BB buys record $7.7b to keep taka stable

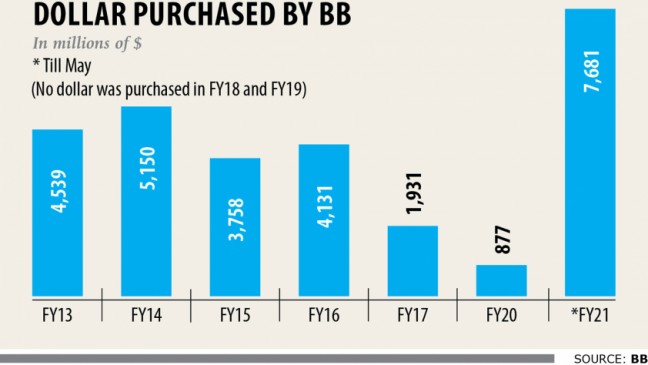

The central bank purchased $7.68 billion from the banking system in the first 11 months of the existing fiscal year, the best on record, to contain any abnormal appreciation of the neighborhood currency.

The previous highest was posted in 2013-14 when Bangladesh Lender bought $5.15 billion.

The regulator was forced to smash the prior record between July and May because of a higher flow of remittance and lower imports due to the business slowdown amid the coronavirus pandemic.

The central bank must continue the intervention until the economy recovers from the slowdown, analysts and businesspeople say.

The US dollar purchase is helping the export sector as regional products become cheaper in foreign market segments. Additionally it is swelling the forex reserves. But it offers flooded the economical sector with excessive liquidity.

But a lower credit rating demand has adversely impacted the price of funds for banks as liquidity has generally remained idle. The surplus liquidity in the banking sector stood at around Tk 200,000 crore in April.

Despite the significant dollar buy, the central bank has failed to devalue the taka against the US currency.

Since July, the central bank has been intervening in market following the local currency started strengthening.

The interbank exchange rate has been hovering around Tk 84.80 per USD since July. The fee was Tk 84.95 on June 2 this past year.

Had the central bank had not intervened in the exchange industry, local currency could have appreciated.

Ahsan H Mansur, executive director of the Coverage Analysis Institute of Bangladesh, said the central bank's stance found in getting the dollar was appropriate to contain the appreciation of the local currency.

"The central bank has to keep up with the intervention until normalcy returns."

The intervention means Bangladesh could have more dollars than required through the pandemic.

The existing business slump might continue until the end of the next fiscal year, given the weak vaccination programme, said Mansur, also a former official of the International Monetary Fund.

Although import payments have recently gone up to some extent due to the selling price hike in the global commodity industry, this has not positively impacted the investment sector.

The quantity of the imported products has not more than doubled, he said.

"The central bank's intervention is usually time-befitting since it is playing a solid role on protecting the interest of exporters from the slowdown," said Kutubuddin Ahmed, chairman of Envoy Group, a garment exporter.

Despite Bangladesh Bank's approach, the exchange fee of the taka continues to be comparatively stronger than those in peer nations. For instance, the currencies of India, Sri Lanka and Pakistan fell against the US dollar earlier.

"So, we will be facing a good competitiveness crisis because of a more powerful taka. The authorities should provide more attempts to devalue the local currency in the coming days and nights to shield the curiosity of exporters."

Md Arfan Ali, managing director of Lender Asia, said Bangladesh would continue enjoying the surplus dollar in the returning days as a result of higher move of remittance.

Between July and May, Bangladesh received $22.8 billion in remittance, already the best in a single year.

The pile-up of US dollars can help the country to a sizable extent when imports start picking right up.

International reserves stood at $45.08 billion on June 2, up 34.70 % year-on-year.