BB clips National Bank’s wings

In a rare maneuver, the central bank has taken a raft of procedures to place National Bank Ltd back on the right track in the wake of massive irregularities at the first-generation private lender.

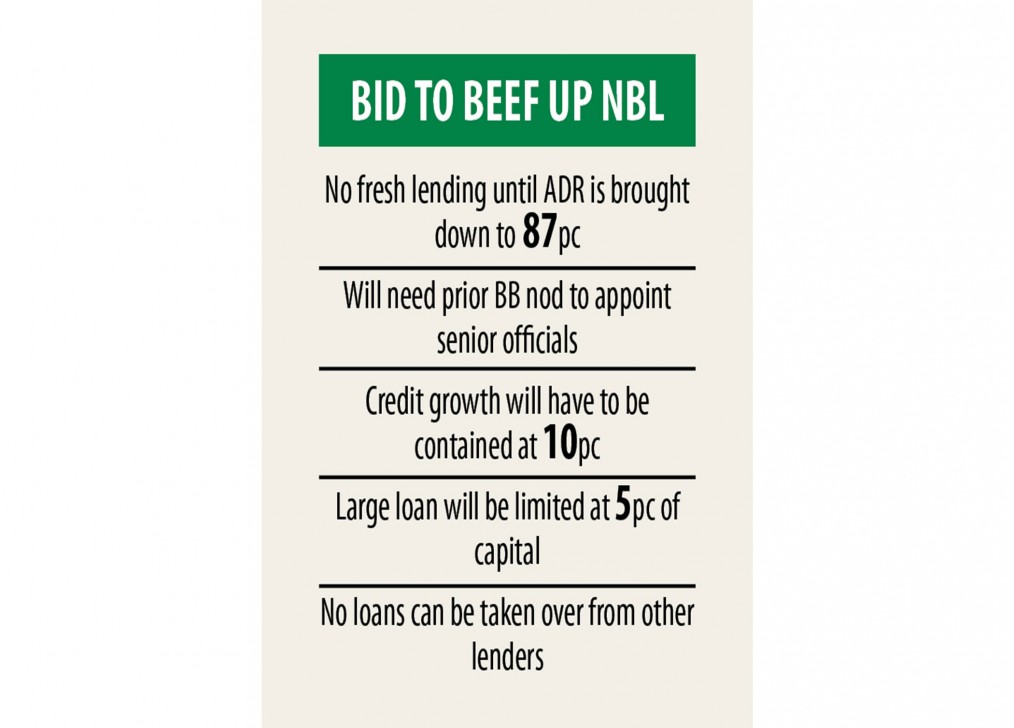

The Bangladesh Bank said NBL, among the oldest private banks in the country, would not manage to disburse fresh loans before bringing down the advance deposit ratio (ADR) to 87 per cent.

Conventional banks need to maintain an 87 % ADR, meaning they are able to lend Tk 87 against every single Tk 100 mobilised.

NBL has been maintaining a lot more than 90 % ADR for a long time, breaching the rules, compelling the central lender to take such a decision, BB officials said.

The bigger ADR indicates that the bank is financing aggressively, ignoring the interest of the depositors.

The central bank issued a letter to the lender on May 3, asking it to check out several instructions strictly.

"The instructions have been given to the lender to boost its financial health insurance and preserve the interest of the depositors," the letter said.

The move from the BB came following the allegations of worsening governance at the lender encircling approval and sanction of loans and appointment of top executives.

The financial health of the lender started worsening in '09 2009 when Sikder Group took over the control of the board.

The board was restructured after its chairman, Zainul Haque Sikder, passed on on February 10. His wife Monowara Sikder was elected chairman on February 24.

NBL didn't hold any board assembly between December 27 last year and April 11 this season, nonetheless it allegedly disbursed large loans without approval from the board.

The BB has imposed an gross annual credit growth ceiling of 10 % on the bank within its efforts to tackle aggressive lending.

NBL has been asked to take permission from the central lender before appointing any consultant, adviser, and additional and deputy managing directors.

As per the Banking Companies Act 1991, banks needs to secure approval from the BB to hire the managing director.

The board of NBL had earlier appointed Additional Managing Director ASM Bulbul as the acting MD.

His tenure ended on March 31, but Bulbul tried to keep holding the content with backing from a portion of the directors in a breach of rules.

This prompted the central bank to order the NBL chairman on April 6 to eliminate Bulbul from the post.

The bank, which commenced its banking procedure in 1983, appointed Shah Syed Abdul Bari as the managing director for 90 days.

The central bank cannot count on the board of NBL anymore, so that it has imposed the conditions on the appointment of senior employees, the BB officials said.

The central bank instructed the lending company not to dominate loans from different banks or non-bank finance institutions.

NBL also will need to comply with various guidelines on the disbursement of loans once it is allowed to start lending after decreasing the ADR to the stipulated level.

For instance, it'll be permitted to give out a maximum of 5 % in large loans against its capital amounting to Tk 3,066 crore.

In addition, the lender will not be allowed to lend a lot more than 10 per cent of the administrative centre to an individual borrower, in comparison to 35 per cent applicable for different banks.

This means NBL can provide no more than Tk 307 crore to an individual party beneath the single borrower exposure limit.

Md Serajul Islam, spokesperson and an executive director of the central lender, said that the BB had recently unearthed gross irregularities committed by a number of the directors of NBL.

"The latest instructions can help the bank restore the organization governance," he said.

NBL has also been asked to submit a statement every month on the recovery trend of loans from the most notable 20 defaulters.

Previous month, the central bank instructed the lender to send in depth information of the loans directed at several companies - Rongdhanu Builders, Desh TV, Rupayan, and Shanta Enterprise.

The lender had disbursed a sizable amount of loans among the directors of other banks.

A good number of banks offer such loans under mutual understanding among the directors, a practice that has created concern over corporate governance in the banking industry.

NBL disbursed Tk 7,216 crore among the directors of different banks, which is 18 % of the full total outstanding credit by December this past year, showed info from the central lender.

Defaulted loans stood in Tk 2,085 crore by December in contrast to Tk 388 crore in '09 2009. The non-executing loans would have been higher had the lender hadn't written off Tk 2,154 crore this past year.

NBL faced a provision shortfall of Tk 435 crore last year because of weak financial health. Forty of its 214 branches are incurring losses.

Shah Syed Abdul Bari didn't respond to a request for comments.