Remittance soars to record $18b

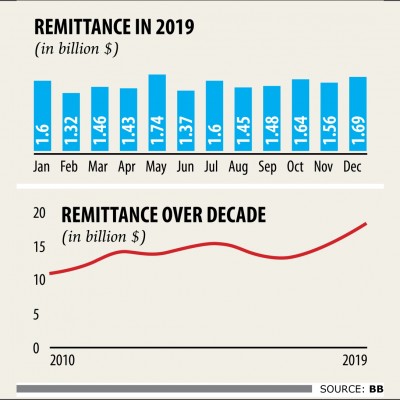

Remittance hit an all-time high of $18.32 billion in 2019, much to the relief of the government that has been on edge for the lower foreign exchange earnings from declining export shipments.

Export earnings contracted 7.59 percent year-on-year to $15.77 billion in the first five months of fiscal 2019-20.

But, remittance brought ample cheer: inflows were up 18 percent from 2019, according to data from the central bank.

“If the trend continues, remittance will hit a benchmark of $20 billion come the end of the fiscal year,” said Kazi Sayedur Rahman, an executive director of the Bangladesh Bank.

The government’s move to provide a 2 percent cash subsidy for remitters from fiscal 2019-20 was the main reason for the spike, he said.

Besides, the favourable exchange rate of taka against the dollar and a strong stance taken by the central bank to fight illegal money transfers also had a positive impact on the record amount sent home by expatriate Bangladeshis last year, according to Rahman.

On January 1, the inter-bank exchange rate stood at Tk 84.90, up 2.66 percent from a year earlier, according to data from the central bank.

He went on to express a hope that the deficit in current account of the balance of payment (BoP) will narrow more this fiscal year because of the upward trend of remittance.

Between July and October, the deficit in current account stood at $1.30 billion, down 36.88 year-on-year.

Md Arfan Ali, managing director of Bank Asia, echoed the same.

The massive expansion of mobile financial services and agent banking have also helped encourage the remitters to send their hard-earned money through the formal channel, he said.

Through the channel, the near and dear ones of remitters can receive the funds within the shortest amount of time, Ali added.

Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue, is less sanguine about the uptick in remittance this year.

“Admittedly, remittance is our best-performing economic indicator. It has absorbed a tremendous amount of the pressure on BoP and foreign exchange. But, it is also costing us money.”

Some Tk 3,500 crore has been kept aside to provide cash incentive to remitters in this fiscal year’s budget.

“So the more remittance inflows there are, the more cash we have to spend, which, in turn, will put pressure on the exchequer.”

Subsequently, Rahman advised the government to come up with ways to boost remittance without relying so much on cash incentives.

“The inflows are good and it is also helping in reducing pressure on BoP, but it is not successfully able to offset the losses from the slump in exports,” said Ahsan H Mansur, executive director of Policy Research Institute.

He is doubtful that the trend of inflows will continue for long as the country’s manpower exports have declined in the last two years.

“Some were even sent back forcefully.”

So, the only way to ensure that the current trend of remittance sustains is by sending more workers abroad, he added.

Remittance, which has been one of the main drivers of the country’s tremendous economic growth over the past decade, sank to a six-year low of $13.53 billion in 2017.

But it bounced back emphatically in 2018: it logged in $15.53 billion, which was the previous record.