Credit growth calls for another beating in Nov

Non-public sector credit growth dropped on November once again as a result of eroding confidence of businesses amid the next wave of coronavirus infections.

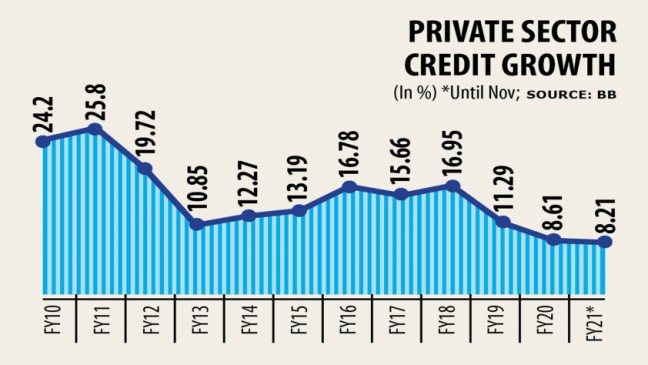

The year-on-year credit growth stood at 8.21 per cent in October, down 8.61 per cent from per month earlier, regarding to info from the Bangladesh Bank.

The credit development in November may be the lowest since 2008 at least. Bangladesh Bank's data goes dating back to 2008.

There is little ray of expect the credit growth to improve in the next three to four months given the ongoing dull credit demand from businesses, said analysts.

Credit growth had risen to some extent in the first three months of the ongoing fiscal season riding on the implementation of the stimulus plans.

But the credit rating growth has began to face a steep descent since September.

The reducing trend in credit growth can be an indication of massive fall in consumption, which is alarming for the monetary recovery beyond any doubt, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The credit growth could have decreased heavily possessed the central bank not offered the ongoing moratorium facility, he said.

This means banks now are the interest, which is yet to be realized, to the main credit amount taken by clients.

The central bank has asked banks never to classify the loans taken by clients in the event of failure of paying the instalments of loans given the ongoing financial hardship.

Clients have been enjoying the moratorium because of this entire year.

The upward trend of excess liquidity in the banking sector is an indicator of lower credit demand, said Md Arfan Ali, managing director of Lender Asia.

Seeing as of September this season, excess liquidity in banking institutions stood at Tk 169,650 crore in contrast to Tk 81,088 crore this past year.

Credit demand from individual sector may shrink even more in the times ahead found in the wake of the second wave of the coronavirus, Ali said.

"It will require at least first quarter of another year to pick up the growth. But, option of the vaccine for the Covid-19 is very important to make the private sector radiant," he said.

Emranul Huq, managing director of Dhaka Bank, also echoed the same saying that imports have declined alarmingly in recent period, hitting the credit growth aswell.

Imports of non-essential items specially the approach to life products features almost come to a good halt due to the economic hardship while capital machinery and professional raw materials have also been down, he said.

Syed Mahbubur Rahman, taking care of director of Mutual Trust Bank, explained that the ongoing business slowdown may possibly worsen further more unless the vaccine is not available in the first quarter of another year.

The outstanding loans in the private sector stood at Tk 1,120,902 crore by November in contrast to Tk 1,114,322 crore the previous month.