Current account deficit narrows 40pc

A massive decline in import and an inflow of record remittance have helped narrow the current account deficit by 40 percent in the first 11 months of the just concluded fiscal year, much to the relief of the Bangladesh Bank.

“This is a good trend that will help stabilise the country’s foreign exchange regime,” said AB Mirza Azizul Islam, a former adviser to a caretaker government.

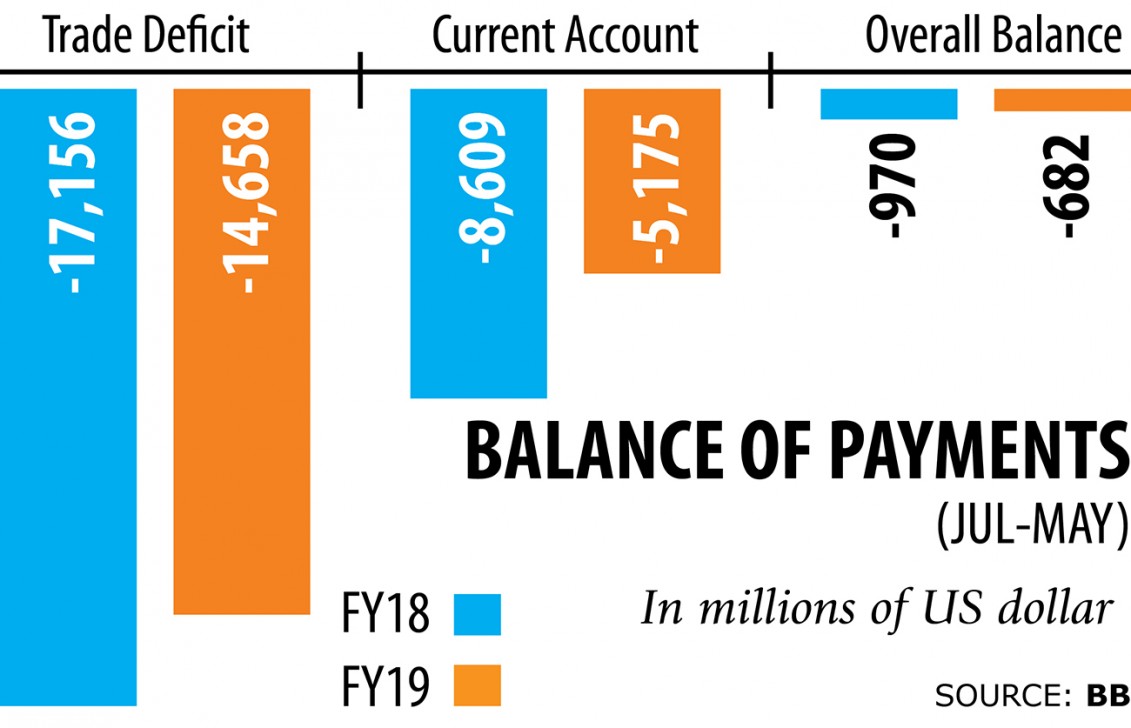

At the end of May the current account deficit stood at $5.17 billion, according to data from the central bank.

But the import of capital machinery and raw materials has nosedived, which is worrying though, Islam said.

This means a slowdown in the productive sector and employment generation is impending.

Exports have so far showed a good performance and more initiatives should be taken to keep it up, he said.

Between July last year and May this year, exports increased 11.45 percent year-on-year to $37.18 billion, while imports grew only 2.62 percent to $51.84 billion.

This narrowed the trade deficit by 14.56 percent year-on-year to $14.65 billion.

Both current account and trade deficit trends have given some breathing space to the government, said Salehuddin Ahmed, a former governor of the central bank.

Despite attracting a record remittance last fiscal year, the inflow dropped 11.55 percent to $1.36 billion in June, he said, while urging the central bank and the government to focus on the issue on a priority basis.

“All things of the balance of payments are good, but foreign exchange reserve is not working as expected,” said an official of the central bank who has strong knowledge on the matter.

Any country must maintain foreign exchange reserves to make import payments for at least three months and Bangladesh’s reserves now are good for at most 5.2 months, down from 5.3 months a month ago and 5.8 months a year ago, he said.

“This has sounded the alarm bells.”

There is no scope to be complacent with the squeezed deficit in both trade and current accounts, the central banker said.

“We have to increase the remittance and exports more in tandem if we are to strengthen the foreign exchange reserves.”