Bangladesh Bank issues guideline on utilization of public fund kept with MFS

Bangladesh Bank yesterday issued guidelines specifying the only real ways in which public money deposited in the accounts operated by mobile financial service (MFS) and e-money service providers can be used.

The MFS providers' clients will not spend almost all their money soon after those have been deposited within their accounts with the providers.

The unused funds of clients which are deposited at MFS providers' accounts are collectively large.

Such accounts are believed as trust cum and settlement accounts (TCSAs).

The TCSAs would act as custody accounts where in fact the legal tender (currency in the sort of printed note) is kept against the issuance of e-money by the MFS and e-money providers.

The MFS and e-money providers need to open the accounts with banks in Bangladesh.

E-money companies are categorised as payment companies (PSPs). The eWallets which persons open with them will be linked with their respective bank accounts.

The eWallet can hold funds transferred from the lender accounts.

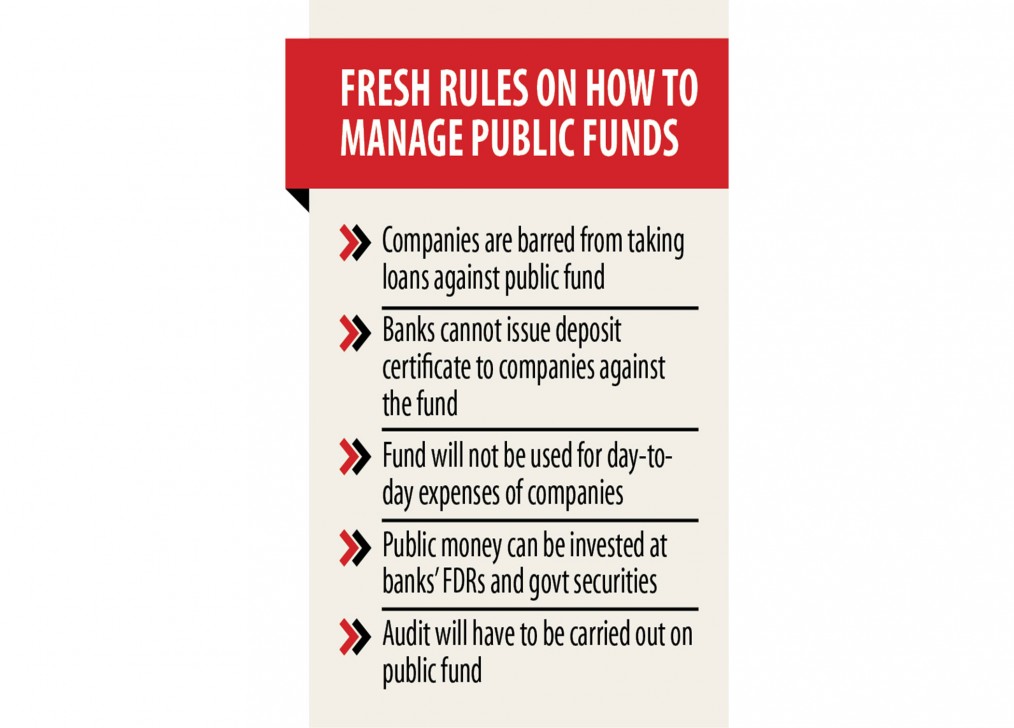

The central bank has imposed a set of restrictions on the utilization of these public funds deposited at the TCSAs.

The MFS providers, PSPs and other entities authorised to hold the TCSAs will not be permitted to take any loan against the general public funds.

Banks cannot issue any deposit certificate and guarantee to the MFS providers and PSPs, which could have then facilitated them in taking loans or using the fund as collateral.

Funds deposited at the TCBAs can't be used for day-to-day company operations.

However, a certain part of the general public funds of the TCSAs could be invested in approved government securities, fixed deposit receipt (FDR) or any other approved instruments with prior approval from the BB.

The instruments ought to be marked informing that those have already been issued against the TCSAs.

In case of such investment, the principal amount of the investment will be credited back again to the TCSAs upon maturity or sale.

Investment in the FDRs will have to happen in the same bank where in fact the TCSAs are opened.

The MFS providers and PSPs will have to maintain separate operational account linked to the TCSAs for obtaining interest.

The TCSAs will have to be used for collecting, disbursing, holding and settling the funds, charge realisation and investing the public money received from customers.

The MFS providers and PSPs will not be allowed to withdraw any cash from the TCSAs.

They will have to share the set of customers, merchants and other participants with the banks where the TCSAs are opened.

They will also need to monitor debit and credit entries in the TCSAs carefully and ensure compliance with relevant regulations.

If there are multiple TCSAs, the MFS providers and PSPs can transfer money in one account to another.

Public funds and the outstanding liability of the MFS providers and PSPs with their customers will be presented separately in the audited financial record of the Trustees (MFS providers and PSPs).

At the end of every day, the MFS providers and PSPs will make sure that the general public funds are higher than or add up to the outstanding liability to its customers or participants for issuing e-money.

The trustees will have a highly effective internal audit mechanism to monitor its outstanding liability and the general public fund.

The trustees must appoint a chartered accountant firm to conduct an audit on the outstanding liability and corresponding balances at the TCSAs.

The MFS providers and PSPs must obtain certification at least one time each financial year from chartered accountant businesses after conducting audit.

The trustees must submit the certification to the BB within thirty days of completion of the audit.

In addition, they have to submit their audited total annual report, financial statements and other required reports to the central bank.

Total transaction through MFS providers stood at Tk 55,059 crore in February, up 147 % from five years back and 33 % year-on-year, data from the central bank showed.

The number of registered accounts in the MFS sector stood at 10.24 crore, a rise of 106 per cent from five years ago and 25 % a year earlier.