Banks fast embracing money recycling machines

Banks are aggressively putting in cash recycling devices (CRMs) to supply faster deposit and funds withdrawal services to clients, a move that's helping customers lower reliance on branches and providing them with more freedom to carry out banking.

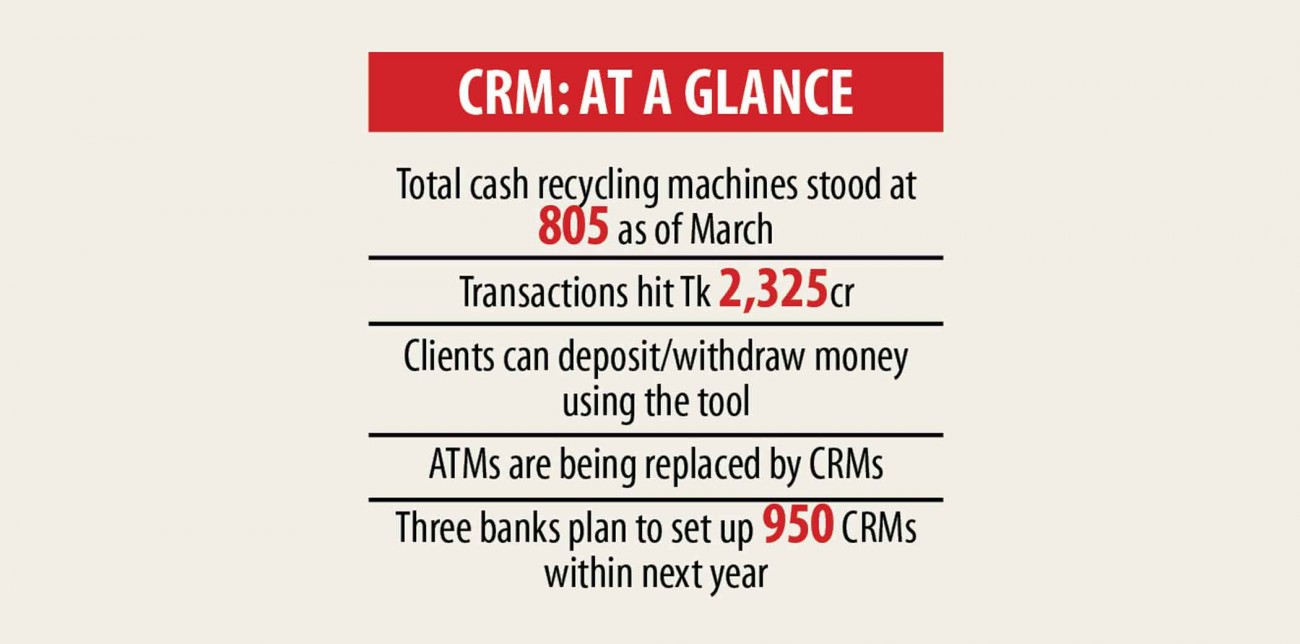

The CRMs are set to create cash deposit devices (CDMs) obsolete, which only allow injecting cash, and replace automated teller machines (ATMs), which permit fund withdrawal, said several bankers.

A CRM accepts cash, counts the notes, authenticates them, and credits the amount to accounts on a real-time basis, helping banks get rid of the manual labour had a need to provide the service.

The new technology can be allowing users to deposit and transfer cash in others' accounts. In Bangladesh, banks started establishing CRMs in 2017. Until June 30 last year, the quantity of machines was 272, info from the Bangladesh Lender showed.

Since then, a lot more than 550 CRMS have been installed.

Today, all of the banks have more than 800 CRMs combined, and these machines account for more than Tk 2,300 crore transaction on a monthly basis.

Total transactions through CRMs grew more than nine instances to Tk 2,325 crore on March from Tk 245 crore on the same month this past year. Compared to February this season, transactions grew 41 %.

CRMs are helping banks manage cash in a competent manner seeing that the deposited notes can be utilized for the withdrawal cash by clients. Therefore, banks won't need to inject income into CRMs usually, said bankers.

The importance of the tool has accelerated during the coronavirus pandemic as banks discouraged clients from doing branch-led banking. The quantity of CRMs increase manifolds within a year as many banks took initiatives to create the digital program, bankers say.

Islami Lender Bangladesh Ltd, the most notable lender found in the segment, has already set up more than 400 CRMs and will setup another 400 CRMs within the next year.

The move aims at reducing clients' dependency on branches, said an official of the lender. The Shariah-based bank created the technology in 2019.

M Kamal Hossain, managing director of Southeast Lender, said his lender had installed 185 CRMs.

The lender has opened letters of credit to import 300 more CRMs, which will arrive by July.

"We will install all equipment by this year. We've 100 ATMs at this moment. We will steadily replace them with CRMs," Hossain said.

The lender has attached priority in establishing the machines in the rural areas to be able to provide banking services to the underprivileged people, he said.

Yesterday, Southeast Lender inaugurated four CRMs, with two each found in Feni and Chattogram.

Banks need to invest a sizeable amount found in deploying CRMs: they need to count between Tk 13 lakh and Tk 18 lakh per CRM. It really is Tk 5 lakh per ATM.

The central bank plans to take the technology one step further by ensuring interoperability.

A central banker said depositing funds through the tool would be interoperable within the next 90 days as the BB has taken actions to this end.

Using the CRMs, clientele can deposit money to any kind of bank-account on a real-period basis when interoperability becomes readily available, the official said.

Similarly, retailers will take advantage of the new technology because they will keep their funds in their accounts at the end of your day, he said.

"The amount of money will be safe," the central banker explained.

City Bank plans to create 150 CRMs this season and another 100 next year.

The lender now has around 350 ATMs, which is slowly but surely replaced by CRMs, said Md Mustafizur Rahman Ujjal, head of alternative delivery channels of City Bank.

"The CRMs will help clients withdraw dollars by using the easy response (QR) code. This implies you will have no necessity to inject cards in to the machine."

City Bank today operates five CRMs. Presently, there are 12,225 ATMs in Bangladesh.