MFS interoperability by December

People should be able to transfer cash from their cell wallets to other accounts owned by another carrier and banking institutions by December in a good development that would supply the mobile financial program (MFS) industry a massive boost.

Bangladesh Bank has already completed the required tasks to ensure interoperability of the provider, that was rolled out in 2011.

Interoperability refers to the essential potential of different computerised goods or systems to readily hook up and exchange information with each other, in either implementation or access, without restriction.

The central bank completed a study between February 1 and February 14 to establish interoperability among MFS providers and banks. Twelve banks, two payment service providers, and one MFS company took component in the piloting.

"We encountered some problems while conducting the study. We are doing work to solve them," stated a central banker, who has strong knowledge on the problem.

The upcoming system allows clients to transfer funds from banks to MFS providers and vice versa.

Within the last decade, the MFS industry has built significant strides.

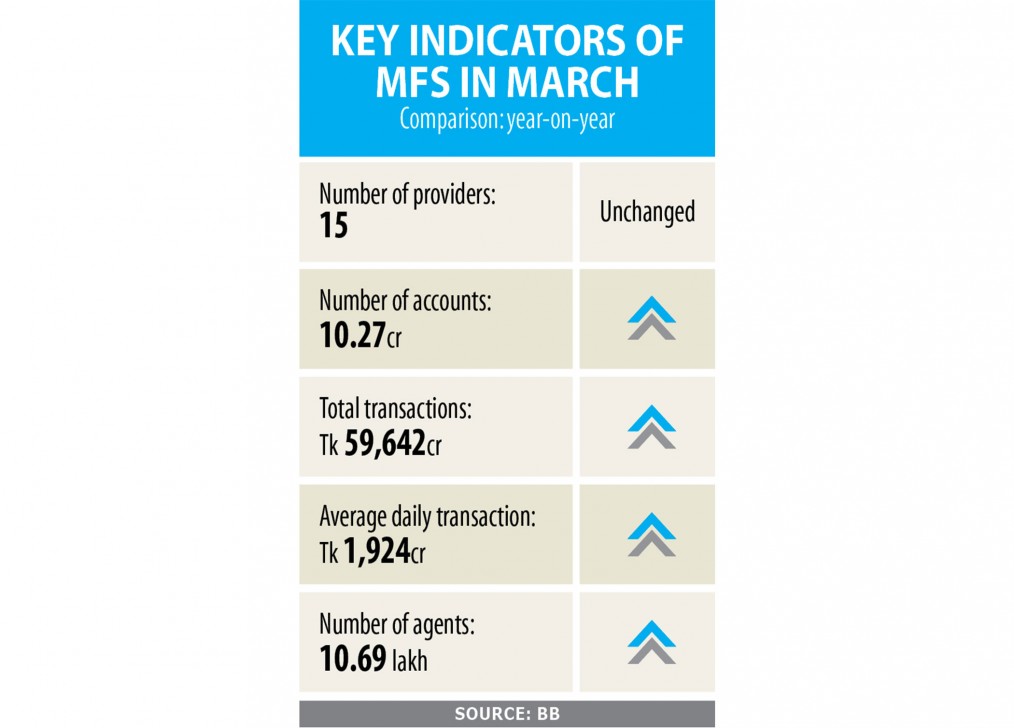

The number of registered accounts with MFS providers spurted to 10.27 crore at the end of March this season. Transactions rose 50 % year-on-year to Tk 59,642 crore.

The interoperability will be ensured through two platforms: the Interoperable Digital Transaction Program (IDTP) and the National Payment Move Bangladesh (NPSB).

The IDTP, a government initiative which makes all accounts of banks, MFS and payment system providers interoperable, will be governed and operated by the central bank.

The federal government will invest Tk 56 crore in establishing the IDTP.

The NPSB will also be used to make sure interoperability among MFS providers and banks, that will ultimately help people transfer funds smoothly.

Create in 2012, the NPSB can be an electronic program that works to achieve interoperability among banking institutions for card-based and online retail transactions.

At the moment, the NPSB is usually processing the transactions carried out on interbank automatic teller machines, point of sales, and internet banking.

The interoperability will eradicate the charging of costs for sending money. Because of this, users won't count any fee in transferring cash within the same carrier and from one carrier to another.

This will put pressure on some MFS providers, which now impose a charge on their clients while sending money, the central banker said.

After the interoperability makes force, MFS service providers must stop charging.

In October this past year, the central bank had moved to make financial companies interoperable. It asked all banking institutions to entire their preparations by March 2021 in order that interoperability could proceed are in the first quarter.

The central bank later backtracked, citing a technical glitch.

"The same won't happen this time around as the central lender has got taken the preparation to remove all of the probable barriers that may emerge," the central banker explained.

Atiur Rahman, a former central lender governor, welcomed the approach, saying interoperability would positively effects the whole financial sector.

"This can help banks understand clients' dynamics by analysing info of interbank MFS transactions," he said.

Lenders may roll out new loans or perhaps deposit products targeting different segments of the customers, said Rahman, who exactly played a crucial role found in introducing MFS found in Bangladesh.

"Although MFS-related data continues to be available, managing the info will be easier once interoperability is introduced."

Abul Kashem Md Shirin, managing director of Dutch-Bangla Lender, which pioneered MFS in Bangladesh, said MFS would be far more convenient for users when the central lender made the program interoperable.

"Furthermore, the reliance on some MFS providers will decline."

For example, an account-holder of Rocket, the MFS make of DBBL, cannot send funds to a remote area of the country where in fact the provider does not have any agents, he said.

"Clients won't face such situations thanks to the upcoming interoperable support," Shirin said.

Tanvir A good Mishuk, co-founder and managing director of Nagad, said interoperability would push world towards using less money.

Shamsuddin Haider Dalim, head of corporate interaction and pr of bKash, said MFS providers had taken the steps needed to join the central bank initiative.