said.

Between the third and fourth weeks of March, people continued their purchasing spree as the impact of the next wave could be noticed because the period.

Arifur Rahman, brain of cards at City Bank, said a good number of e-commerce transactions through his bank were settled in March.

The month was also the starting amount of the next wave of the pandemic, which had a positive impact on card transactions.

Abul Kashem Md Shirin, managing director of Dutch-Bangla Lender, said that persons had travelled to domestic tourist sites on March to celebrate the holiday season.

This helped maximize card transactions aswell, he added.

Mahiul Islam, mind of retail banking at Brac Lender, said that persons had almost comeback to their normal lifestyle on March, which largely pushed up the amount of digital transactions.

The issuance of credit cards was on the rise in March, when the outstanding number of bank credit cards stood at 17.37 lakh whereas it was 17.13 lakh the month before.

Similarly, the quantity of debit cards issued simply by banks stood at 2.24 crore as opposed to 2.20 crore respectively.