The curious rise of Islamic banking in Bangladesh

Conventional banks have to maintain 18.5 % statutory liquidity ratio (SLR) and cash reserve requirement (CRR) of their total clients' deposits. They must also maintain a maximum 85 % loans-deposit ratio.

However the regulatory requirements are much lax for Islamic banks: they need to keep a combined SLR and CRR of 11 % and their loans-deposit limit is 90 %.

And it is therefore that lenders are jumping on the Islamic banking bandwagon.

Jamuna Bank got the approval from the central bank yesterday to become a full-fledged Islamic lender, following the lead of Standard Bank and NRB Global Bank, who became Shariah-based lenders on February 9.

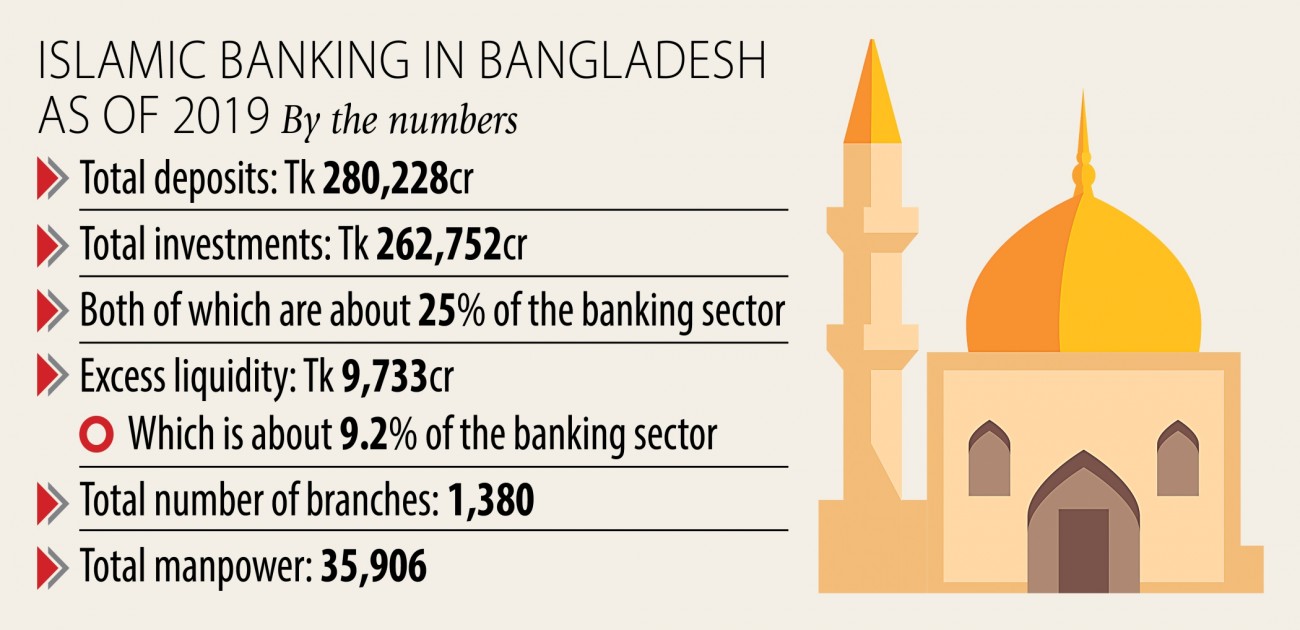

This takes the tally of Islamic lenders in Bangladesh to 11.

And IFIC Bank, another conventional lender, is waiting to achieve the central bank's nod to be an Islamic lender.

But, there are questions on if the Islamic lenders in Bangladesh actually follow the Shariah regulations in the lack of strict monitoring by the Bangladesh Bank.

"The central bank doesn't have enough prudential guidelines to monitor Islamic banks," said Ahsan H Mansur, executive director of the Policy Research Institute.

They frequently violate the Shariah rules while setting profit-sharing method for both deposits and investments, said Yasin Ali, a former supernumerary professor of the Bangladesh Institute of Bank Management.

Islamic lenders usually set a provisional profit rate before mobilising deposits and giving out loans.

"But the country's Islamic lenders hardly change the profit rate towards the end of the entire year, which is fictitious in true sense. This cannot happen if they follow the actual Shariah rules."

The country's Islamic lenders had earlier confessed the issue following the researchers unearthed this issue, said Ali, also a former executive director of the central bank

This implies the Islamic lenders fix the profit rate just like the interest rate setting by the traditional banks.

The country's existing eight Shariah lenders and Islamic windows of the traditional banks have provided loans at significantly less than 2 % of their total lending portfolio according to different research works.

"No bank in the world has yet to start out a full-fledged Islamic banking."

Only Malaysian and Turkish banks 've got a bit success in replicating Islamic banking. But even they aren't Shariah banks in the truest sense, Ali added.

"One section of men and women are employing Islam for politics plus some businessmen are employing exploiting people beneath the guise of Islamic banking," said Khondker Ibrahim Khaled, a former deputy governor of the central bank.

There was no bank operating system in seventh century when persons embraced Islam as religion. Islamic banking started its journey in the 70s.

The central bank should strengthen its monitoring on lenders with a view to ensuring the discipline in the banking sector.

He suspects conventional banks are switching to Islamic banking to circumvent the interest bounds of 9 per cent and 6 % for lending and deposit respectively.

"Because the Islamic lenders usually do not follow the interest module, they could take undue facilities from the central bank's initiative," he added.

But a BB high official said the 9-6 % interest rate bound may also be applicable for Islamic lenders.

When his attention was drawn on the central bank's claim, Khaled said that such embargo would not qualify for Islamic lenders because of the Shariah norms.

Mansur echoed the same as Khaled.

"The spree of conversion has turned into a matter of concern. The central bank should take decision cautiously to the end," he added.