Internet banking gaining traction

Internet banking transactions possess surged lately as persons increasingly embraced the digital mode while opting never to visit branches.

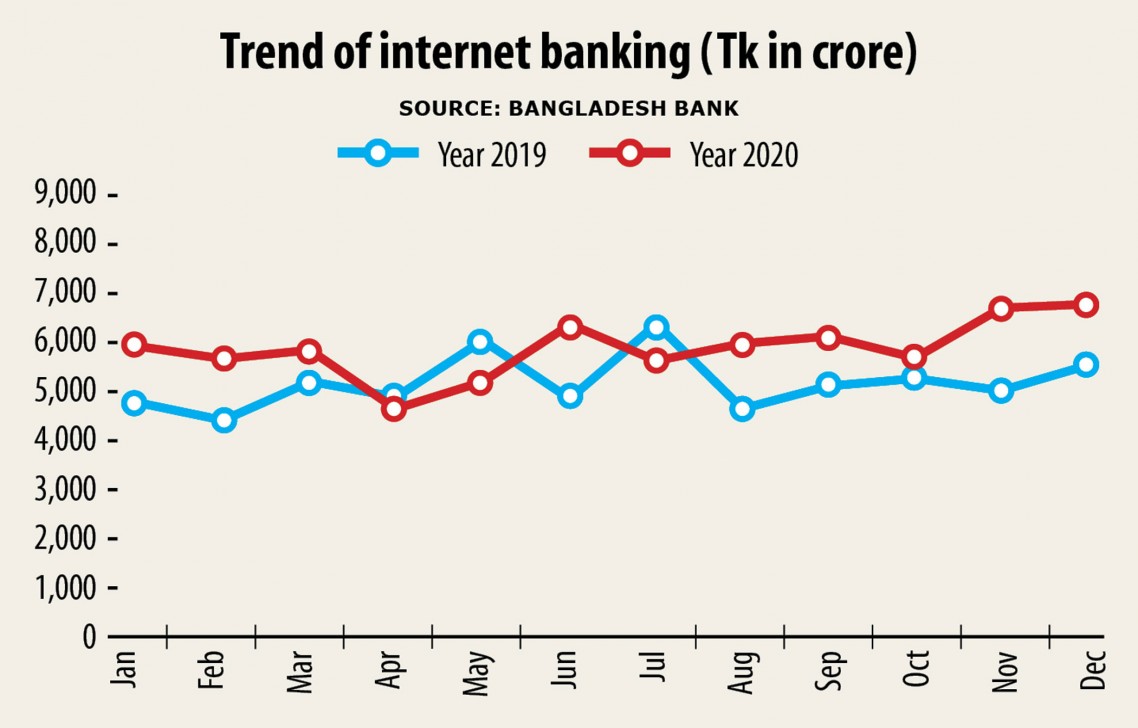

The transactions amounted to Tk 8,093 crore in December, up 33.47 % year-on-year, showed Bangladesh Bank info.

Clients started heavily counting on internet banking transactions when the government declared a lockdown found in March this past year to limit the spread of the coronavirus.

Banks now promote various kinds of digital financial companies, including internet banking, which attracted clients, said Dhaka Bank Managing Director Emranul Huq.

A good number of banks have previously introduced app-centered financial services, allowing customers to stay financial transactions hassle-free, he said.

"It has also given a good push to net banking," Huq said, adding that, subsequently, would reduce the application of cash.

A few of the facilities are the transfer of cash from one account to another, payment of tuition costs and bills and adjustment of loans taken against credit cards.

There have been 23.44 lakh such transactions in December, that was 41.88 % higher year-on-year.

Md Shafquat Hossain, head of SME and retail banking of Mutual Trust Bank, said internet banking gained momentum soon after the federal government imposed the lockdown as persons opted to mostly stay in the home to keep carefully the virus at bay.

Although the government started easing limitations from the final week of May, persons continued showing interest in settling transactions through internet banking, he said.

"Clients are actually enjoying the service because they don't want to go to branches to settle little transactions," he said.

Transactions through net banking will go up significantly in the days ahead seeing as the central bank has taken several initiatives to popularise the digital banking offerings, Hossain said.

"The central bank possesses produce regulations to drive the digitalisation agenda forward in the last almost a year," said Enamul Huque, region head of corporate, industrial and institutional banking at Normal Chartered Bangladesh.

Huque is confident that the changes during the pandemic would accelerate digitalisation found in the financial industry.

The Bangladesh Bank increased the limit of inter-bank fund transfers through internet banking in September with a view to giving a boost to IT-based financial services.

Clients are permitted to transfer a maximum of Tk 5 lakh each day against a good previous ceiling of Tk 2 lakh.

People are utilising the web banking platform as part of your before to maintain social distancing and protect themselves from the rogue virus, said a higher official of the central bank.

The central bank also doubled the ceiling of a single transaction to Tk 1 lakh from Tk 50,000.

Clients are actually permitted to settle just as much as 10 transactions each day, that was five previously.

Net banking will reach its subsequent level when banks start starting micro merchant accounts about an enormous scale, said a central bank official.

Such merchant accounts allow smaller businesses - vegetable vendors and owners of tiny shops or tea stalls -to accept bills from clients' accounts and bank cards. This could be enabled through the use of quick response (QR) codes.

"This will help persons embrace digital means, sidestepping manual payment strategies," said the state.

The central bank rolled out an interoperable QR code in January within its efforts to give a boost to cashless transactions in the united states, especially in rural areas.

The uniform digital payment method named "Bangla QR" can help clients pay bills for goods and services utilizing the mobile software of banks and mobile financial and payment providers.