Risky loans soaring. BB’s plan? Hide figure.

The central bank is planning to sweep the bulging stressed assets under the rug when it publishes its annual financial stability report in April such that it can paint a rosy picture of the banking sector.

Stressed assets, which include default loans, restructured and rescheduled advances, have shot up 18.89 percent to Tk 222,162 crore in the six months to June last year, according to data from the Bangladesh Bank.

The ratio of stressed assets in the banking sector was 22 percent of total loans as of June last year, up 16.10 percent from four-and-a-half years earlier.

This has forced the central bank to think of camouflaging the figure, four central bank officials with direct knowledge of the matter told The Daily Star.

“The International Monetary Fund and other multilateral lenders and donor agencies have taken into account the figure while assessing our economy. This has created an uncomfortable situation for us,” said a central banker requesting anonymity due to sensitivity of the topic.

Such risky assets can put adverse effect on banks’ balance sheets and profitability because of the need for provisioning against the classified loans and reduced returns on investment, according to a recent central bank report on stressed assets.

They also push up the cost of capital, widen assets and liability imbalance and upset the economic value addition by banks.

“Considering the effect that it has on both capital and liquidity position of banks, it may turn into a financial stability threat if it remains unaddressed,” the report said.

BB higher-ups have verbally instructed not to disclose the figure in its next financial stability report, said another senior official.

The central bank is yet to take a decision whether it will unveil the figure of stressed assets in the next financial stability report, said Md Serajul Islam, spokesperson and an executive director of the central bank.

“It will take three or four more months to publish the next stability report. So, this is not the right time to make the comment,” he added.

Experts have strongly opposed the central bank idea, saying the move will erode public’s confidence in banks.

“Peoples’ confidence in the banking sector will not be restored and the financial health of lenders will not improve in the true sense if the central bank conceals the figure of stressed assets,” said Zahid Hussain, former lead economist of the World Bank’s Dhaka office.

The central bank’s effort has indicated that it may try to show off an artificial image of the banking sector by concealing stressed assets.

Default loans are supposed to go down significantly in the second half of last year on the back of rising rescheduled loans following the central bank’s relaxed move on rescheduling policy.

As per the new policy, defaulters can make a 2 percent down payment to reschedule their loans for 10 years, including one year’s grace period, at 9 percent interest rate.

“The central bank’s initiative will help reduce default loans for the time being. But this will not be the actual picture of the banking sector as rescheduled loans are treated as stressed assets, which are highly unrecoverable,” Hussain said.

As of June, default loans in the banking sector stood at Tk 112,619 crore, while rescheduled and restructured loans amounted to Tk 109,543 crore.

“Getting economic data from regulators is becoming difficult day by day,” said Fahmida Khatun, executive director of the Centre for Policy Dialogue, a think-tank.

Trying to conceal the figure of stressed assets will create problem for the banking sector.

“People will not get any clear indication about banks if such kind of information is not disclosed.”

The large volume of stressed assets has already created a liquidity crunch in the banking sector, putting an adverse impact on the private sector credit growth.

“Banks will lose capability to pay expected corporate tax as rising stressed assets will hit their profitability,” Khatun added.

Stressed assets is a broader definition of default loans and the central bank should continue to publish the figure on a regular basis for the greater interest of the economy, said Ahsan H Mansur, executive director of the Policy Research Institute, a think-tank.

The upward trend of stressed assets has already sounded off alarm for the financial sector as a whole, he said.

Banks hardly recover any amount from rescheduled and restructured loans as habitual defaulters misuse the facility frequently, he said, adding that the central bank should fix targets for every bank to recover stressed assets.

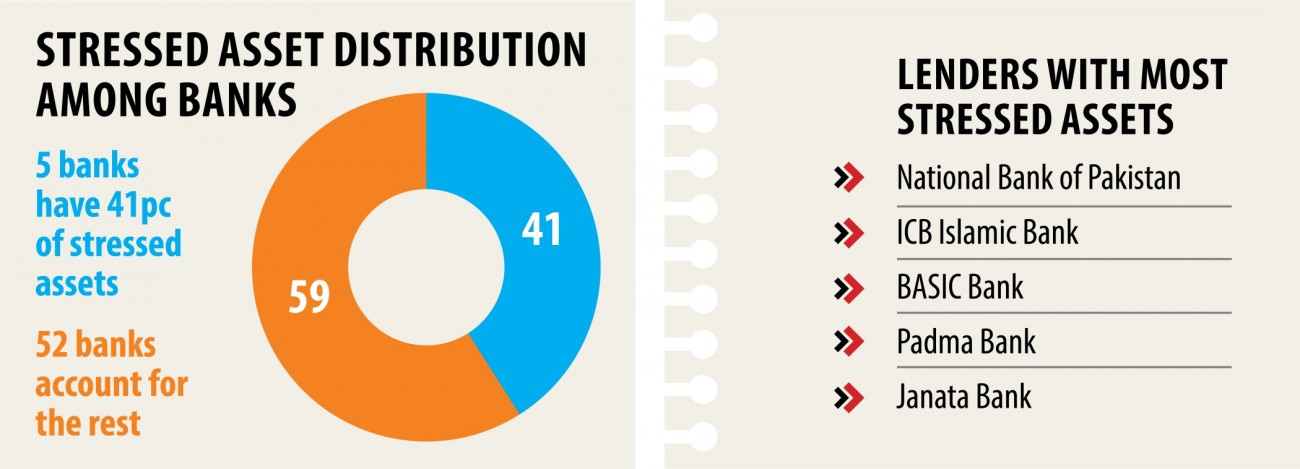

In June, five banks -- National Bank of Pakistan, ICB Islamic Bank, BASIC Bank, Padma Bank and Janata Bank -- faced the highest amount of stressed assets.

The five banks faced a good number of financial scams that pushed up the level of their stressed assets, said a high BB official.

Large loan borrowers, whose average loan size goes past the Tk 75 crore-mark, are mainly responsible for the rising stressed assets in the industrial sector. They accounted for 52.20 percent of the stressed assets in the segment as of June.

Both the central bank and the government should take strict measures against the habitual defaulters in order to bring down the stressed assets, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

“We should get out of the culture of impunity in order to restore financial discipline in the banking sector. Social embargo should be imposed on habitual defaulters.”

The government should confiscate the passports of the habitual defaulters and they should be stripped off their VIP (very important person) and CIP (commercially important person) status, said Rahman, also the immediate past chairman of the Association of Bankers, Bangladesh, a forum of managing directors of banks.

The government could use its proposed public asset management company to reduce the burden of stressed assets on banks, said Md Arfan Ali, managing director of Bank Asia.

“We will have to bring down the stressed assets at any cost. Or else, it will pose a major threat to the financial sector,” he added.

BB Spokesperson Islam, however, expressed his hope that stressed assets would decline in the final quarter of 2019 as banks recovered a good amount of default loans.