Small enterprises, farmers even so languish in neglect

The implementation of stimulus packages for small and medium enterprises, the agriculture sector and underprivileged professionals and businesses continues to be weak due to lukewarm response from banks although they were unveiled more than a year ago.

The lacklustre execution of the three packages has already established an adverse effect on the recovery of the economy from the pandemic-induced slowdown, bankers say.

The federal government has rolled out 23 bailout packages since March to help various sectors of the economy absorb the coronavirus shock. A lot of the packages were declared in April.

The quantity under financial assistance stands at Tk 124,053 crore, which is 4.44 % of the gross household item. Of the sum, the central lender has produce Tk 87,750 crore in the sort of seven packages.

The central bank has formed a stimulus package worth Tk 20,000 crore for CMSMEs (cottage, micro, small and method enterprises). Beneath the package, loans receive at 9 %.

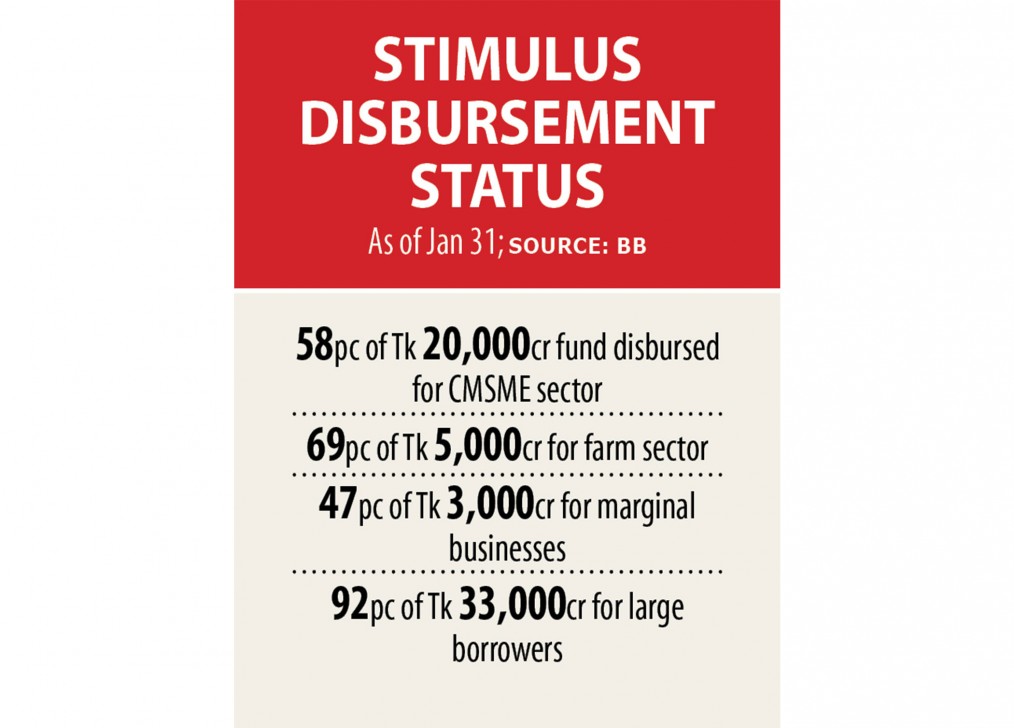

Of the rate, 4 % is borne by the debtors and 5 % by the government. Banks disbursed 58 per cent of the fund as of January 28, info from the central lender showed.

The central bank had earlier asked lenders to implement the package by September last year, a target loan providers cannot meet, prompting the BB to increase the deadline several times.

It has asked banks to put into practice the bundle by March this year.

Some banks have proven reluctance to disburse loans from the fund as nearly all CMSME clients are not running business in an organised approach, a central banker said.

"Lenders don't know if they can recover the loans," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

He, however, said banking institutions had already taken initiatives to disburse loans to CMSMEs.

Banks are also definately not achieving the disbursement deadline for farm loans beneath the stimulus bundle of Tk 5,000 crore.

When the package was announced in the sort of a refinance scheme, the central bank asked banks to distribute it by September last year. But banks performed poorly, forcing the central lender to rebel the deadline twice.

On December 29, banking institutions were asked to attain the mark by March 31 this season. They distributed Tk 3,466 crore by January, which is 69 % of the package.

Forty-three banking institutions signed participation agreements with the central bank to disburse loans from the fund focused on reviving the agriculture sector. Of these, 16 banks lent significantly less than 30 per cent of the funds these were given the duty to disburse.

The central bank has repeatedly asked banks to expedite the disbursement, however, many of them didn't take the problem with the most importance, the BB official said.

The BB now plans to re-allocate the undisbursed part of the 16 banking institutions to lenders that fared well, he said.

Banks gave out 47 % of Tk 3,000 crore bundle introduced for the marginal businesses and farmers by January 31.

The BB asked banking institutions to provide out the fund through microfinance institutions (MFIs), but MFIs are not interested given the low interest, another central banker said.

Under the bundle, the BB provides the fund to banks at 1 per cent interest rate. MFIs get the fund from banking institutions at 3.5 % interest and are permitted to charge its clients no more than 9 % interest.

MFIs charge about 24 per cent interest on their standard loans as their expense of operation is high.

Some banking institutions and MFIs are having to disburse the loans due to the central bank's pressure, the BB official said, adding that the central bank should have considered the problem of the interest rate when it announced the offer.

The situation is completely opposite for the stimulus package for the large industries and the service sector.

Around 92 per cent of the Tk 33,000-crore package was disbursed by January 21.

The central bank has expanded the fund size to Tk 40,000 crore to focus on the industries positioned in the monetary zones, export processing zones and hi-tech parks.