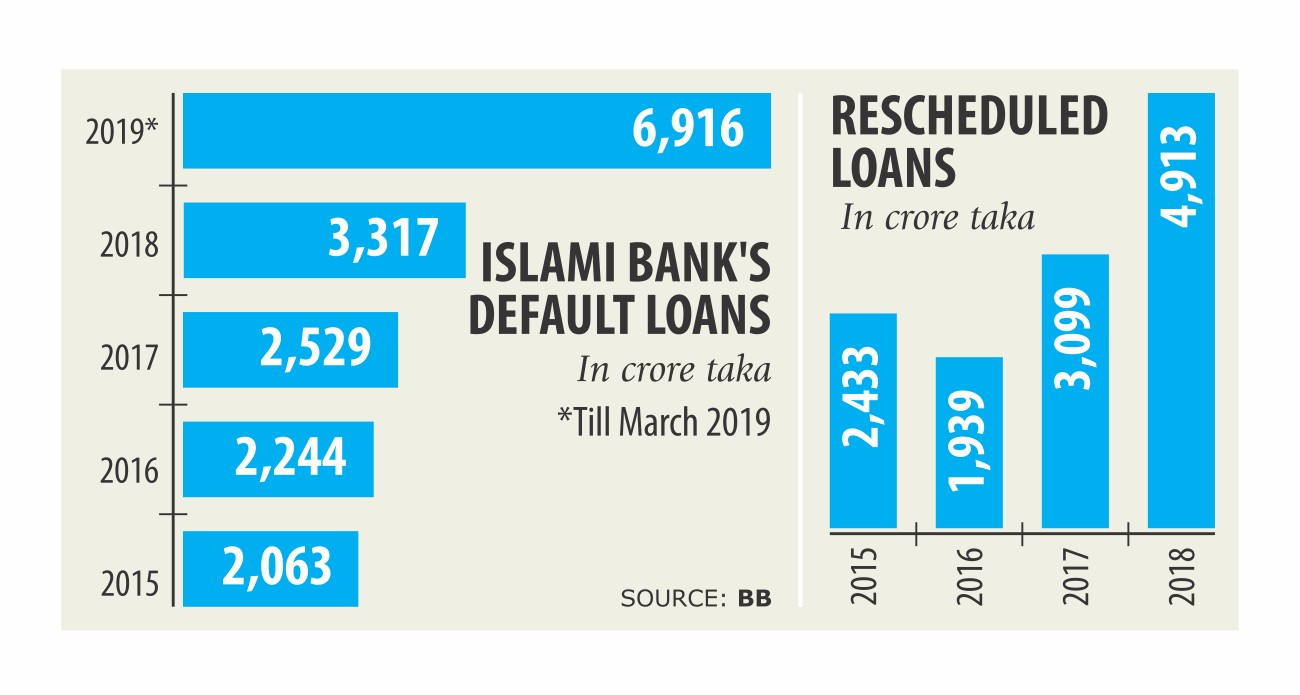

Islami Bank’s default loans double in three months

Despite rescheduling huge amount of loans, the default loans of Islami Bank Bangladesh Ltd (IBBL) more than doubled to Tk 6,916 crore between the months of January and March, raising concerns about the financial health of the country’s biggest private bank.

In 2018, the bank rescheduled default loans worth Tk 4,813 crore -- the highest among all banks -- 55 percent more than it did a year earlier, according to data from the central bank.

The bank managed at least 600 special approvals from the central bank to reschedule default loans on relaxed conditions such as waiver from the required down payment of at least 10 percent of outstanding amount.

Some clients who earlier enjoyed rescheduling facility have become defaulter between January and March, which has pushed up the bank’s default loans, said Abu Reza Mohd Yeahia, deputy managing director and spokesperson of IBBL.

Notwithstanding, the bank is aggressively pushing to lend more.

As of last year, the bank’s loans stood at Tk 75,885 crore, up 15 percent year-on-year. In contrast, its deposit base expanded only 8 percent.

“Corporate governance of the bank is on the decline after its ownership and management started to change in 2016,” said Ahsan H Mansur, executive director of the Policy Research Institute.

A Chattogram-based business group bought more than 16 percent stakes in the bank under different names, unheard of in Bangladesh.

On January 5 in 2017, in a sudden change, IBBL’s chairman, several directors, managing director and heads of different committees resigned and new people took charge.

“IBBL is a case study on how a well-run bank can lose steam all on a sudden.”

If not handled properly the bank may go the same way as BASIC Bank, which is saddled with default loans of more than half of its total outstanding loans because of scams. “But the impact of IBBL going bad would be 3 to 4 times more,” said Mansur, also a former senior economist of the International Monetary Fund.

The central bank should take prompt measure to protect the IBBL or else the banking industry and financial sector as a whole may face the music, he added.

Khondker Ibrahim Khaled, a former deputy governor of the central bank, echoed the same as Mansur, saying the financial health of the bank has deteriorated after the new owners took over.

When the financial health of a bank declines its invariably because its sponsors intervened in the operations.

“The central bank should ensure the independence of the IBBL’s management,” he added.

Meanwhile, Yeahia said the bank’s default loans will come down in the second quarter of the year as a number of initiatives have been take to recover and reschedule the default loans once again.