Govt again miskicks in the stock market

There is a Spanish proverb that goes along the lines of pouring water on a drowned mouse, which means investing in more resources into a losing battle.

At the same time when stocks around the world are tumbling on coronavirus fears, the finance minister's proceed to summon all bank chiefs on Monday to his office to teach them to take up on the Bangladesh Bank bundle for lenders with the view to propping up the ailing currency markets -- felt something such as the Spanish proverb.

Was it a wise approach? Will it create extra burden on the banking system that is previously drowning under heaving default loans?

On February 10, the central lender announced a bundle for banks, allowing them each to create funds worthy of Tk 200 crore by firmly taking the cash from the central lender through repurchase agreements against treasury bills and bonds owned by them.

The banks must pay 5 % interest for the fund and the credit tenure will be until February 2025.

So far, simply nine banks have formed the special fund, in what can be construed just as reluctance amidst banks in taking on this voluntary scheme.

This raises the question: why are banks reluctant?

Had they deemed expenditure on the market profitable, they would did it out of their own volition, which we found in '09 2009 -- if they invested even by violating the guidelines of their optimum scope of investment.

A number of bankers told the correspondent yesterday that a shortage of liquidity isn't the only reason behind the indisposition.

Moreover, almost all of the banks realise that gambling is rampant in Bangladesh's bourse, as a result junk stocks become hot cakes out of the blue while well-performing businesses are on the slide.

Some businesses soar abnormally without the reason. Only a few happen to be punished for the manipulation.

You will find a huge insufficient good governance among listed companies -- and giving their shareholders heathy returns is leaner down their set of priorities.

Many companies came to the stock market within the last one decade through initial open public giving. But within a couple of years, they turned into junk stocks. Not only that, most of them confirmed lower earnings soon after listing.

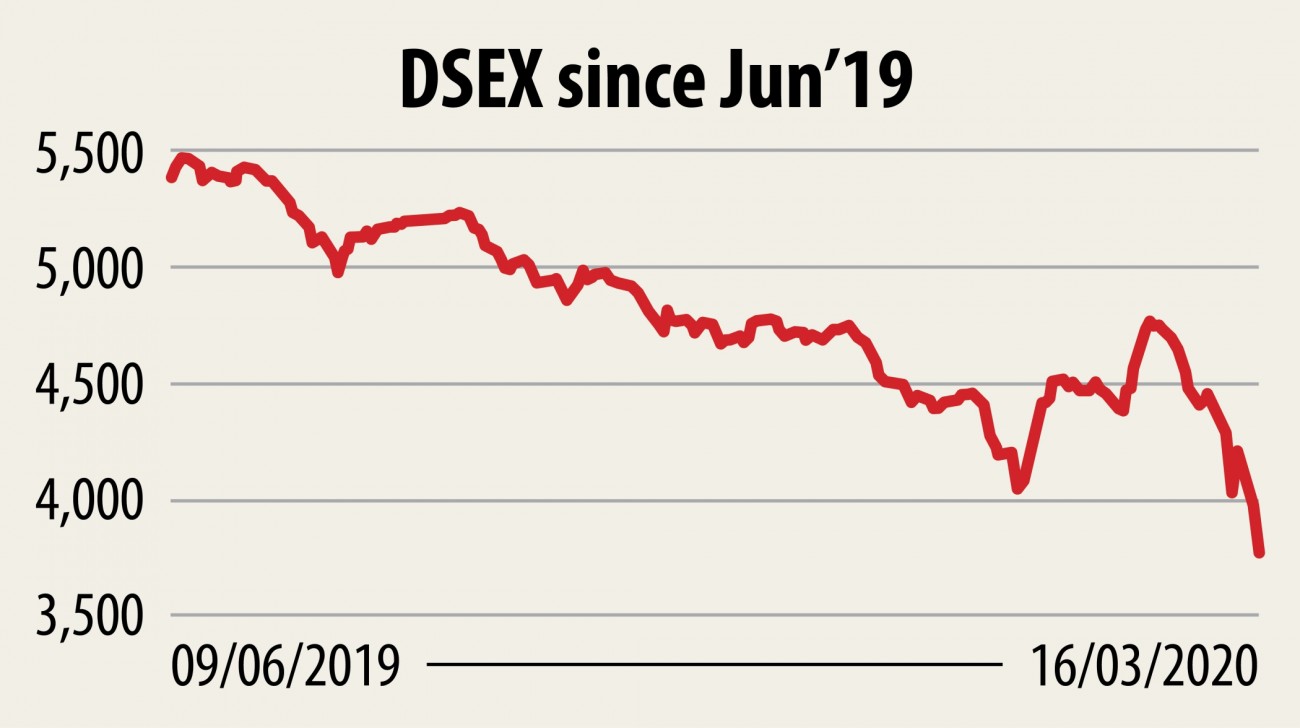

These, along with a few other factors, dented investors' confidence available in the market -- badly. Which explains why, the Dhaka bourse possesses been on the slide for an excellent six months now.

Amid this fraught circumstances came the blow of coronavirus, which includes left most currency markets investors, not simply in Bangladesh but all around the world, in circumstances of panic.

Since March 8, when the Institute of Epidemiology Disease Control And Research, the only real assessment agency for coronavirus, announced three persons have been tested great for COVID-19, in the country's maiden cases, the index shed 612 points, or 13.95 %.

During the time, about Tk 37,853 crore, or 11.24 %, have been wiped off the Dhaka Stock Exchange.

In the last a month, American Dow Jones plunged 31.3 per cent, S&P 500 index 29.4 per cent, European Euro Stoxx 50 36.7 per cent, Germany's DAX index 37.3 %, Spain's IBEX 35 37.8 % and Japan's Nikkei 225 index 27.8 per cent.

Hence, if the coronavirus epidemic tears through Bangladesh like in many countries around the world, the country's bourse cannot against the tide.

Then, who'll take the duty for the banks' losses if they invest in stocks simply by heeding the orders if the BB and finance ministry?

With the impact of the the latest bear run, various well-performing companies' stocks crashed to a 4- or 5-year-low.

So, a few of the institutional investors could possibly be tempted to snap up those businesses' stocks.

But that isn't a surety as the overriding issue of the stock marketplace, which is a crying insufficient good governance continues to be missing.

So, the government may take this possibility to truly fix the currency markets instead of some stopgap measures, which come across as positioning a Band-Aid about a bullet wound.

For a start, the government can bring in corporations with robust corporate governance to the marketplace. Already the government has used some initiatives to carry some state-run companies.

This is an excellent move. However they should get the very well performing state-manage companies, so that the investors' self-assurance gets a boost.

However, the federal government should create an environment in a way that well-performing big companies are tempted to get listed.

Such initiatives will boost stock investors' confidence and they will channel funds to the currency markets.

Nothing else will work.

The BB package came after a bunch of frills the federal government had provided for the bourse failed.

The Dhaka stocks has been on the downtrend for a while now. To halt the free of charge fall, the central lender also furnished a revolving fund to the Expense Company of Bangladesh to purchase the stock market.

It redefined banks' publicity definition to improve their investment capacity.

When those failed did the BB generate the big guns. But that move is also primed to be a non-success.

So, the federal government should focus in the right space and it should realise liquidity isn't the only reason for the slide.

Otherwise, it will always keep on supplying incentives and the marketplace will keep on bleeding.