SMEs face long road to recovery

Cottage, micro, compact and medium enterprises (CMSMEs), which will be the backbone of the economy, have been struggling to revive their battered business seeing as the country entered into the second calendar year of the pandemic.

The income and profitability of CMSMEs took an enormous beating from the pandemic that hit the united states in March last year.

Activity in many sectors has picked up in recent months. But the recovery rate of the CMSME sector is normally weaker-than-expected because of feeble financial health in comparison to that of the moderate and large professional units.

A lot of the CMSMEs were closed for years due to the countrywide lockdown announced by the government this past year and for the shortage of cash.

The highest number of job loss also occurred in the CMSME sector.

For example, Design by Rubina, a small household leather and jute goods factory at Mirer Bazar in Gazipur, resumed its procedure from December with only eight staff instead of 22 personnel who were employed before the pandemic.

The factory was closed between April and November this past year. Its pre-pandemic monthly product sales amount was $5,000, including exports.

The fallouts of Covid-19 shattered the imagine Rubina Akter Munni, managing director of Style by Rubina.

Her buyers on Dubai, the Philippines, Qatar and China are yet to pay out her $1 lakh yet, hurting her incomes, the fashion designer-turned entrepreneur said.

She is not by yourself.

The pandemic has shattered the dreams of thousands of budding entrepreneurs in almost all sectors, from garments, household leather, jute, food-processing to plastic goods, printing and packaging.

The country's key export-earning garment industry witnessed the severest impact when international clothing retailers and brands either cancelled or put carry work orders worth $3.18 billion. As the problem has improved to some extent, 90 % of the cancelled ordered have up to now been reinstated.

Naim Bazlul Karim, managing director of APT Sweater Ltd, a little garment exporter based in Kamarpara area found in Dhaka, faced a substantial loss while his factory was closed for three months from April to June.

Through the period, he didn't receive the subcontracting orders from large factories he employed to get as even the larger industrial units have been experiencing the shortage of orders from international clothing retailers and designs.

"I have been looking to get back more do the job orders from my clients," said Karim, who received an purchase value $200,000 from a good buyer this month.

He employs 150 personnel. He has not terminated any worker despite the closure of the factory for 90 days.

"My business is reviving gradually, and I recently recruited a few workers," said Karim.

Regardless of the disastrous situation, lots of small entrepreneurs did well, although their number isn't high.

Z Pack, a tiny packaging factory in Salna in Gazipur, found an increase in its organization. The operations of the factory did not close operations even through the pandemic.

"My clients were satisfied as I supplied the merchandise when almost all such factories were closed," said Mesbahul Alam, the proprietor of Z Pack.

"So, the clients have continued putting work orders with me personally."

Alam recruited practically 45 new employees, although he had wished to hire 70 even more workers to have the tally of the staff to 100.

Through the pandemic, the business owner helped many people financially. It found his head that it would be better if employment is offered to the workers to ensure that they can make money during the crisis, top rated him to new hiring.

Before Covid-19, his monthly sale was Tk 30 lakh to Tk 40 lakh. Nowadays, it has already reached Tk 1 crore.

Alam said there have been about a 20 % rise in the prices of packaging recycleables such as for example chemicals, ink and plastic material granola because of the abnormal hike in freight charges.

He received Tk 15 lakh in loans from the stimulus bundle.

The emerging agro-machinery tools business in the country has not spared from the extreme impact of the pandemic.

A large number of small and channel enterprises mixed up in manufacturing of modern agriculture equipment have become across the country because of the emergence of contemporary technologies found in the farming sector.

"I have been struggling to regenerate my business as the revenue of agricultural tools dropped significantly as a result of cash flow losses of rural dealers and affluent farmers," said Md Sheikh Saadi, managing director of Agro Machinery Industry, which makes mainly paddy reapers and grass cutters at his Darshana factory.

Over fifty percent of his 25 staff members were terminated as a result of the pandemic.

"I am in trouble as well because my buyers aren't paying Tk 1 crore for the merchandise I sold on credit. My buyers are as well in big trouble nowadays," said Saadi. He explained he failed to receive any mortgage loan from the stimulus bundle as a result of stringent conditions.

