Banks’ operating profit rises despite liquidity crisis

Most of the private banks saw their operating profits edge up in the first half of the year despite the ongoing liquidity crisis and a decline in credit growth.

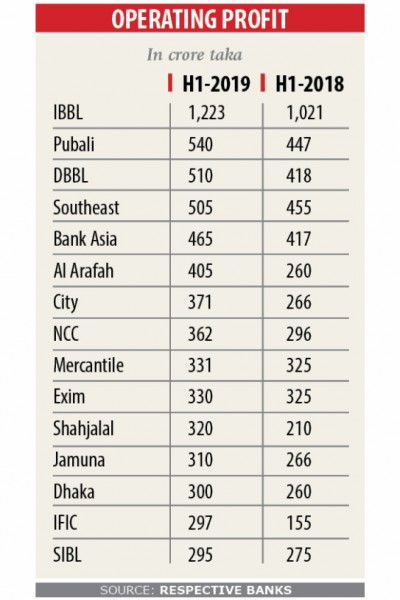

The Daily Star obtained data of 23 banks and all of them posted growth in operating profit -- which is the profit before deduction of taxes and setting aside provisioning for loans -- ranging from 2 percent to 120 percent.

Of them, Islami Bank Bangladesh, which is the largest private sector bank, posted the highest operating profit of Tk 1,223 crore in the six months to June, up 19.78 percent year-on-year.

City Bank reported a 39 percent jump in operating profit to Tk 371 crore between the months of January and June as it concentrated on mobilising low-cost deposits and expanding its trade finance business.

“We have also recovered a significant amount of default loans during the period,” said its Managing Director Mashrur Arefin.

Pubali Bank, whose operating profits escalated 21 percent, saw all its departments perform well, said its Managing Director MA Halim Chowdhury.

“The bank recovered a good amount of default loans and expanded trade-based financing in tandem,” he added.

Southeast Bank, whose operating profits increased 11 percent during the period, also turned to its trade finance business, according to its Managing Director M Kamal Hossain.

“In many cases, we offered a discounted rate to importers than our normal rates,” he said, adding that the bank also worked on recovering default loans.

Along with the low-cost deposits Jamuna managed funds from the central bank at a lower rate as the lender is one of the largest primary dealers in the country, which ultimately pushed its profit up, said its MD Shafiqul Alam. But in the case of remittance, the cash incentive recovery will not be easy, the central bank said.

However, a high official of the finance ministry said the ministry has calculated the cost involved in sending money abroad through hundi and it found that the charge of hundi is more or equal compared to the incentive.

So, there is no possibility to misuse the cash incentive benefit, he said.

The official said the incentive will just cover the cost of sending money through official channels.

If the remittance comes through proper channel, the deficit of the current account will come down and the foreign exchange rate will remain stable, he said.

A finance ministry official says the government will take step if any problem arises.

Earlier Zahid Hussain, a consultant of the World Bank Dhaka office, differed with the government move, saying it will not be the best way to encourage remitters to send money through legal channels.

The government should depreciate the taka to incentivise remitters and exporters, he said.

Hussain said the flow of remittance already rose compared to last year’s, so this incentive was not required.