Shorter lead time key to RMG export growth

Maintaining a shorter lead time holds the key for Bangladesh's garment exporters as Western customers increasingly become dependent on e-commerce rather than the traditional brick-and-mortar stores, said industry people.

“If Bangladesh can't maintain a strict lead time, we will move to alternative destinations like Vietnam,” said Jordi Juani, director for Spanish company Jeanologia's Asia division.

So, Bangladesh has to maintain a mixture of short lead time and competitive pricing, he said.

Juani was talking with The Daily Star at his stall at the ninth edition of the Bangladesh Denim Expo held at the International Convention City, Bashundhara in Dhaka.

Jeanologia has been supplying modern technologies on how to increase productivity and on how to reduce the use of water in the washing of garment fabrics.

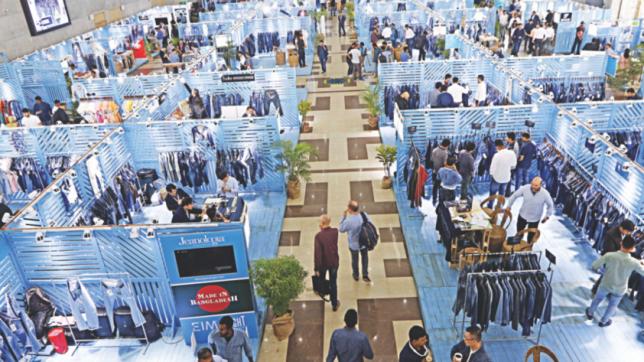

Two foreign buyers take a close look at denim products at the fair. Photo: Star

“So, if Bangladesh wants to do better in the garment business, especially in the denim business, the local fabric makers and exporters will have to adopt new technologies, increase productivity and bring changes in designs,” Juani added.

Carmen Chan, senior director of US-based Cone Denim, echoed the same.

“Lead time is important for Bangladesh to grab more market share in the US. Speed is everything now,” he added.

American customers are more interested in the prices than where the garments are made. “If the prices are competitive, American customers will buy more.”

In the traditional retail chain shopping system, 90 days or more is the ideal lead time for retailers. But recently it has declined to 40 to 45 days thanks to the e-commerce juggernaut.

“Western retailers are also under tremendous pressure due to fast fashion,” Juani said.

Nearly 15 percent of the stores are shuttering in Europe every year as customers move to buying online, he added.

“So, we need to stockpile a lot of denim fabrics in the warehouses,” said said Sayeed Ahmad Chowdhury, general manager for operations at Square Denims.

Currently, there are a huge number of work orders from international retailers. “So, we have improved our production capacity.” Two years ago, Square Denims used to produce 1.5 million yards of denim fabrics a month; it has now doubled it to 3 million yards.

Currently, the monthly demand for denim fabrics in Bangladesh is 80 million yards and 31 local denim mills can supply 60 million yards in a month, according to Chowdhury.

Thanks to the higher demand, new denim mills are coming into operation in Bangladesh almost every year, he said.

The local participants in the show complained about the low prices of garment items from Bangladesh although the cost of production is increasing 15 to 18 percent every year.

This year, 63 companies from 12 countries such as Germany, the US, Turkey, Italy, Singapore, Spain, Pakistan, Japan, San Marino, China and India are displaying denim products and technologies in the two-day show.

In the world market of denim, simplicity is now the ultimate sophistication, said Mostafiz Uddin, the organiser of the exposition, which is ending today.

“So, in this edition, the Bangladesh Denim Expo will try to give a much simpler message about sustainability and ecology in denim,” he added.