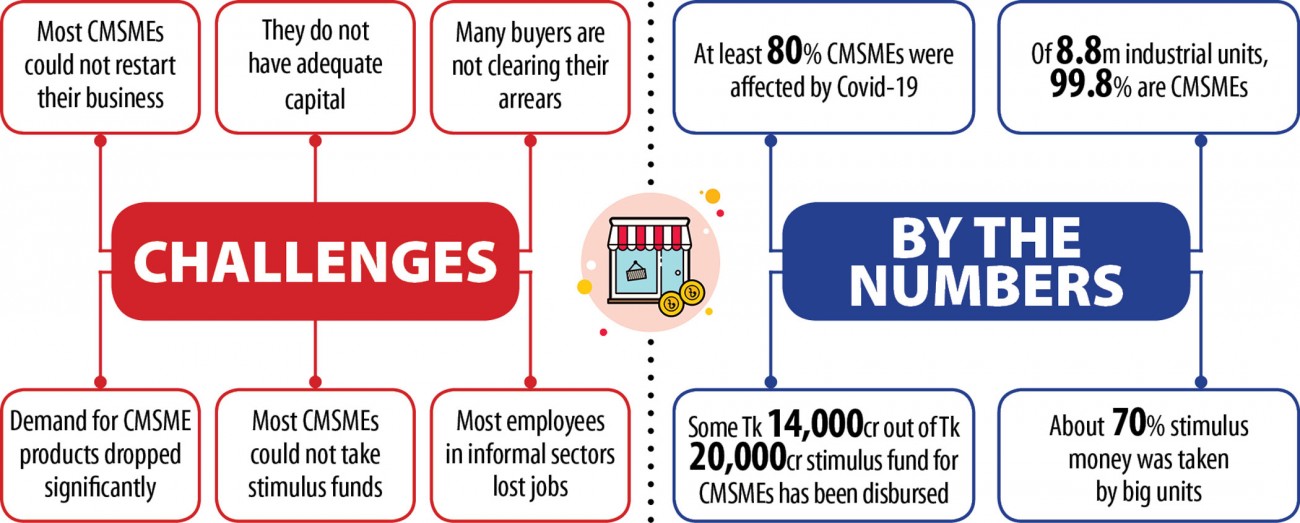

At least 80 % of CMSMEs were damaged as a result of the pandemic, according to Md Ali Zaman, president of the SME Owners Association of Bangladesh.

Virtually all CMSMEs were closed for at least 90 days between April and July. Big professional units weren't closed through the period, he said.

"Many of them could not entire the orders they received prior to the pandemic, so they didn't get the payment."

Zaman blamed the stringent banking circumstances that made it difficult for most CMSMEs to receive the loan from the stimulus package.

"So, the financial move to CMSMEs was severely influenced," he said.

Some 70 % of the stimulus money was taken by the big products, he said.

The CMSMEs have not made the turnaround fully. Consequently, career in the sector has not rebounded. A lot of the CMSMEs possess halved the quantity of their employees because they are struggling to survive right now, said Ferdaus Ara Begum, a specialist on the CMSME sector.

"We are recovering, nonetheless it will take a long time," she said.

From the Tk 20,000-crore stimulus fund for CMSMEs, about 59 % has been disbursed so far, said Begum, also the principle executive officer of the business enterprise Initiative Leading Development.

The introduction of a credit guarantee scheme, re-financing schemes, plus some other facilities possess expedited the disbursement of loans in the CMSME sector, she said.

Of the 8.8 million industrial units in Bangladesh, 99.8 % are categorized as the CMSME category, and most of the informal jobs for millions of people are generated by the CMSMEs in Bangladesh.

Md Masudur Rahman, chairman of the SME Base, said almost all of the CMSMEs missed several big business seasons, including Pahela Baishakh and Eid-ul-Fitr, this past year.

"So, these units happen to be struggling to survive," he explained, adding that Tk 14,000 crore provides been disbursed from the stimulus fund for the CMSME sector.

Another Tk 3,000 crore from the SME Base is set to come to be disbursed among the business owners at a 4 per cent interest rate.

"So, it is predicted that the CMSMEs would revive next half a year," he said.