Private banks ready for Basel III

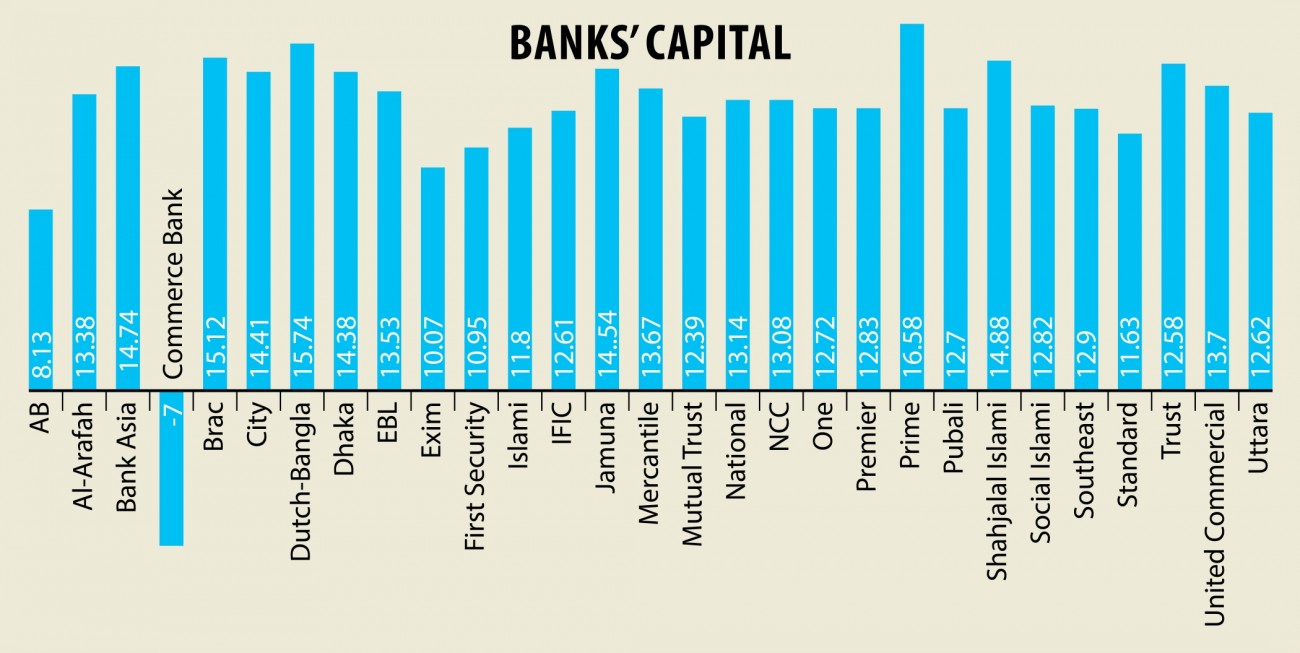

Most of the private banks have raised their capital base in line with the Basel III requirements three months prior to the deadline set to reach the global regulatory standard.

However, the state banks are nowhere near the level they were supposed to reach by the time.

As per a roadmap issued by the Bangladesh Bank in 2014, the banks were supposed to raise their minimum capital adequacy ratio (CAR) to 12.5 percent of their risk-weighted assets by December 2019 from the then 10 percent.

Of the 41 private banks, only 11 are yet to reach the level. But the six state-owned commercial banks are still far behind the 2014’s target of 10 percent.

The CARs of nine foreign banks are hovering between 17 percent and 143 percent.

The central bank planned to raise the ratio to 10 percent by 2015, 10.625 percent by 2016, 11.25 percent by 2017, 11.875 percent by 2018 and 12.5 percent in 2019.

To date, there has been no internationally harmonised standard on bank capital adequacy ratio, stress testing and market liquidity risk, which the Basel III would provide.

The roadmap comes at a time when banks’ capital base has been shrinking on the back of mounting bad loans and the central bank has been on their tail to raise their CAR.

In 2015, the banking regulator also formed special teams to work with banks’ directors to encourage them to take effort to boost their capitak.

However, the problematic banks failed to despite the effort.

Many banks have improved their conditions in phases by taking different initiative, said Anis A Khan, former managing director of Mutual Trust Bank.

“But there are still some challenges for the banks.”

If the default loans increase keeping pace with the loan growth of the banking sector, the CAR will fall again.

So, banks should make sure that they are giving quality loans only and their default loans do not increase further, he added.

The capital situation may get worse because of the new loan rescheduling rules set by the banking watchdog, said Zaid Bakht, chairman of Agrani Bank.

To regularise a loan, a 2 percent down payment is a must now along with keeping 100 percent provisioning against their income. The state banks will now seek for deferrals to maintain the provisioning and they should get the go-ahead, he said.

If they cannot reach the desired CAR level the state banks will have to pay more in case of international trading.

However, the government owes a huge amount of money to the state banks. If it clears the dues, the state banks’ capital will increase, Bakht added.

As of September 30, the banks maintained a capital of Tk 118,917 crore, which is 11.65 percent of their risk-weighted average.

The CAR of foreign banks is 25.07 percent, private banks’ 12.87 percent and state banks’ 7.74 percent, according to data from the BB.