Worries among 15 banks, NBFIs over Tk 850cr deposit

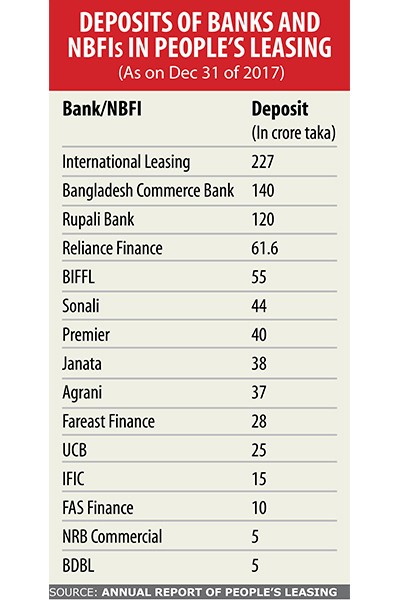

Some 15 banks and non-bank financial institutions (NBFI) that have Tk 850 crore stuck with People’s Leasing Financial Services (PLFS) are on edge over the government’s decision to liquidate the ailing NBFI as they stand to lose a large portion of the sums.

Of the institutions, International Leasing and Financial Services (ILFS), another NBFI, alone has deposited Tk 227 crore in PLFS, which is more than its paid-up capital of Tk 211 crore. ILFS may be in serious trouble if it has to write off the sum.

Four state-owned commercial banks also have huge deposits with PLFS.

In the event of liquidation external creditors are paid off first and then the depositors, debenture holders and preferential shareholders in that sequence, according to Mohammad Mohiuddin Ahmed, executive director of Financial Reports Monitoring Division at Financial Reporting Council.

But given the dire position of PLFS, there is unlikely to be much to salvage from liquidation. For instance, in the first nine months of 2018 the NBFI’s operating expenses stood at Tk 22.48 crore against the operating income of Tk 2.05 crore.

It has failed to repay depositors’ money despite the maturity of funds, found a central bank report. PLFS sometimes failed to pay its employees’ wages because of severe liquidity crunch, some officials informed The Daily Star.

When a financial institution sinks it brings down some other good financial institutions with it, said Mizanur Rahman, professor of the Department of Accounting & Information Systems at Dhaka University.

“It’s a contagion.”

The government should deploy every tool in its box to recover PLFS’s money.

“Who took the money and where is the money being kept? It should be found out and then paid back to depositors. Otherwise, it will create a crisis of confidence among the people, which is not good for the financial sector,” he added.

PLFS’s problems began in earnest in 2013-14, when some of its directors made off with more than Tk 1,000 crore by way of submitting fake documents, according to the central bank report.

Meanwhile, the news of PLFS’s liquidation has impacted the stocks of NBFIs, with the sector losing 1.8 percent.

The decision has further exposed the vulnerabilities of the financial sector, said UCB Capital, one of the leading stock brokerage houses.

“Investors penalised the NBFI sector,” it added.

As of May 31, retail investors held 68 percent of the PLFS’s stock, according to the Dhaka Stock Exchange.

If PLFS’s liquidation goes through -- which will be a first in Bangladesh’s financial sector -- the general shareholders stand to lose about Tk 193.52 crore and institutional investors Tk 25.75 crore.

In the event of liquidation, the general shareholders’ turn comes in the end, once all the parties have been paid off. They get a sum if the net asset value (NAV) per share is positive.

But in PLFS’s case its net asset value was Tk 67.66 in the negative as of March 31, so the chances of retail investors getting anything are next to nil.

Dawned with the possibility, PLFS’s retail investors yesterday tried to dump their shares but in vain.

PLFS shares slid 8.33 percent yesterday to close at Tk 3.30.

DSEX, the benchmark index of the DSE, shed 49.41 points yesterday to close at 5,230.06, the lowest in two months.

Turnover, another important indicator of the DSE, also sank 20.28 percent to Tk 408.88 crore.