People’s Leasing faces liquidation

The government has directed the central bank to liquidate People’s Leasing and Financial Services (PLFS), a non-bank financial institution, due to deterioration of its financial health in the last several years.

If the liquidation goes through -- in line with the Financial Institutions Act, 1993 -- it will be a first in Bangladesh’s financial sector.

Previously, two banks -- Bank of Credit and Commerce International and Oriental -- that were on their last legs were restructured but not liquidated.

Liquidation of PLFS means closing its operations permanently and the government will take actions to settle liabilities by selling off its assets. But the central bank as the regulator has to take approval from the High Court before liquidation.

Earlier on June 27, the finance ministry instructed the central bank to shutter the NBFI for its failure to improve its conditions, said Asadul Islam, senior secretary of the banking division.

The ministry arrived at the decision after going through a detailed central bank report on the NBFI.

The NBFI has failed to repay the depositors’ money despite maturity of the funds, found the Bangladesh Bank report. Default loans and net losses have recently escalated as well.

Sami Huda, managing director of PLFS, however, said the central bank is yet to take a call on the NBFI’s liquidation.

“A special team of the Bangladesh Bank is auditing us for the last few days. A final decision will come after this audit report,” he told The Daily Star yesterday.

The NBFI’s problems came to the surface in 2013-14, when some of its directors made off with more than Tk 1,000 crore by way of submitting fake documents, according to the central bank inspection report.

In 2015, the central bank had removed five directors for their involvement in the financial scandal.

But it was not enough. Since then the bank has been on a downward spiral. For instance, in the first nine months of last year PLFS’s operating expenses stood at Tk 22.48 crore against the operating income of Tk 2.05 crore.

PLFS sometimes failed to pay the wages to its employees because of the severe liquidity crunch, some officials told this correspondent.

Last year, to get deposits the NBFI offered more than 12 percent interest rate, when many other lenders were paying the highest of 6-7 percent, said a BB official.

“The central bank is now working on the issue. We are looking whether any systemic risk will be created in the banking sector after closing the business operation of the NBFI.”

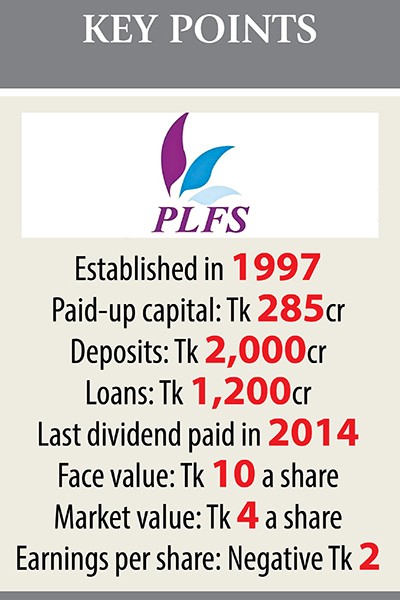

Sources said some banks and other NBFIs and public have Tk 2,000 crore as deposits with PLFS.

If PLFS is liquidated, depositors and shareholders may not get their money back. Latest data shows, nearly 68 percent shares of the NBFI is with the public and 23 percent with sponsors and directors.

Each PLFS share traded at Tk 4 yesterday against the face value of Tk 10. The company last paid dividends in 2014. Many clients have already sought the central bank’s intervention to recover their money, the BB official added.

Some 34 financial institutions are now operating in Bangladesh after securing licenses from the central bank. But many of them are struggling to survive in the absence of corporate governance.

Earlier in 2018, the central bank also sought recommendation from the finance ministry to liquidate another NBFI -- Bangladesh Industrial Finance Company (BIFC) -- which was also facing severe liquidity crunch stemming from loan scams.

But the government did not give any opinion to this end.