Banks forfeit Tk 858cr in interest

Interest waiver against bad loans more than doubled to Tk 858 crore in the first nine months of 2019 -- an indication of the desperation of banks to bring down their default loans by any means.

Only those borrowers with strong connections with the government and directors of private banks can manage exemptions, said Salehuddin Ahmed, a former governor of the central bank.

“This is an unethical practice,” he said, adding that general borrowers can hardly manage such waiver. Lenders of developed countries barely waive interest, Ahmed said.

Banks usually offer the facility for delinquent borrowers, giving rise to moral hazard for good borrowers, said Khondkar Ibrahim Khaled, a former deputy governor of the central bank.

Both good and habitual defaulters will rush to banks for waiver if the ongoing trend continues, said Fahmida Khatun, executive director of the Centre for Policy Dialogue.

The exemption of interest has a direct negative impact on banks’ profitability. Strangely, most of the banks logged a hefty amount of profit last year, Khaled said, adding that some of the banks might have imposed hidden service charges on customers to ensure profits.

The large amount of interest exemption suggests of feeble corporate governance in the banking sector, Khatun said, while blaming the upward trend of default loans for the spike in interest exemption.

As of September last year, defaulted loans in the banking sector stood at Tk 116,288.31 crore, up 23.82 percent from nine months earlier.

“For the time being banks could clean up their balance sheets by way of waiving interest. But their financial health will deteriorate drastically in the long run,” she added.

Both Khaled and Ahmed advised lenders to put emphasis on recovering default loans by avoiding exemption to habitual defaulters.

Banks usually waive interest when they can manage a lump sum amount of default loans from borrowers, said Md Arfan Ali, managing director of Bank Asia.

All banks, however, do not follow the same waiver policy to recover the default loans, he said, adding that such exemption puts adverse impact on lenders’ income.

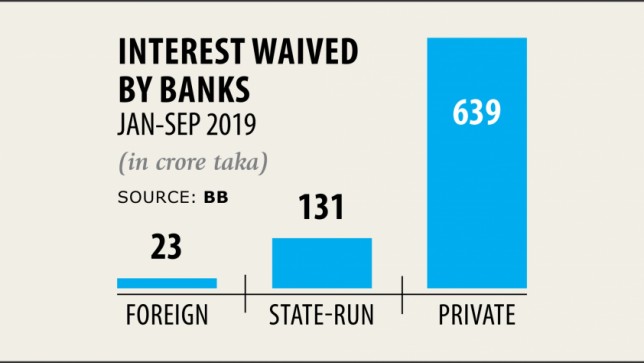

Private banks waived interest amounting to Tk 639 crore between January and September, up from Tk 131 crore a year earlier, according to data from the Bangladesh Bank.

Interest waived by six state banks -- Sonali, Janata, Agrani, Rupali, BASIC and Bangladesh Development -- increased 20 percent year-on-year to Tk 131 crore.

Foreign banks waived Tk 23 crore in the first nine months of last year, up Tk 9.36 crore from a year earlier.

In January-September of 2018, banks had waived Tk 421 crore.