SMEs with usage of finance double employee numbers since inception

Small and medium businesses with access to finance have improved the staff size by a lot more than 100 % from their beginning level, playing a substantial role in task creation and making the entire economy radiant, according to a new research.

IDLC Financing and the Policy Study Institute (PRI) of Bangladesh jointly conducted the study titled "Usage of Financing for SME and Effect on Work Creation: Empirical Evidence Predicated on IDLC Finance Ltd".

The research assessed a complete of 782 small and medium enterprises (SMEs) which availed loans from IDLC Financing in the united states and covered information from their inception to 2019.

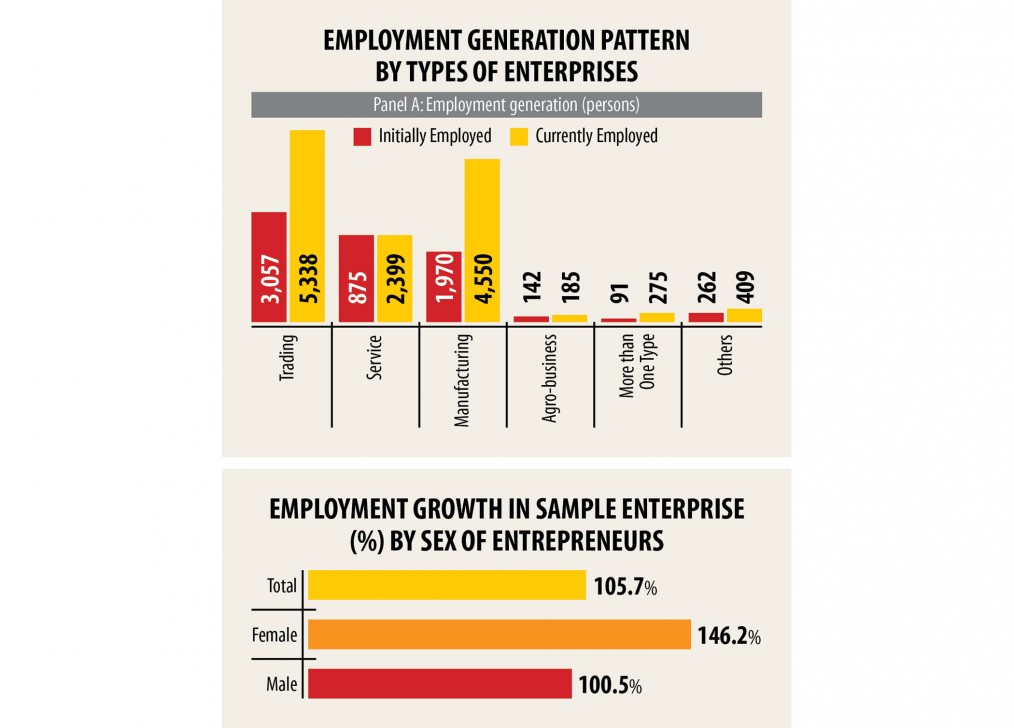

There has been up to 105.7 per cent growth in the employment generation by the SMEs, in line with the review that was disclosed at a webinar jointly organised by the PRI and IDLC Finance yesterday.

Some 8.4 per cent of the SMEs had been owned by females.They informed that they had posted task growth of 146.2 % because the inception of their businesses.

The SMEs owned by males, even so, registered job growth of 100.5 per cent, and therefore they are lagging behind females in terms of the expansion of businesses.

The SMEs, historically, have played a substantial role in pushing growth for the growing economies, said Ahsan H Mansur, executive director of the PRI.

South Korea, Japan, China and several various other developed countries had previous managed their economical development by method of giving a increase to the SME sector, he said.

"And Bangladesh is very little exception. The united states will have to move forward predicated on the SME sector," he said.

The large industries are highly reliant on the SME sectors in several nations. But such interdependence is not that strong here.

Technology adaptation, make use of skilled workforce and access to finance are very important for the expansion of the SME sector.

"But, the SMEs are neglected to an excellent extent in the country. They will have to be brought beneath the global value program from the local one," said Mansur, as well a former high recognized of the International Monetary Fund.

The need for the sector will not any highlight in countrywide dialogues, which is not expected at all, he said.

SMEs today occupy an important position found in the national economy, accounting for approximately 45 % of manufacturing value addition, 80 per cent of professional sector employment, 90 % of total professional units and employment of about 25 % of the labour drive.

Their total contribution to export earnings hovers in the range of 75 per cent to 80 %.

The industrial sector makes up 31 % of the country's gross domestic product, the majority of which is from the SMEs.

The country's SME sector has generated 15 lakh jobs between 2009 and June 2014.

Business turnover in IDLC features been on the rise, playing a significant role found in keeping the wheels of the rural market running as well, said Mansur.

IDLC SME division has been developing by around 21 % on the average for days gone by 10 years.

The non-bank financial institution's SME loans so far amount to 46 % of its Tk 8,700 crore outstanding credit by October this year.

The board of directors of several banks have persistently showcased a reluctant attitude in disbursing SME loans, said Mansur, also chairman of Brac Bank.

The directors of some banks are taking loans from other banks through mutual understandings, putting a detrimental effect on the SME sector, he said.

Many lenders are actually struggling to disburse the loans of the stimulus program initiated by the federal government for the SME sector, he said.

Too little infrastructure for disbursing the loans is the key roadblock for lenders, he said.

The central bank should give the responsibility of offering loans to banks which are capable of it, Mansur said.

The rise in the quantity of SME loans will not gain momentum unless the transparency of boards is ensured, said Arif Khan, managing director of IDLC Financing.

The NBFI began to hand out loans in 2007 when many industry persons argued that such financing options are highly risky, he said.

"But, we have got success by method of disbursing loans to the SME sector," he explained.

Defaulted loans at IDLC Finance is below 3 %, much lower compared to the average non-performing loans on the NBFI sector.

NPLs in the 33 NBFIs in Bangladesh stood in Tk 8,905.62 crore in June, which is 13.29 % of the outstanding loans, according to data from the central bank.

Bazlul Haque Khondker, a professor of economics at the University of Dhaka, presented the study paper at the event.

Quoting the analysis, he said the best employment growth was documented in the service (174.2 %) and manufacturing (131 %) enterprises since their inceptions.

The best growth rate of 134 % has been found for salaried jobs over the time.

This form of employment is more stable, creating a predictable income stream for the workers, Khondker said.