Engage micro lenders to disburse stimulus loans among SMEs: Sanem

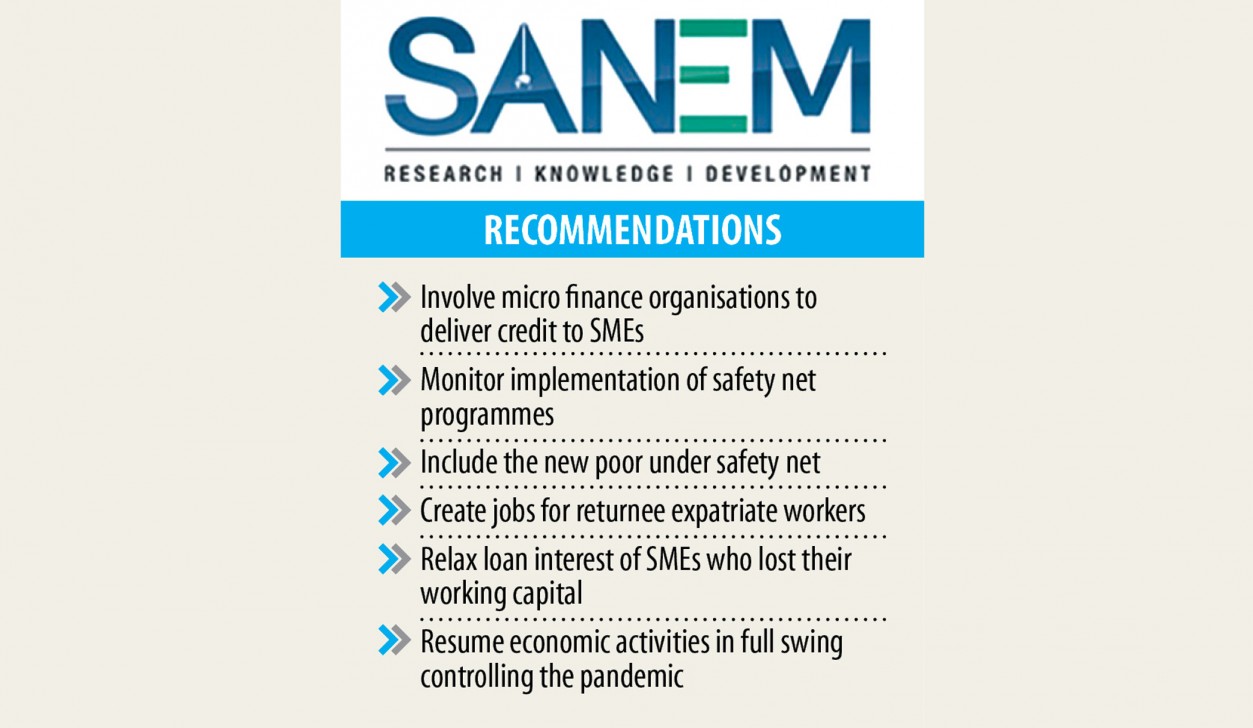

Microfinance institutions should be involved with fund disbursements from the government's stimulus bundle to small and channel enterprises (SMEs) to ensure that those companies have quick access to financing amid the ongoing coronavirus pandemic, in line with the South Asian Network on Economic Modeling (Sanem).

"Although entrepreneurs happen to be benefitting from the stimulus package deal, disbursements are appearing made through the banking system, that is a very slow process," explained Sanem Executive Director Selim Raihan.

Raihan made these remarks while speaking at a virtual debate, held yesterday as part of the Sanem Netizen Forum on Covid-19 Pandemic - Instance 8, styled 'assessing the entire current situation of the pandemic'.

The federal government previously announced a Tk 20,000 crore stimulus package for SMEs in a bid to supply the sector with enough working capital to make it through the coronavirus fallout and continue its growth.

In his argument for why small-scale lenders should be authorised to create disbursements, Raihan said that micro lenders primarily provide financing to SMEs and for that reason, involving them would support the sector utilise the stimulus program to its fullest.

The Sanem executive director also expressed appreciation for the government's initiative to protect SMEs as it can help the sector recover alongside the entire economy.

However, he also advised that authorities should screen the implementation of the stimulus package to ensure that funds will be being properly utilised.

Regarding the social back-up programme, Raihan explained that the federal government is but to bring persons who were recently forced into poverty simply by the Covid-19 outbreak beneath the scheme.

Many self-employed individuals became redundant and ended up time for their villages after failing to secure enough working capital because of the ongoing pandemic.

"So, they should be added to the set of eligible persons and get full fiscal cooperation beneath the stimulus bundle," Raihan said.

Meanwhile, it is a good initiative to utilize the foreign exchange reserve to invest in development activities. Nevertheless, the reserve shouldn't be overused as it will discourage foreign immediate investment, he added.

While Bangladesh's monetary activities will not go back to full-swing until the outbreak is brought to heel, East Parts of asia like Vietnam are jogging at full steam after successfully controlling the spread of the deadly pathogen.

Addressing the discussion, Sayema Haque Bidhisha, professor of economics in the University of Dhaka, said that inward remittance rose sharply in recently times as expatriates happen to be transferring all their earnings back with a observe to returning to the country.

"However, their return may also create issues for the economy because they will practically certainly head back to their villages and continue to be uninvolved in economical activities," said Bidhisha, likewise the study director of Sanem.

Besides, the other low-income people still left Dhaka to save lots of money on rent while some have even lost their jobs.

"So, this sector ought to be brought under the social back-up," she added.

Bidhisha also pointed out that SMEs are found in not in virtually any position to pay for a 4 per cent fascination on loans from the stimulus deal and so, the federal government should ease a few of the criteria.

Mahtab Uddin, analysis fellow, and Eshrat Sharmin, research associate, also spoke at the discussion.