NBR collection target may remain unchanged

The government may keep its tax collection target unchanged for the National Board of Revenue in the next fiscal year due to the devastating aftereffect of the coronavirus pandemic on the economy.

This is a significant shift for the federal government, which includes set sky-high revenue generation goal for tax officials recently.

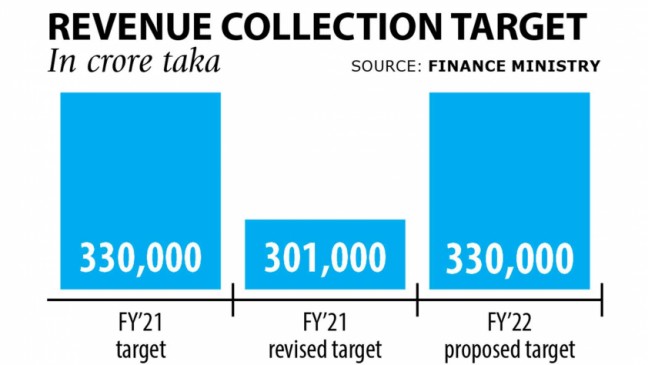

Initially, the federal government had targeted to generate Tk 330,000 crore through the NBR in the current fiscal year of 2020-21, that was 51 per cent higher than some of the receipts of Tk 218,409 crore from the previous year.

In the face of a devastating coronavirus pandemic, which put a brake on monetary activities at the height of the crisis this past year, the federal government was forced to revise down the collection goal to Tk 301,000 crore. The revised goal will probably remain unachieved this year as well.

The NBR's target for the next fiscal beginning with July 1 may be set at Tk 330,000 crore, which is up 10 % from the revised target.

Zahid Hussain, a former lead economist at the World Bank's Dhaka office, termed the Tk 330,000 crore NBR income target as nearer to reality.

"We saw ambitious revenue targets during the past, but that could not be achieved towards the end of the entire year. From that time of view, it appears to bring the earnings target closer to reality."

Setting any unrealistic and illogical target discourages the officials working to gather tax revenue, Hussain said.

"It is better to create an authentic target when you will find a lot of risk and uncertainty over economic recovery amidst the pandemic."

As the economy was ravaged by the pandemic this past year, the government didn't impose any new tax in today's fiscal's budget.

The countrywide lockdown from late March to May this past year to contain the spread of the virus caused severe disruptions throughout the market. The second wave of infections from last month has resulted in another round of lockdown-like situations. Under the circumstances, the government might not exactly raise the target.

Recently, the targets for the NBR were set at 30 to 40 % higher year-on-year regardless of the widening gap between your target and actual collection.

The common growth in NBR revenue collection was 11.8 % in the six years to 2019-20. The best 18 per cent growth was registered in FY2015-16.

The collection declined 2.26 per cent in 2019-20, the first negative growth in the annals of Bangladesh after monetary activities slumped.

Nasiruddin Ahmed, a former chairman of the NBR, however, termed the next fiscal year' tax collection target "ambitious".

"Economic activities have already been facing disruption for greater than a year. Where will the income result from when uncertainty prevails globally as a result of pandemic?"

The power of NBR can be a concern, he opined.

Zahid Hussain emphasised reforms in two issues.

The tax policy is complicated, and it requires to be simplified, the economist said. There have been so many multiple rates in value-added tax, income tax, and import duty, so it is tough to use them.

There are several chances for tax evasion, and the government is deprived of getting tax, he said, stressing the necessity for completing automation to increase revenue.

"Automation of VAT and tax has remained unimplemented for long. It isn't that we are creating a bridge that it will require so long."

Former NBR chairman Ahmed emphasised amending regulations.

The tax ordinance was enacted in 1984. A draft for a fresh law was made but is yet to be passed.

There are so many exemptions in the income tax and VAT, and these need to be little by little reduced, he said.

"We must amend regulations and ensure the power. Otherwise, the target has to be revised down later, and even that may well not be performed at the end."

Regarding the existing low tax-GDP ratio, Ahmed said in a country where 82 % of parliament members were large businessmen, there worked a web link, and the NBR officials were also mixed up in process.

Revenue collection can't be raised to the expected level under such circumstances, he said.

The World Bank in April said administrative reforms to automate VAT and tax remained largely incomplete.

The government plans to repair an overall earnings collection target of Tk 389,000 crore in the FY22, up 3 % from Tk 378,000 crore in the initial budget of the existing fiscal year. The revised target is Tk 351,508 crore.

It plans to raise the wages from the non-NBR segment to Tk 16,000 crore, from the existing year's Tk 15,000 crore.

The government would look to earn Tk 43,000 crore from non-tax revenue, which is 30 % higher than Tk 33,000 crore set for FY21. In the revised budget, the prospective has been raised to Tk 35,500 crore.

The higher target came as state-owned enterprises have started depositing their surplus funds to the government after a law was passed in January last year, making it mandatory to allow them to give the idle and excess funds to the state coffer.