No handouts for state banks last fiscal year

State banks did not get a single penny from taxpayers in the just concluded fiscal year to make up their capital deficit, in a clear sign from the government of its intent to stop pampering the errant lenders.

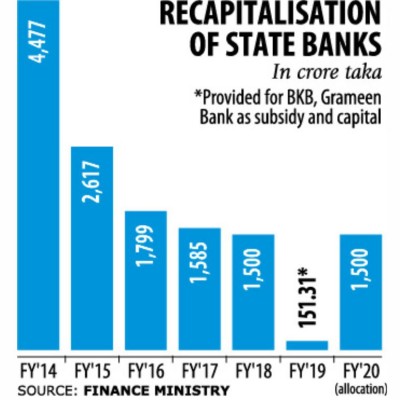

Between fiscal years 2009-10 and 2017-18 the government had injected a total Tk 16,016 crore of taxpayers’ money into the state-run banks -- without any tangible improvement in their governance and lending practices to show for.

The aim of the state-run commercial banks is to provide funds to the government from their profits and the government will spend the money for welfare activities.

But the banks were given money to meet their capital shortfall without any stringent performance improvement conditions, which defeats the purpose of their existence.

“This time, the finance minister gave a message to the state banks that no capital would be injected from the public coffer without any improvement in financial health,” said a finance ministry official requesting anonymity.

Some Tk 1,500 crore was set aside in the budget for fiscal 2018-19 budget, but in the end Tk 151.31 crore was disbursed to Bangladesh Krishi Bank and Grameen Bank from the allocation.

Bangladesh Krishi Bank got Tk 150 crore as subsidy as it had lent at lower rates following government orders, while Grameen Bank got Tk 1.31 crore as capital.

No money was given to banks facing capital shortfall due to ill lending practice, the official added.

“This was a good move,” said Khandker Ibrahim Khaled, a former deputy governor of the central bank.

However, the government has allocated Tk 1,500 crore in this fiscal year’s budget for state banks’ recapitalisation.

Khaled expressed apprehension about the allocation as it may hold the banks back from fully committing to cleaning up their acts. But the finance ministry official said the government allocates money every year for the state-run banks for a number of reasons and the decision is taken at the end of the fiscal year on whether to give them the money or not. The government may set a five-year target for the banks that have capital shortfall to improve their situation, Khaled said.

If there is no improvement, then the bank’s chief executive officer should be let go, he added.

State-owned banks are at the heart of the default loan problem dogging Bangladesh’s banking sector: at the end of 2018, they accounted for 52 percent of the total default loans in the industry. They remain severely under-capitalised despite capital injections every year over the past years.

As of March this year the capital shortfall of the four state run commercial banks stood at Tk 6,334 crore, of which Tk 4,888 crore was of Janata Bank alone.

Even a few years ago Janata Bank had no capital shortfall. But it plunged into capital crisis for irresponsible lending practices.