BB announces credit guarantee scheme for small enterprises

The central bank yesterday made a decision to introduce a credit guarantee scheme for the micro and small enterprises, the to begin its kind in the country, giving a much-needed lifeline to the SME sector struggling to stay afloat.

The board of the Bangladesh Bank approved the scheme worth Tk 2,000 crore for the entrepreneurs in the cottage, micro and small (CMS) sector to greatly help them tackle the ongoing crisis due to the coronavirus pandemic.

The scheme will in the beginning give coverage to the fund, which has been disbursed from the stimulus package of Tk 20,000 crore for the SME sector.

"The credit guarantee will surely noticeably raise the entire SME sector," said Abu Farah Md Naser, an executive director of the central bank.

A credit guarantee scheme offers a third-party credit risk mitigation to loan providers through the absorption of a portion of the lender's losses on the loans designed to SMEs in the event of default, typically in substitution for a fee.

Banks are certain to get 80 % coverage of a credit rating given to an individual or a good company. This means banking institutions will avail the fund from the scheme if loans choose sour.

The scheme will help get the stimulus package for the SME sector vibrant, said a central bank official said.

Under the package, funds will be given at 9 % interest to borrowers. Of the interest, 4 per cent will end up being borne by the borrowers and 5 % by the government in subsidies.

Also, the central bank provides half of the Tk 20,000 crore stimulus package to cash-strapped banking institutions in order that they could hand out the loans smoothly.

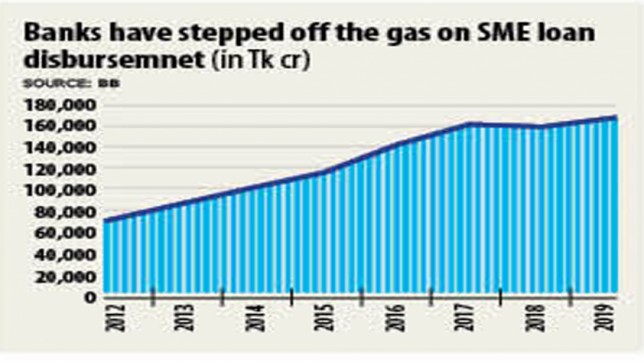

But banks are constantly showing reluctance to distribute loans from the stimulus package granted the reduced interest rate caused by the 9 % lending cap the BB had imposed in April.

Bankers argue that 9 % interest is not adequate as the operational cost for SME loans is high and nearly all CMS loans needs to be given without collateral.

The scheme gives coverage of Tk 8,320 crore given the 10 per cent defaulted loans of the full total outstanding credit in the market, Naser said.

The central bank will support the banks that apply first.

The BB has asked banking institutions to give out 70 % of the stimulus package of Tk 20,000 crore to the CMS sector.

Lenders must bear a 1 per cent charge as registration charge to the credit warranty scheme. The central bank has also fixed an gross annual charge for lenders.

Banking institutions, whose default loans happen to be more than 10 per cent, will never be allowed to enjoy the support from the scheme. The provision will never be applicable for the eight state-run banks.

Banks, whose default loans are below 5 per cent, must give 0.50 % commission to the central bank.

Loan providers with bad loans ranging from 5 per cent to 10 per cent would need to pay 0.75 %.

Banks won't keep any provisioning against their loans covered by the scheme titled Credit rating Guarantee Scheme for CMS.

They can look at a client to be beneath the cottage category when they borrow significantly less than Tk 10 lakh, as micro if they take Tk 10 lakh to less than Tk 75 lakh and as smaller businesses in the event of borrowing of Tk 75 lakh to Tk 15 crore.

The scheme would little by little be widened and bring all sorts of SME loans under the scheme in phases, Naser said.

He went on expressing trust that the initiative would help revive the SME sector from the ongoing pandemic.

"This is a good time-befitting initiative certainly," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

"The credit assurance scheme gives a tempo to the whole SME sector. And banking institutions will show their interest in offering loans," he added.

Public credit assurance schemes are a common sort of government intervention to unlock finance for SMEs, according to a global Bank report.

Over fifty percent of the countries on the globe have CGS for SMEs and the number keeps growing, it said.

For example, the Indian government provided a credit rating guarantee of Rs 3 lakh crore for the SME sector in May to fight the ongoing financial fallout. It created the scheme in 2000.

Small businesses have been hit particularly hard by the pandemic, which includes threatened the existence of 2.5 million SMEs in Bangladesh.

The SMEs employ 40 % of the labour force with a GDP contribution of 25 %, in line with the International Labour Organisation.

This prompted economists to advocate for a credit guarantee scheme for SMEs since the pandemic hit the country in March.

One of these is Atiur Rahman, a good former central bank governor. Last month, he explained banks come to mind about risk management, so they might not exactly prefer to lend to new borrowers and would prefer to remain focused on existing borrowers.

The central bank should implement a credit guarantee scheme to greatly help banks lend to the vulnerable CMSME sector, he said. The MSMEs ought to be granted support because if indeed they continue to be inactive for a long time as a result of the lockdown, 60 per cent will be out of business.